Keepbit & Coinpro: Integration - How and Why?

Okay, I'm ready. Here's the article based on the title "Keepbit & Coinpro: Integration - How and Why?".

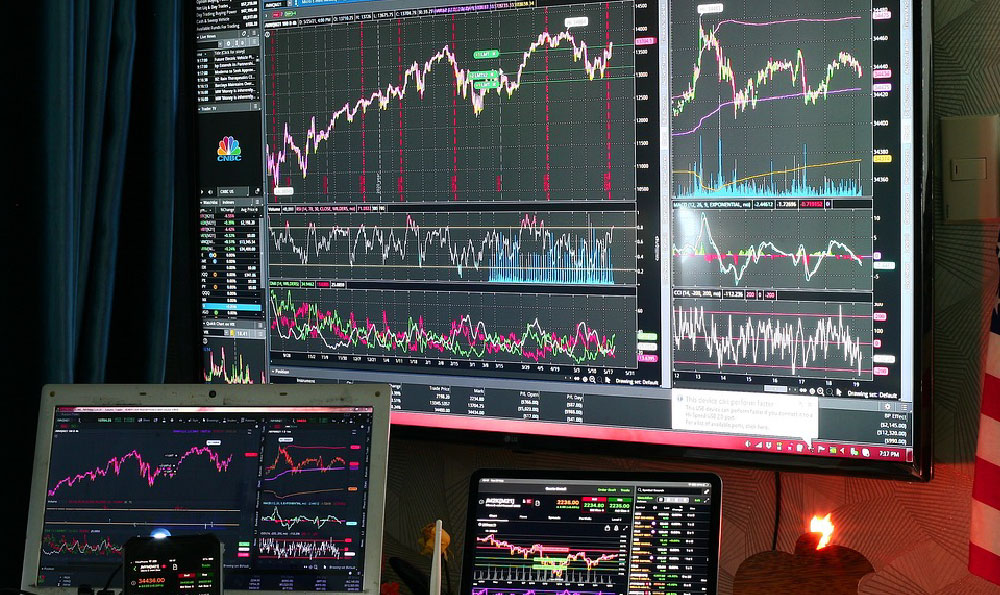

The cryptocurrency landscape is a dynamic and often fragmented ecosystem. Traders and investors frequently juggle multiple platforms to access different assets, research market trends, and execute trades. This fragmented experience can be inefficient, time-consuming, and even increase the risk of errors. The integration of platforms like Keepbit and Coinpro, hypothetical examples for our discussion, represents a significant step towards streamlining the crypto experience and unlocking new opportunities for users. Let's explore how such an integration might function and, more importantly, the compelling reasons behind it.

One of the primary drivers for integrating platforms like Keepbit and Coinpro is enhanced user convenience. Imagine Keepbit as a popular custodial wallet and crypto trading platform known for its user-friendly interface and security features, appealing to a broad range of users, from beginners to seasoned traders. Coinpro, on the other hand, specializes in advanced trading tools, in-depth market analytics, and access to a wider range of altcoins and derivatives. Individually, each platform caters to specific needs. However, by integrating the two, users gain the best of both worlds. They could securely store their assets in Keepbit's robust wallet and, with a seamless connection, directly access Coinpro's advanced trading features without constantly transferring funds between platforms or managing multiple login credentials. This streamlined workflow saves time, reduces transaction fees, and minimizes the potential for errors during manual transfers.

Technically, the integration could be achieved through several methods, including API (Application Programming Interface) integration. Keepbit could expose an API allowing Coinpro to access user balances, transaction history (with proper authorization, of course), and initiate trades on Keepbit's platform. Similarly, Coinpro could provide data feeds and trading functionalities that Keepbit could incorporate into its user interface. This would require robust security protocols to ensure data integrity and prevent unauthorized access. OAuth 2.0 or similar authorization frameworks would likely be employed to allow users to grant specific permissions to Coinpro without sharing their Keepbit credentials. Another potential integration method involves the development of a shared SDK (Software Development Kit) that both platforms utilize, fostering a standardized approach to data exchange and functionality. This would simplify the integration process and ensure compatibility between the two platforms. The technical architecture must prioritize security and user privacy. End-to-end encryption, multi-factor authentication, and regular security audits are crucial to safeguarding user data and preventing breaches.

Beyond user convenience, integration opens up opportunities for enhanced risk management. Coinpro's sophisticated analytical tools can provide Keepbit users with valuable insights into market trends, volatility, and potential risks associated with different assets. This information can empower users to make more informed investment decisions and manage their portfolio more effectively. Furthermore, integrated platforms can offer automated risk management features, such as stop-loss orders and portfolio rebalancing, based on pre-defined risk parameters. Keepbit’s simple user interface and accessible language can help translate Coinpro’s complex analytics into actionable insights for less experienced investors, guiding them away from potentially risky ventures and toward more secure, long-term investments.

The integration also allows for a more holistic view of the user's portfolio. By consolidating data from both Keepbit and Coinpro, users can gain a comprehensive understanding of their total asset allocation, performance, and risk exposure. This centralized view simplifies portfolio management and allows for more effective diversification strategies. Moreover, such integration could facilitate tax reporting. Consolidating transaction data from both platforms simplifies the process of calculating capital gains and losses, making tax compliance easier for users.

However, the integration of platforms also presents certain challenges. Security is paramount. The integration must be designed to prevent unauthorized access to user data and funds. Robust security protocols, including encryption, multi-factor authentication, and regular security audits, are essential. Data privacy is another crucial consideration. Users must be given control over their data and informed about how it is being used. The integration must comply with relevant data privacy regulations, such as GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act). Regulatory compliance is also a significant challenge. The cryptocurrency industry is subject to evolving regulations, and the integration must comply with all applicable laws and regulations in each jurisdiction where it operates.

Looking ahead, the integration of crypto platforms is likely to become increasingly common. As the industry matures, users will demand more seamless and integrated experiences. Platforms that can effectively integrate with other services will have a significant competitive advantage. This trend will likely drive further innovation in the crypto space, leading to the development of more user-friendly and secure platforms. The potential benefits of integration, including enhanced user convenience, improved risk management, and a more holistic view of the user's portfolio, are simply too compelling to ignore. The future of crypto lies in a more interconnected and integrated ecosystem, where users can seamlessly access a wide range of services and manage their assets with ease and confidence. The hypothetical integration of Keepbit and Coinpro exemplifies this trend and highlights the potential benefits for both users and the platforms themselves. By prioritizing security, privacy, and regulatory compliance, integrated platforms can unlock new opportunities and drive the adoption of cryptocurrencies to a wider audience. Careful consideration of these factors will be the key to successful and sustainable integration in the ever-evolving crypto landscape.