How do rich people become rich, and why aren't you?

It's a question that has intrigued and motivated individuals for generations: How do the wealthy amass their fortunes, and why does that success seem to elude so many others? The answer isn’t a simple one, and it extends far beyond mere luck or inheritance, though those can certainly play a role. It's a complex interplay of financial literacy, strategic investment, disciplined habits, and a specific mindset that differentiates the wealthy from the rest. Understanding these elements can provide a roadmap, though not a guarantee, for improving one's own financial situation.

One of the key differentiators lies in financial education. Wealthy individuals prioritize understanding the intricacies of money management. They don't just rely on superficial knowledge; they delve into the details of budgeting, saving, investing, and tax planning. They understand the power of compound interest, the importance of diversification, and the risks and rewards associated with various investment vehicles. This understanding allows them to make informed decisions, rather than relying on gut feelings or the advice of others who may not have their best interests at heart. They read books, attend seminars, consult with financial advisors, and continually seek to expand their knowledge base. This commitment to financial education empowers them to navigate the complex financial landscape with confidence and make strategic decisions that contribute to wealth accumulation.

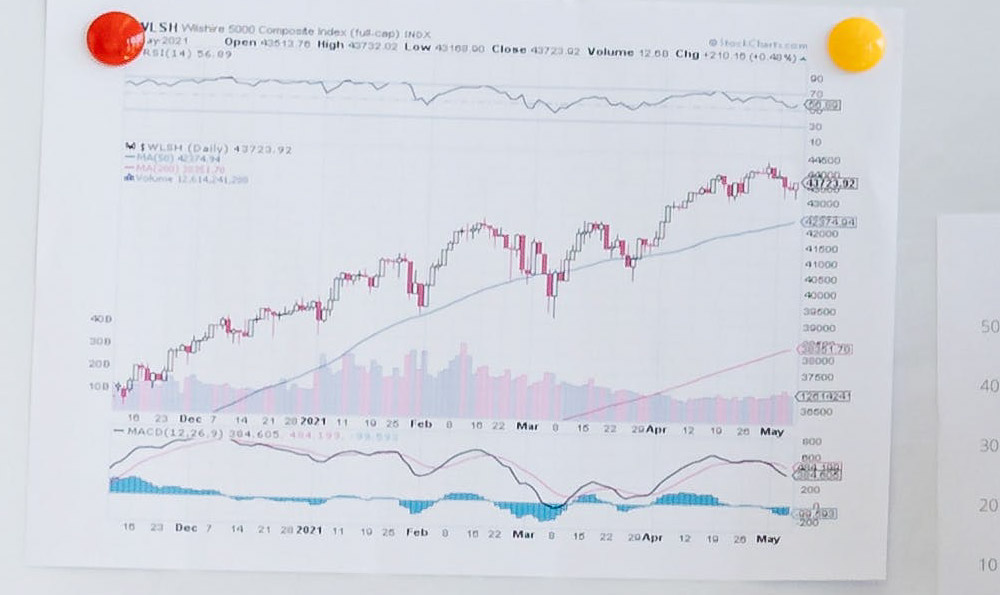

Another crucial aspect is the focus on investing, rather than simply saving. While saving is undoubtedly important for building a financial foundation, it's often insufficient for achieving substantial wealth. The wealthy understand that money sitting in a savings account, even one with a decent interest rate, is likely to be eroded by inflation over time. They actively seek out investment opportunities that offer the potential for higher returns, even if those opportunities involve some degree of risk. This doesn't necessarily mean gambling on high-risk, high-reward ventures. It often involves investing in a diversified portfolio of assets, including stocks, bonds, real estate, and perhaps even alternative investments like private equity or venture capital, depending on their risk tolerance and financial goals. They understand the importance of long-term investing and are willing to weather market fluctuations to achieve their desired returns.

Furthermore, rich people often cultivate a specific mindset centered around delayed gratification and value creation. They understand that building wealth is a marathon, not a sprint. They are willing to forgo immediate gratification in favor of long-term financial security. They avoid impulsive purchases and focus on acquiring assets that will appreciate in value over time. More importantly, they often focus on creating value for others. Many wealthy individuals are entrepreneurs who have built successful businesses by identifying a need in the market and providing a solution. They understand that wealth creation is often a byproduct of providing value to society. This emphasis on value creation fosters innovation, drives economic growth, and ultimately contributes to their own financial success.

Beyond investment strategies and mindset, disciplined habits play a vital role. Wealthy individuals tend to be meticulous about their finances. They track their income and expenses, create and adhere to budgets, and avoid unnecessary debt. They understand the importance of living below their means and saving a significant portion of their income. They are also proactive about managing their taxes, taking advantage of all available deductions and credits to minimize their tax burden. This disciplined approach to financial management ensures that their money is working for them, rather than against them. They also typically surround themselves with a team of trusted advisors, including accountants, lawyers, and financial planners, who can provide expert guidance on various aspects of their financial lives.

The reasons why many people fail to achieve similar levels of wealth are multifaceted. One significant factor is the lack of financial literacy. Many people simply don't have the knowledge and skills necessary to make informed financial decisions. They may be intimidated by the complexities of investing or lack the confidence to manage their money effectively. Another obstacle is the prevalence of consumerism and instant gratification. Many people prioritize immediate gratification over long-term financial security, leading them to accumulate debt and spend excessively. This can create a cycle of financial instability that is difficult to break.

Additionally, societal factors can also play a role. Access to education and opportunities can be limited for certain individuals and communities, making it more difficult to achieve financial success. Systemic inequalities and discriminatory practices can also create barriers to wealth accumulation. Furthermore, many people lack the support and mentorship necessary to navigate the financial landscape effectively. They may not have access to role models or mentors who can provide guidance and encouragement.

Ultimately, becoming wealthy is not just about luck or inheritance. It's about acquiring financial knowledge, developing a strategic investment plan, cultivating disciplined habits, and adopting a mindset focused on delayed gratification and value creation. While there are undoubtedly external factors that can influence one's financial outcomes, these internal factors are largely within one's control. By focusing on these key areas, individuals can significantly improve their financial situation and increase their chances of achieving long-term financial security. It’s a journey that requires commitment, perseverance, and a willingness to learn and adapt, but the rewards can be substantial. The key is to start now, regardless of your current financial situation, and to commit to making continuous progress toward your financial goals.