how to achieve rich soil in dreamlight valley

Investing in digital currency and financial management often requires a strategic approach that mimics agricultural principles, such as preparing fertile ground for growth. While the phrase "rich soil in Dreamlight Valley" originates from a game, its metaphor can be applied to the world of crypto investments, where understanding the fundamentals of cultivation, patience, and adaptation is key to achieving long-term success. In this context, "rich soil" symbolizes the foundation of your investment strategy, the ecosystem of the market, and the ability to nurture opportunities across time. By analyzing market cycles, optimizing capital allocation, and avoiding common pitfalls, investors can create a sustainable environment for their assets to flourish.

The first step in cultivating a profitable investment landscape is to establish a solid foundation, akin to erecting a sturdy structure on fertile land. This involves thorough research into the projects or tokens you wish to invest in. A successful crypto investment begins with identifying the "soil" that can support growth—this means evaluating the team behind the project, the technology or utility it provides, and its long-term vision. Markets are often driven by innovation, so focusing on projects with strong fundamentals, clear use cases, and wide adoption potential is crucial. For instance, blockchain-based solutions that address real-world problems in supply chain management or financial inclusion might thrive in the long run, while speculative tokens with weak underpinnings could quickly erode value. Investors should prioritize projects that align with their risk tolerance and financial goals, much like selecting crops that suit the climate and soil of a particular region.

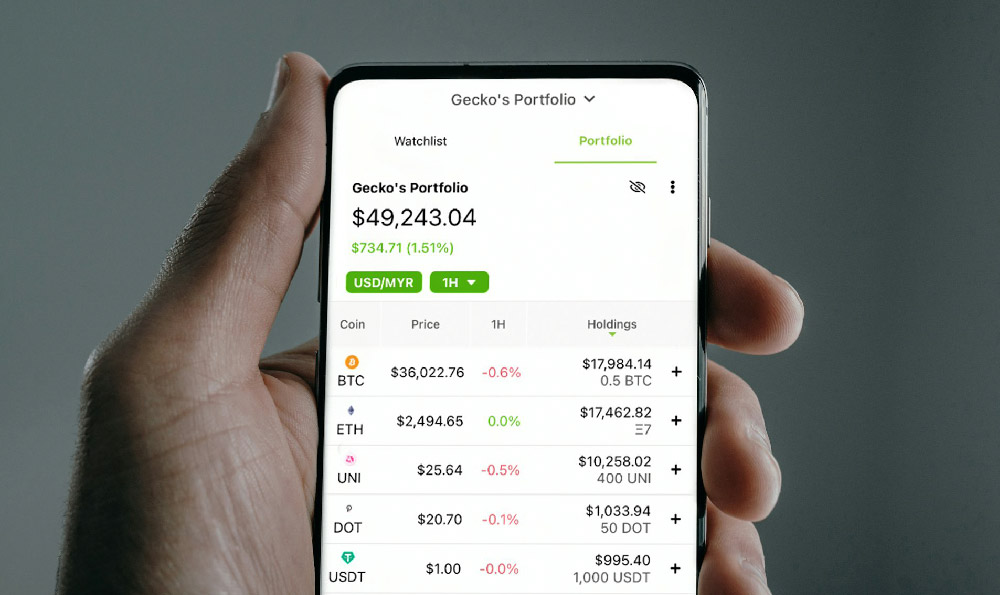

Beyond the initial setup, maintaining the health of this "soil" requires a balance between short-term gains and long-term sustainability. In crypto, this translates to diversifying your portfolio and managing risk through hedging strategies. Just as a farmer might rotate crops to prevent soil depletion, investors should avoid overconcentration in a single asset or sector. For example, allocating a portion of capital to both established cryptocurrencies like Bitcoin and promising newcomers with innovative solutions can mitigate volatility. Additionally, monitoring macroeconomic indicators such as inflation, interest rates, and geopolitical trends is essential. These factors can influence the price movements of digital assets, much like natural conditions determine crop yields. By staying informed and adjusting your strategy accordingly, you can ensure your investments remain resilient amid market fluctuations.

