Is Making Money Possible? How Can You Do It?

The allure of cryptocurrency is undeniable. The stories of overnight millionaires, coupled with the promise of a decentralized financial future, draw countless individuals into this volatile market. But is making money with cryptocurrency truly possible? The answer, while not a simple yes or no, leans towards a cautious "yes, but with significant caveats." The path to profitability in crypto is paved with knowledge, discipline, and a healthy dose of risk assessment.

First and foremost, understand that cryptocurrency is not a "get rich quick" scheme. The market's inherent volatility means that fortunes can be made – and lost – in a matter of hours. Approaching crypto with a get-rich-quick mentality is a surefire way to get burned. Instead, adopt a long-term perspective and view cryptocurrency as a component of a diversified investment portfolio. Allocate only what you can afford to lose, and resist the urge to chase short-term gains fueled by hype and speculation.

The cornerstone of successful crypto investing is education. You need to understand the underlying technology, the specific projects you're considering, and the overall market dynamics. This means going beyond the headlines and diving into the whitepapers, understanding the use cases, and analyzing the tokenomics of each cryptocurrency. Learn about blockchain technology, consensus mechanisms, and the various types of cryptocurrencies – Bitcoin, Ethereum, altcoins, stablecoins, and decentralized finance (DeFi) tokens.

Do your own research (DYOR) is not just a catchy phrase; it's a fundamental principle. Don't rely solely on influencers or social media chatter. Scrutinize the information you find, verify its accuracy, and consider the source's potential biases. Understand the team behind the project, their track record, and their commitment to the long-term development of the platform. A strong team with a clear vision and a proven ability to execute is a crucial indicator of a project's potential success.

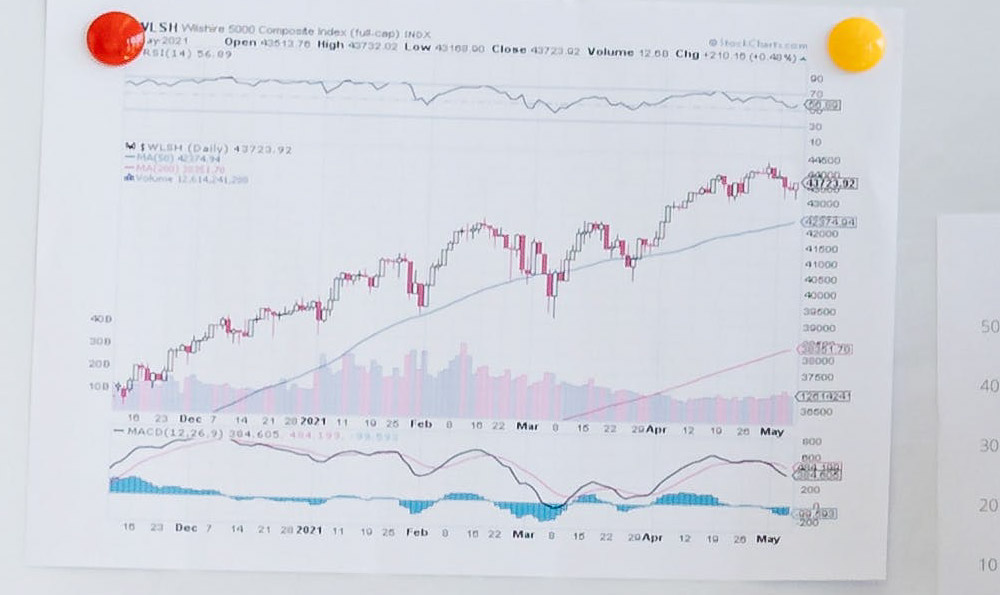

Beyond understanding the fundamentals, mastering technical analysis is essential. Learn to read charts, identify trends, and use technical indicators to make informed trading decisions. Common technical indicators include moving averages, relative strength index (RSI), and Fibonacci retracements. While technical analysis is not foolproof, it can provide valuable insights into market sentiment and potential price movements. Remember that past performance is not indicative of future results.

Risk management is paramount in the volatile world of crypto. Implement strategies to protect your capital and minimize potential losses. A crucial aspect of risk management is diversification. Don't put all your eggs in one basket. Spread your investments across different cryptocurrencies and asset classes to mitigate the impact of any single asset's underperformance.

Another critical risk management technique is setting stop-loss orders. A stop-loss order automatically sells your cryptocurrency if it falls below a predetermined price, limiting your potential losses. Use stop-loss orders to protect your profits and prevent significant losses in a volatile market. Similarly, take profit orders allow you to automatically sell when a certain price target is met, ensuring that you capitalize on gains.

Furthermore, it’s crucial to understand the different cryptocurrency exchanges and choose reputable platforms. Look for exchanges with strong security measures, such as two-factor authentication (2FA) and cold storage for the majority of their assets. Be wary of exchanges with unverified histories or lax security protocols. The collapse of several large crypto exchanges serves as a stark reminder of the importance of platform security and regulation.

Staying informed about regulatory developments is also critical. Governments around the world are grappling with how to regulate cryptocurrency, and these regulations can have a significant impact on the market. Be aware of the laws and regulations in your jurisdiction and understand how they might affect your investments.

One area rife with potential pitfalls is decentralized finance (DeFi). While DeFi offers exciting opportunities for earning passive income through staking, lending, and yield farming, it also carries significant risks, including smart contract vulnerabilities, impermanent loss, and rug pulls. Before participating in any DeFi protocol, thoroughly research the platform, understand the risks involved, and only invest what you can afford to lose. Consider the possibility of smart contract bugs or vulnerabilities which could lead to loss of funds.

Finally, resist the urge to follow the herd. The cryptocurrency market is often driven by hype and fear. Don't let emotions dictate your investment decisions. Stick to your strategy, do your research, and remain disciplined, even when the market is experiencing extreme volatility. FOMO (fear of missing out) and FUD (fear, uncertainty, and doubt) can lead to impulsive decisions that you may later regret.

In conclusion, making money with cryptocurrency is possible, but it requires a combination of knowledge, discipline, risk management, and a long-term perspective. It's not a guaranteed path to riches, but with careful planning and execution, it can be a valuable addition to a well-diversified investment portfolio. By prioritizing education, staying informed, and managing your risks effectively, you can increase your chances of achieving your financial goals in the exciting, yet challenging, world of cryptocurrency. Remember, investing in cryptocurrency is a marathon, not a sprint. Sustainable success relies on consistent effort, continuous learning, and a commitment to responsible investment practices.