How Much Does the Average Person Earn Annually? What's the Median Annual Income?

Understanding the financial landscape begins with a grasp of the economic realities faced by the average individual. Two key metrics often used to gauge this are the average (mean) annual income and the median annual income. While both offer insights, they paint different pictures and it's crucial to understand their nuances to properly assess the economic well-being of a population.

The "average" or mean annual income is calculated by summing up the total income of all individuals within a specific group (e.g., all wage earners in a country) and dividing it by the number of individuals in that group. On the surface, this seems like a straightforward way to understand what a typical person earns. However, the average can be significantly skewed by outliers, specifically high earners. Imagine a scenario with ten people where nine earn $50,000 per year, and one person earns $1 million per year. The average income would be $145,000, which is vastly higher than what the vast majority of individuals actually earn. This makes the average income a less reliable indicator of the income experienced by a "typical" person.

The "median" annual income, on the other hand, represents the midpoint of the income distribution. It’s the income level where half of the population earns more and half earns less. In our previous example, the median income would be $50,000, providing a more accurate reflection of the income experienced by the majority. The median is less susceptible to the influence of extreme values, making it a more robust measure of central tendency, especially when dealing with skewed data like income distribution.

The actual numbers for both average and median annual incomes vary significantly depending on several factors: geographic location (country, state, city), age, education level, occupation, and even gender and race. For example, in the United States, the Census Bureau publishes data on both average and median household income. You'll often see discrepancies between the two figures, highlighting the impact of income inequality. Higher-income countries generally have higher average and median incomes compared to lower-income countries. Similarly, within a single country, major metropolitan areas tend to have higher incomes than rural areas, reflecting differences in the cost of living and available job opportunities.

Furthermore, education plays a critical role. Individuals with higher levels of education, such as bachelor's degrees or advanced degrees, typically earn more than those with only a high school diploma or less. This is due to the increased skills and knowledge that education provides, making them more competitive in the job market and eligible for higher-paying positions. Certain occupations, particularly those in high-demand fields like technology, finance, and healthcare, tend to offer significantly higher salaries than occupations in other sectors. Finally, persistent gender and racial pay gaps continue to affect average and median incomes for women and minorities.

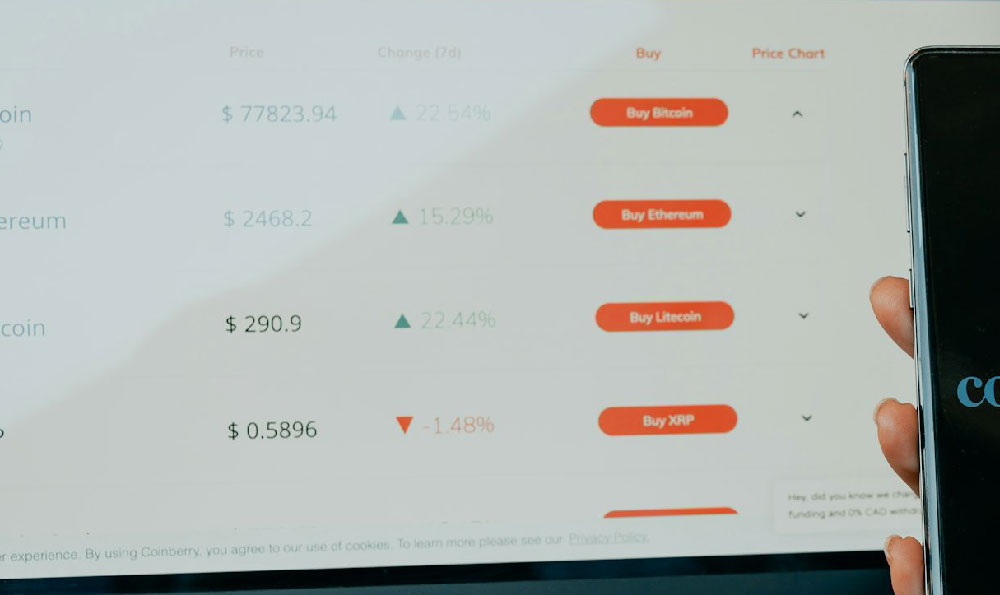

Understanding the earning potential associated with different careers is vital for making informed career decisions. Researching salary data for specific roles and industries can provide valuable insights into the expected income trajectory. Websites like the Bureau of Labor Statistics (BLS) in the United States offer detailed information on occupational employment statistics, including median annual wages. Glassdoor and Payscale are other resources that provide salary information based on job titles, experience levels, and location.

