Turning Pennies into Profits: Overnight Success or Just a Dream?

The allure of turning pennies into profits, especially overnight, is a siren song that has captivated countless individuals. The idea of achieving financial independence with minimal effort and lightning speed is undeniably appealing. However, the reality of significant wealth accumulation requires a nuanced understanding of financial markets, realistic expectations, and a healthy dose of patience. While the dream of overnight success in investing isn't entirely unattainable, it's crucial to distinguish between realistic possibilities and potentially dangerous fantasies.

Let's dissect the core elements of this aspiration. The "pennies" represent the initial capital. Starting small is a responsible approach, allowing investors to learn the ropes and manage risk effectively. The problem arises when individuals expect disproportionately large returns from this modest investment in an unreasonably short timeframe. Financial markets are inherently complex and unpredictable. While high-growth opportunities exist, they invariably come with elevated risk.

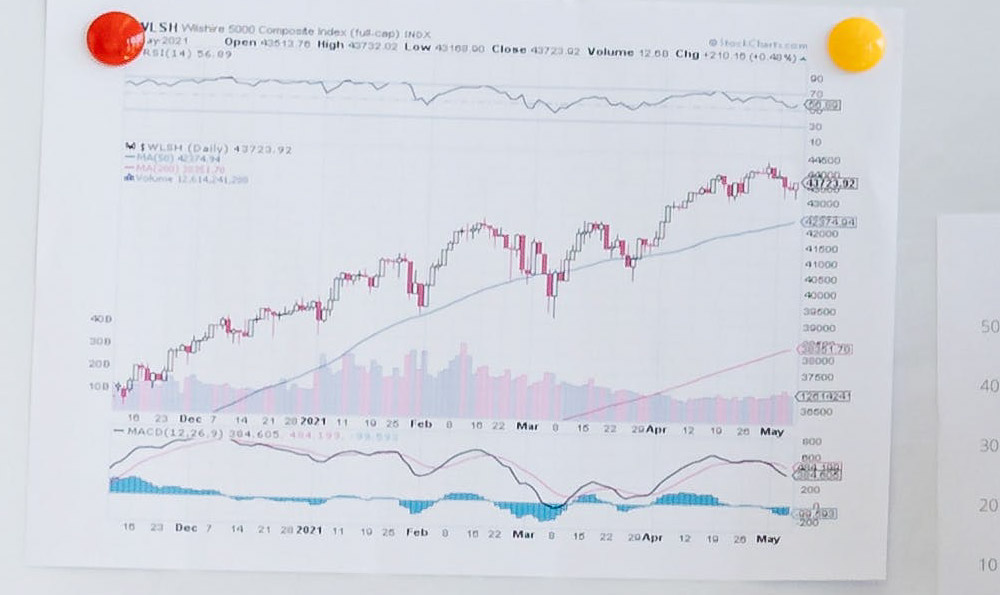

Consider the landscape of investment options. Stock markets, for example, offer the potential for substantial gains. Investing in promising startups or rapidly growing technology companies might seem like a shortcut to riches. However, these investments are notoriously volatile. The same factors that fuel rapid growth can also trigger dramatic declines. Market corrections, economic downturns, and company-specific setbacks can quickly erode initial investments. Success in the stock market requires careful research, diversification, and a long-term perspective. Chasing fleeting trends or relying on unsubstantiated rumors is a recipe for financial disaster.

Cryptocurrencies have emerged as another arena where the promise of rapid wealth accumulation is often touted. The volatile nature of these digital assets creates opportunities for significant gains, but it also exposes investors to substantial risks. Regulatory uncertainty, security vulnerabilities, and market manipulation can all contribute to sudden and drastic price swings. Investing in cryptocurrencies requires a deep understanding of the underlying technology, risk management strategies, and a high tolerance for volatility. Blindly following hype or investing more than one can afford to lose is a dangerous gamble.

Real estate offers a more tangible investment option, but the path to overnight riches is equally challenging. While property values can appreciate over time, significant gains typically require substantial capital, time, and strategic management. Flipping houses, for example, involves purchasing undervalued properties, renovating them, and selling them for a profit. This requires a keen eye for undervalued properties, expertise in renovation, and the ability to manage costs effectively. Furthermore, real estate markets are subject to cyclical fluctuations, and there's no guarantee that a property will appreciate in value within a desired timeframe.

Another avenue often explored is entrepreneurship. Starting a business can be incredibly rewarding and financially lucrative, but it's far from a guaranteed path to overnight success. The vast majority of startups fail within the first few years, often due to poor planning, inadequate funding, or market saturation. Building a successful business requires hard work, dedication, and a willingness to learn from mistakes. It also involves a significant amount of risk, as personal savings and borrowed funds are often at stake.

So, is the dream of turning pennies into profits overnight merely a delusion? Not necessarily. There are instances where individuals have experienced rapid wealth accumulation through shrewd investments or entrepreneurial ventures. However, these cases are often the exception rather than the rule. They typically involve a combination of luck, skill, and a willingness to take calculated risks.

Instead of chasing the elusive dream of overnight success, a more prudent approach is to focus on building a solid foundation for long-term financial security. This involves setting realistic goals, developing a diversified investment portfolio, and consistently saving and investing over time. Diversification is key to mitigating risk. Spreading investments across different asset classes, industries, and geographic regions can help cushion the impact of market volatility.

Furthermore, continuous learning is essential. Staying informed about financial markets, economic trends, and investment strategies can empower individuals to make informed decisions and adapt to changing circumstances. Consulting with a qualified financial advisor can also provide valuable guidance and support. A financial advisor can help assess individual risk tolerance, develop a personalized financial plan, and provide ongoing monitoring and adjustments.

Ultimately, achieving financial freedom is a journey, not a destination. It requires patience, discipline, and a willingness to learn and adapt. While the dream of turning pennies into profits overnight may be enticing, a more realistic and sustainable approach is to focus on building a solid financial foundation through consistent saving, diversified investing, and continuous learning. This path may not lead to instant riches, but it's far more likely to result in long-term financial security and peace of mind. The focus should be on building a robust portfolio that aligns with individual risk tolerance and financial goals, rather than chasing fleeting trends or relying on speculative investments. Remember that building wealth is a marathon, not a sprint, and consistent effort over time is the key to success.