How to Get Rich as a Teenager: Is It Even Possible?

Okay, here's an article exploring how teenagers can build wealth, keeping in mind the constraints and opportunities unique to their age group, and written in a style suitable for a financially savvy young audience:

How to Get Rich as a Teenager: Is It Even Possible?

The idea of a teenager accumulating significant wealth might seem far-fetched, a storyline ripped from a movie about a tech prodigy or a lucky inheritance. However, while becoming a millionaire by 18 is statistically unlikely, building a solid financial foundation and establishing wealth-generating habits is absolutely achievable. The key lies in understanding the unique advantages and limitations of being a young investor, and leveraging those opportunities strategically.

One of the most significant advantages teenagers possess is time. Albert Einstein famously called compound interest the "eighth wonder of the world." This powerful concept works by reinvesting the earnings from an investment, allowing those earnings to generate further earnings. Over decades, the effect is exponential. A teenager starting with even a small amount of money invested wisely can benefit immensely from this long-term growth. Consider this: even a relatively small, consistent investment in a low-cost index fund, like one tracking the S&P 500, can blossom into a substantial sum over a 30-40 year period. The earlier you start, the less you need to invest regularly to reach your desired financial goals.

However, limited capital is often a hurdle for young investors. Most teenagers don't have large sums of money readily available. This necessitates a focus on income generation. The traditional lemonade stand has evolved. Think beyond the conventional part-time job (though those are still valuable!). Explore opportunities aligned with your skills and interests. Do you excel at graphic design? Offer freelance services online. Are you a talented musician? Provide virtual lessons. Can you code? Build simple websites for local businesses. The gig economy provides a multitude of avenues for teenagers to earn money on their own terms, often at rates exceeding traditional minimum wage jobs.

Building a strong financial foundation extends beyond simply earning. It involves prudent saving and budgeting. Create a budget that tracks your income and expenses. Identify areas where you can cut back. Even small savings, when consistently invested, can make a significant difference over time. Resist the urge to splurge on fleeting trends and instead prioritize investments that will yield long-term returns.

Speaking of investments, educating yourself is paramount. The world of finance can seem intimidating, but there are countless resources available to help you understand the basics. Read books on personal finance, follow reputable financial blogs and podcasts, and take advantage of free online courses. Understand the different types of investments – stocks, bonds, mutual funds, real estate – and the associated risks and rewards. Remember, knowledge is power when it comes to managing your money.

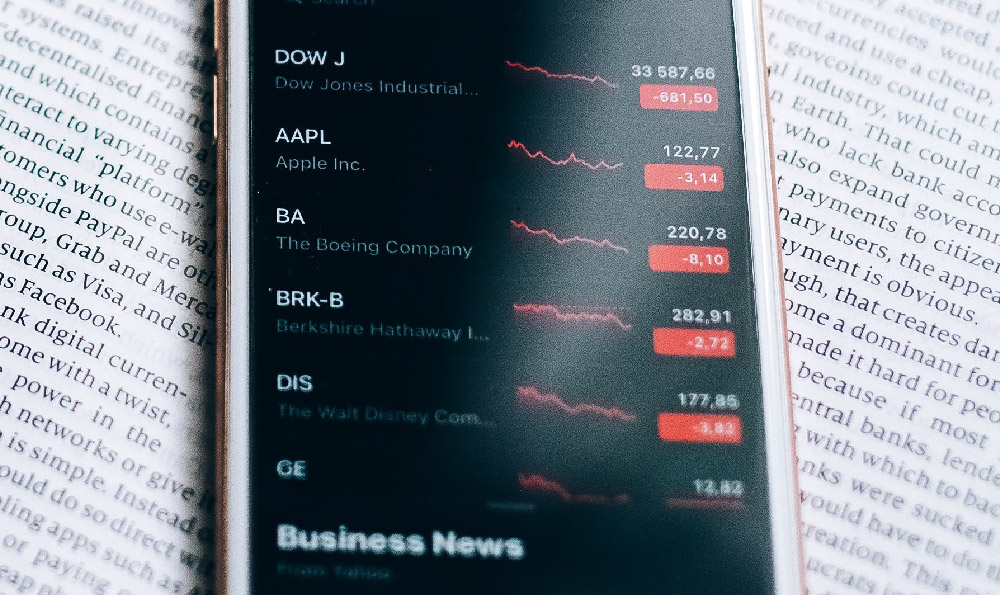

When it comes to specific investment strategies, diversification is crucial, especially for younger investors with a long time horizon. While you might be tempted to chase the "next big thing," resist the urge to put all your eggs in one basket. Spread your investments across different asset classes to mitigate risk. Index funds and ETFs (Exchange Traded Funds) are a great way to achieve instant diversification at a low cost. These funds track a broad market index, such as the S&P 500 or the Nasdaq, giving you exposure to hundreds or even thousands of companies.

Consider also the potential of investing in yourself. This might not be a traditional financial investment, but it can yield substantial returns in the long run. Investing in your education, learning new skills, or pursuing a passion project can open doors to future earning opportunities and career advancement. Developing marketable skills will increase your earning potential, allowing you to save and invest even more aggressively.

Navigating the legal aspects of investing as a minor can be tricky. In many jurisdictions, teenagers cannot directly own certain types of investments. However, custodial accounts allow a parent or guardian to manage investments on behalf of a minor. Research the specific rules and regulations in your area and work with a trusted adult to set up the appropriate accounts.

Beyond the practical strategies, cultivate a healthy mindset towards money. Avoid the pitfalls of consumerism and instant gratification. Develop a long-term perspective and focus on building wealth gradually. Surround yourself with people who support your financial goals and avoid those who encourage reckless spending.

It's crucial to be aware of potential scams and fraudulent investment schemes. If something sounds too good to be true, it probably is. Do your research, ask questions, and be wary of unsolicited investment offers. Remember, building wealth is a marathon, not a sprint. There are no shortcuts to financial success.

Finally, remember that building wealth as a teenager is not just about accumulating money. It's about developing valuable financial habits that will serve you well throughout your life. It's about learning to manage your money responsibly, understanding the power of compounding, and making informed investment decisions. Even if you don't become "rich" in the traditional sense by the time you reach adulthood, you'll be well on your way to achieving financial security and independence. You will also learn the value of hard work, discipline, and delayed gratification – qualities that are essential for success in all areas of life. The journey is just as important as the destination. Start small, stay consistent, and never stop learning. The future is yours to build.