Another vital aspect is nourishing the ecosystem of your investments through active participation and behavioral management. In the world of crypto, this could involve engaging with communities, attending virtual events, or following expert analysis to stay ahead of trends. However, it also refers to managing your own mindset and emotions. Markets are inherently unpredictable, and fear or greed can lead to poor decisions. A cool and analytical approach, similar to a farmer’s steady hand in the face of weather changes, helps prevent impulsive actions like selling during a downturn or buying blindly during a bullish surge. Practicing discipline and adhering to a predefined plan, such as a stop-loss strategy or a target profit exit, ensures that your "soil" remains fertile rather than being overexploited by emotional biases.

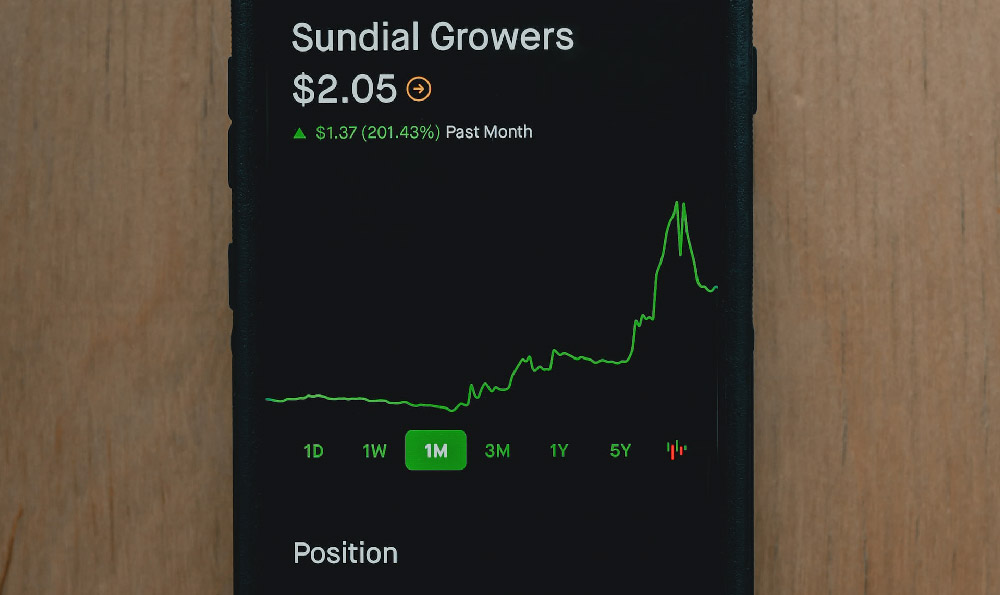

The final layer of cultivation involves adapting to change, as the digital currency market is in constant evolution. This requires a proactive mindset, much like a farmer who adjusts planting schedules based on seasonal shifts. For instance, the rise of decentralized finance (DeFi) and the integration of NFTs into mainstream markets highlight the importance of staying agile. Investors should be open to new trends, such as the adoption of staking protocols or the emergence of cross-chain solutions, while also being cautious of overhyped projects that lack substance. By embracing both innovation and caution, you can create a dynamic environment where your investments grow organically.

Ultimately, achieving "rich soil" in digital currency investment is not just about selecting the right assets but about building a resilient strategy that accounts for time, knowledge, and adaptation. This parallels the process of growing crops, where patience, care, and understanding of the environment are as important as the initial planting. Investors must recognize that sustained success in crypto requires a long-term perspective, consistent monitoring, and the ability to navigate both opportunities and challenges with a calm and analytical mind. By fostering these qualities, individuals can transform their investment portfolios into thriving ecosystems, capable of withstanding market uncertainties and delivering meaningful returns.