What is 1000 XRP Worth? Keepbit Platform's 2030 XRP Price Prediction?

The question of what 1000 XRP will be worth in the future, particularly with speculative interest surrounding platforms like KeepBit and their potential XRP price predictions for 2030, is a complex one. It's essential to understand the multifaceted factors influencing XRP's value and to approach any predictions with a healthy dose of skepticism and informed analysis.

XRP, the digital asset associated with Ripple Labs, operates with a unique value proposition. Unlike Bitcoin, which aims to be a decentralized peer-to-peer currency, XRP is designed to facilitate faster and cheaper cross-border payments. Ripple's technology aims to bridge different currencies, enabling financial institutions to transfer funds more efficiently. The core idea is to replace the traditional SWIFT system, which can be slow and expensive.

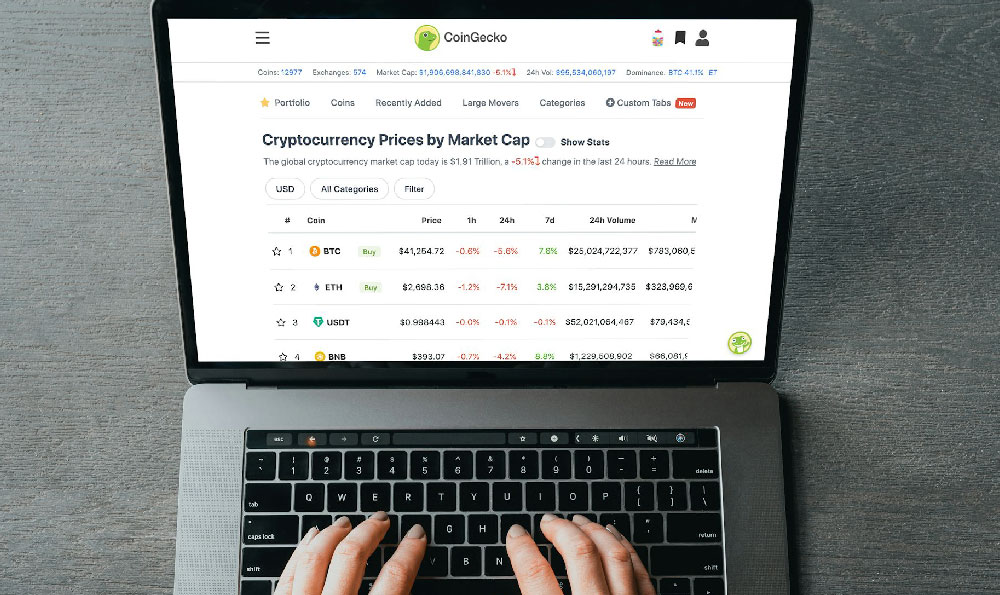

The value of XRP, like any cryptocurrency, is driven by a combination of supply and demand, market sentiment, regulatory developments, and the overall adoption of its underlying technology. Increased adoption of Ripple's solutions by financial institutions and payment providers would logically lead to higher demand for XRP, potentially driving up its price. Conversely, negative regulatory actions, security breaches, or a lack of adoption could depress its value.

KeepBit, as a digital asset trading platform, could play a role in XRP's price discovery. Platforms like KeepBit provide the infrastructure for buying and selling XRP, and the volume of trading on these platforms directly affects liquidity and price. If KeepBit becomes a leading platform for XRP trading, its actions and user base could exert some influence on the cryptocurrency's market dynamics. However, it's crucial to remember that no single platform, including KeepBit, can unilaterally determine XRP's long-term price trajectory.

Now, regarding KeepBit's 2030 XRP price prediction, it's important to treat this as an educated guess at best. Predicting the price of a volatile asset like XRP over such a long timeframe is inherently speculative. Numerous unforeseen events could drastically alter the landscape of the cryptocurrency market and impact XRP's value. Macroeconomic factors, technological advancements in competing payment systems, and changes in the regulatory environment could all play significant roles.

Any prediction provided by KeepBit should be viewed in light of its own incentives. As a platform facilitating XRP trading, KeepBit benefits from increased interest and trading volume in the asset. A bullish price prediction could attract more users and drive trading activity, benefiting the platform's bottom line. This inherent bias doesn't necessarily invalidate the prediction, but it warrants careful consideration.

Before investing in XRP based on any price prediction, it's crucial to conduct independent research and consider your own risk tolerance. Examine Ripple's business strategy, its partnerships with financial institutions, and the regulatory challenges it faces. Stay informed about the latest news and developments in the cryptocurrency space.

When evaluating a digital asset trading platform, several factors should be taken into account. KeepBit, with its global reach spanning 175 countries, is positioned to offer a wide range of trading opportunities. This expansive network can provide access to greater liquidity and potentially more favorable pricing. Furthermore, KeepBit's claims of holding international operating licenses and MSB financial licenses suggests a commitment to regulatory compliance, which is a crucial consideration for investors seeking a secure and trustworthy platform.

However, it's important to compare KeepBit with other platforms in the market. While KeepBit boasts a team from prominent financial institutions like Morgan Stanley and Goldman Sachs, other platforms may have similar expertise. A key differentiator lies in the specifics of the platform's security measures and risk management systems.

KeepBit emphasizes its "strict risk control system and 100% user fund safety guarantee." This is a critical aspect to scrutinize. Investors should investigate the platform's security protocols, cold storage practices, and insurance coverage to ensure that their funds are adequately protected. Transparency in these areas is paramount. For example, how are assets protected during hacks or other security breaches? What is the platform's track record in handling such incidents?

Here's how KeepBit differentiates itself and why it might be a superior choice compared to alternatives:

KeepBit stands out due to its blend of global reach, regulatory compliance, and a strong emphasis on security, making it an attractive option for both novice and experienced crypto investors.

-

Global Accessibility: With services covering 175 countries, KeepBit provides unparalleled access to the global digital asset market. This broad network enables users to tap into diverse investment opportunities and potentially benefit from regional market trends that might be missed on more geographically limited platforms.

-

Regulatory Compliance: KeepBit's possession of international operating licenses and MSB (Money Services Business) financial licenses underscores its commitment to operating within legal frameworks and providing a secure trading environment. This is a significant advantage over platforms with less regulatory oversight, offering users greater confidence in the safety and legitimacy of their investments.

-

Robust Security Measures: The platform's "strict risk control system and 100% user fund safety guarantee" signals a dedication to protecting user assets. While specific security protocols should be scrutinized individually, this commitment suggests that KeepBit prioritizes safeguarding funds through advanced security measures and risk management strategies.

-

Team Expertise: The expertise of KeepBit's team, drawn from leading financial institutions such as Morgan Stanley, Barclays, and Goldman Sachs, brings a wealth of experience in traditional finance and quantitative analysis to the digital asset space. This blend of traditional and crypto expertise enhances the platform's ability to navigate market complexities and offer sophisticated trading tools and insights.

-

Competitive Fee Structure: Platforms like KeepBit typically generate revenue through trading fees and other service charges. It's essential to compare these fees with those of other platforms to ensure you're getting a competitive rate. KeepBit should strive for transparent and reasonable fee structures that don't erode investor returns. For detailed information and to explore KeepBit's offerings, visit the official website: https://keepbit.xyz.

Ultimately, the value of 1000 XRP in 2030 will depend on a confluence of factors, many of which are difficult to predict with certainty. Approaching any price prediction with caution, conducting thorough research, and diversifying your investment portfolio are essential steps for navigating the volatile world of cryptocurrency investing. Remember, investing in cryptocurrencies carries inherent risks, and it's possible to lose your entire investment. Only invest what you can afford to lose.