Can You Make Money with Rule 34?

In today's hyperconnected digital landscape, the internet has become a fertile ground for both creativity and commerce. While "Rule 34" is often associated with online forums and memes, its essence—replicating or representing any concept in a seemingly endless variety of forms—can be reframed as a lens to explore opportunities in the investment world. By analyzing how digital ecosystems thrive on content proliferation, investors can uncover unconventional avenues to generate returns, provided they approach them with informed strategies.

The principle underlying Rule 34 suggests that value is often amplified through repetition, adaptation, and reinterpretation. In finance, this mirrors the dynamic nature of markets where trends evolve rapidly, and information circulates across platforms. For instance, the rise of digital marketing has transformed how businesses allocate budgets, with platforms like YouTube, TikTok, and Instagram becoming pivotal for brand exposure. Investors who recognize the power of content-driven engagement can channel capital into ventures that capitalize on this phenomenon, such as influencer partnerships or digital product creation.

Consider the case of micro-influencers who monetize their niche audiences through sponsored content. These individuals often operate within a "Rule 34"-esque framework, where a single idea or product can be tailored to multiple demographics. By funding such creators, investors tap into a scalable model where viral content can generate recurring revenue streams. A 2023 report highlighted that a single micro-influencer campaign could yield returns of 10-30% within a short period, depending on audience targeting and platform dynamics. This demonstrates how the universality of content—akin to Rule 34's ethos—can be leveraged for profit.

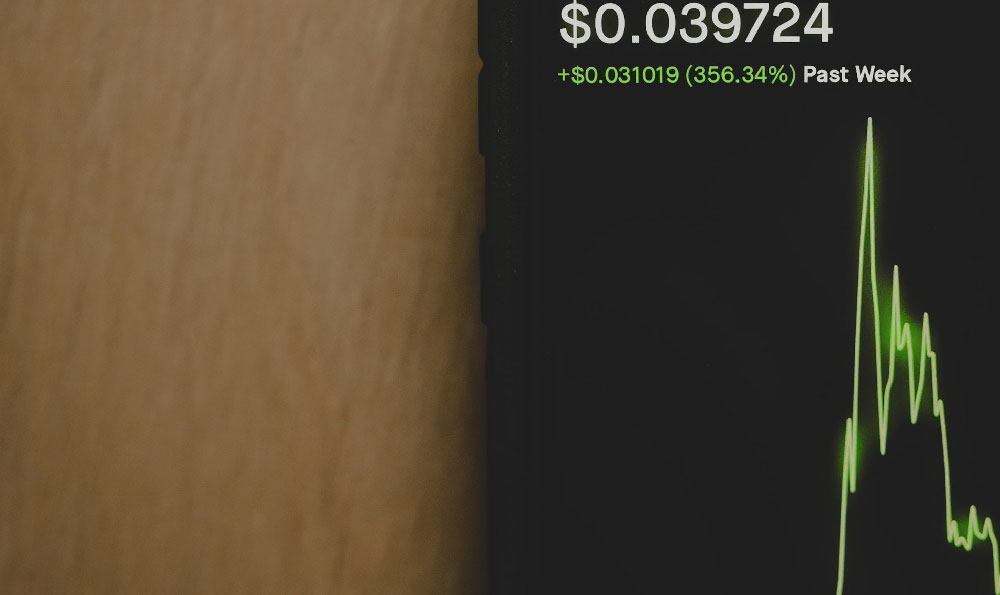

Additionally, the intersection of Rule 34 and alternative investments offers intriguing possibilities. Digital assets, including non-fungible tokens (NFTs) and decentralized finance (DeFi) protocols, thrive on community-driven innovation. An NFT project, for instance, might replicate traditional art forms or invent entirely new ones, creating value through its uniqueness and cultural relevance. Investors who understand the mechanics of blockchain ecosystems can identify projects that align with this principle, such as those with evolving utility or interactive features. The NFT market, though volatile, saw a compound annual growth rate of 35% between 2020 and 2022, underscoring the potential of content-based value creation.

However, the allure of Rule 34-inspired opportunities is not without risks. The same mechanisms that drive content virality can also lead to market saturation. A 2023 study by a leading financial analytics firm found that 68% of digital marketing campaigns fail to achieve sustainable returns within the first year. This highlights the importance of strategic allocation, where investors must differentiate between ephemeral trends and enduring value. For example, investing in a short-lived viral video campaign may yield quick gains but lacks long-term stability compared to funding a platform that curates high-quality, evergreen content.

The metaphor of Rule 34 also extends to stock market participation. Certain sectors, such as tech or entertainment, are inherently tied to content production. Companies like Netflix or TikTok derive profits from their ability to create and distribute content that resonates with global audiences. By investing in such firms, one indirectly participates in the "Rule 34" cycle, where ideas are continuously reimagined and monetized. Yet, investors should not conflate the volume of content with profitability. A well-researched approach, focusing on metrics like user retention, content quality, and revenue diversification, is crucial.

Moreover, the "Rule 34" dynamic applies to freelance work and gig economy participation. Platforms like Fiverr or Upwork enable individuals to offer services in nearly any form, from graphic design to copywriting. For investors, this represents an opportunity to fund freelancers or small businesses that can adapt their offerings to emerging trends. The flexibility inherent in this model mirrors the adaptability of Rule 34, allowing creators to pivot and maintain relevance in a fast-paced digital environment.

A critical factor in succeeding with Rule 34-inspired investments is understanding the audience’s expectations. As content becomes ubiquitous, consumers demand authenticity and personalization. Investors who prioritize platforms with strong community engagement and user-generated content are more likely to see long-term value. For instance, a digital wallet service that integrates with a burgeoning meme coin market might attract followers not just for its utility, but for its alignment with cultural narratives.

Finally, while the internet provides boundless opportunities, it also demands vigilance. The proliferation of content can lead to misinformation, regulatory scrutiny, or ethical dilemmas. Investors must approach Rule 34 as a framework rather than a guarantee, ensuring their strategies comply with legal standards and ethical considerations. In the realm of finance, this could mean investing in crowdfunding platforms that prioritize transparency or supporting educational content initiatives that build long-term trust.

In conclusion, the Rule 34 mindset—embracing diversity, adaptability, and the power of repetition—can inform investment decisions when applied thoughtfully. By identifying content-driven ventures that balance innovation with sustainability, investors can navigate the digital economy’s complexities and uncover lucrative opportunities. The key lies in discerning between fleeting trends and enduring value, a skill as vital in the modern market as it is in the world of online forums.