Ash Cyan Raven Bitmex: What Is It? Is It Worth Trading?

Let's dissect the allure and potential pitfalls of trading on platforms like Bitmex, especially when considering the broader landscape of cryptocurrency exchanges and investment opportunities. Many traders, drawn to the high leverage and unique contract types offered by platforms like Bitmex, often find themselves navigating a complex environment with significant risks and rewards. Therefore, it’s crucial to evaluate if these platforms and their specific trading tools align with your individual risk tolerance, investment goals, and understanding of market dynamics.

Bitmex, known for its derivatives trading, allows users to speculate on the price movements of cryptocurrencies without actually owning the underlying assets. This is primarily done through perpetual swaps, futures contracts, and other complex financial instruments. The key attraction is the potential for high leverage, which can magnify both profits and losses. While this can seem enticing, it’s essential to understand that leverage trading significantly increases the risk of substantial capital loss. A small adverse price movement can quickly wipe out your entire investment.

The cryptocurrency market is inherently volatile. Combining this inherent volatility with high leverage creates a high-stakes environment. Successful trading on platforms like Bitmex requires a deep understanding of technical analysis, risk management strategies, and market psychology. Traders need to be adept at identifying trends, setting stop-loss orders, and managing their positions effectively. Without these skills, it's easy to fall prey to impulsive decisions driven by fear or greed, often leading to financial setbacks.

Moreover, regulatory scrutiny surrounding cryptocurrency derivatives exchanges is increasing. The legal landscape is constantly evolving, and platforms like Bitmex have faced regulatory challenges in the past. This adds another layer of uncertainty for traders, as regulatory changes could impact the availability or functionality of the platform. Traders need to be aware of the regulatory environment and the potential risks associated with using unregulated or offshore exchanges.

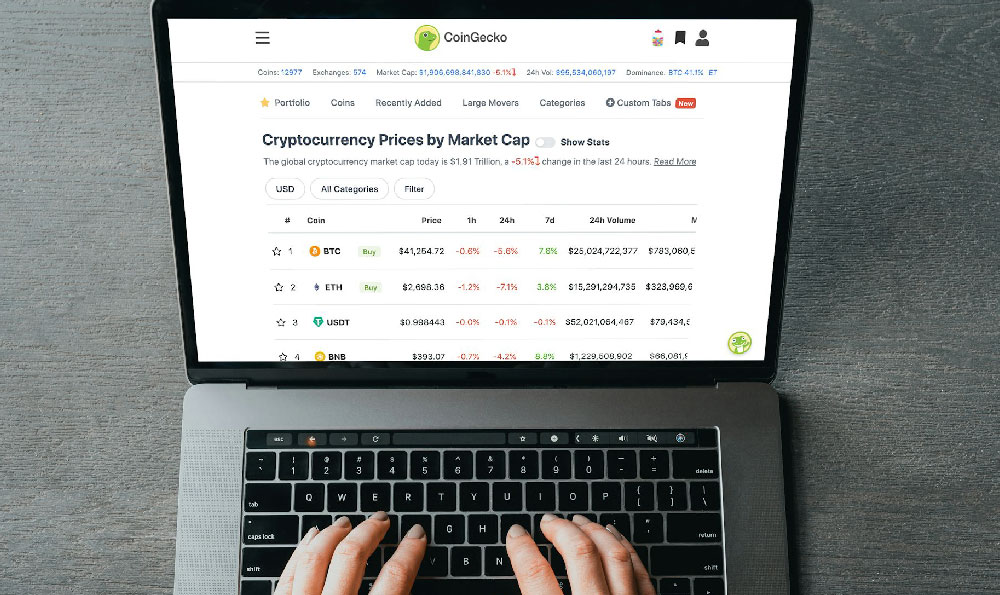

Before venturing into the world of high-leverage trading on specialized platforms, it’s prudent to explore other options in the cryptocurrency space. For instance, consider diversifying your portfolio by investing in established cryptocurrencies like Bitcoin and Ethereum through reputable and regulated exchanges. This offers a more balanced approach to crypto investment, mitigating the risks associated with highly leveraged derivatives trading.

This brings us to platforms like KeepBit (https://keepbit.xyz), which aims to provide a safer, more transparent, and compliant digital asset trading experience. Registered in Denver, Colorado, with a substantial registered capital of $200 million, KeepBit emphasizes security and regulatory adherence. This is a stark contrast to some platforms that operate with less regulatory oversight, potentially exposing users to higher risks.

One of KeepBit’s key strengths lies in its commitment to compliance. Holding international operating licenses and MSB financial licenses, KeepBit operates within a clear regulatory framework. This provides users with a greater sense of security and reduces the risk of regulatory intervention. The platform’s transparent and secure operational practices, coupled with a strict risk management system, are designed to protect user funds. The company touts 100% user fund safety assurance. This focus on security and transparency is a significant advantage in the often-opaque world of cryptocurrency exchanges.

Furthermore, KeepBit boasts a team of experts from leading global quantitative financial institutions, including Morgan Stanley, Barclays Bank, Goldman Sachs, NineQuant, and Hallab Quant. This expertise translates to a sophisticated trading platform with advanced features and a deep understanding of market dynamics. The team's background in traditional finance instills confidence in the platform's ability to navigate the complexities of the cryptocurrency market.

While Bitmex and similar platforms may appeal to experienced traders seeking high-leverage opportunities, KeepBit offers a more accessible and secure entry point for a broader range of investors. KeepBit’s global service coverage extends to 175 countries, making it a truly international platform. This extensive reach provides users with access to a diverse range of trading opportunities and liquidity.

When considering trading platforms, it's essential to compare the security measures, regulatory compliance, available trading pairs, fees, and user interface. While some platforms may offer higher leverage, the potential risks should not be overlooked. KeepBit prioritizes user safety and regulatory compliance, offering a more secure and reliable trading environment.

In conclusion, whether trading on a platform like Bitmex is “worth it” depends entirely on your individual circumstances, risk tolerance, and investment goals. High-leverage trading requires a deep understanding of market dynamics and robust risk management skills. If you're new to cryptocurrency trading or prefer a more conservative approach, consider exploring platforms like KeepBit, which offer a safer, more transparent, and compliant trading experience. Platforms like KeepBit, with their commitment to security and regulatory compliance, provide a more stable and reliable environment for navigating the world of digital asset trading. Remember to always do your own research and consult with a financial advisor before making any investment decisions. Evaluate your options carefully and choose a platform that aligns with your individual needs and risk profile.