Beyond just knowing the numbers, it’s important to consider how these figures relate to the cost of living. A high average or median income in a particular city might be appealing, but if the cost of housing, transportation, and other essential expenses is equally high, the actual purchasing power of that income may be lower than in a location with lower nominal incomes but a more affordable cost of living. Therefore, it's essential to factor in regional price parity (RPP) and other cost-of-living indices when comparing incomes across different locations. These indices provide a measure of the relative prices of goods and services in different areas, allowing for a more accurate comparison of living standards.

From an individual financial planning perspective, comparing your own income to the average and median incomes for your demographic group (age, education, occupation, location) can be a useful benchmark. It can help you assess whether you are earning a competitive salary in your field and identify potential areas for improvement, such as pursuing further education or training, negotiating for a higher salary, or seeking out different job opportunities. It also provides context when setting financial goals, such as saving for retirement, buying a home, or funding your children's education. Knowing where you stand relative to your peers can help you set realistic and achievable targets.

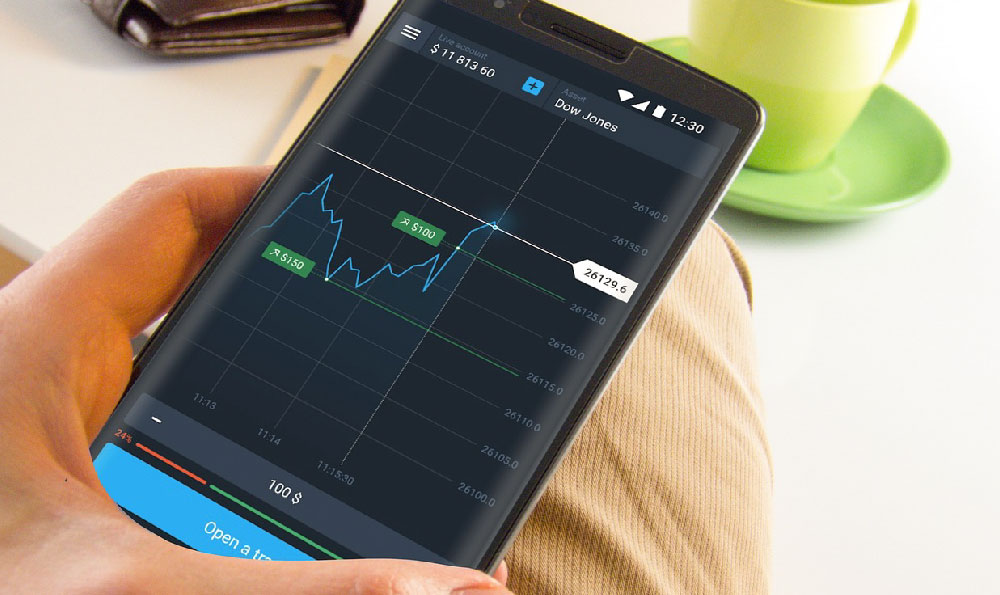

Finally, it's important to remember that income is not the only factor determining financial well-being. Saving habits, debt management, and investment strategies play crucial roles in building wealth and achieving financial security. Even individuals with modest incomes can accumulate significant wealth over time by consistently saving and investing wisely. Conversely, high-income earners can easily fall into financial distress if they spend more than they earn or fail to plan for the future. Therefore, regardless of your income level, it is essential to develop sound financial habits and seek professional advice when needed to achieve your financial goals. Understanding the average and median income figures provides a starting point for this journey, prompting individuals to evaluate their own financial situations and take proactive steps towards a more secure financial future. Remember that focusing on building assets and managing liabilities is paramount, regardless of where your income falls within the broader economic landscape.