Keepbit Execution Logs: Export, or Not to Export?

Navigating the intricacies of cryptocurrency trading involves meticulous attention to detail, and one crucial aspect often overlooked is the management of execution logs. Specifically, when using platforms like Keepbit, the question of whether or not to export these logs is paramount. It's a decision that hinges on a blend of security considerations, analytical needs, and long-term investment strategies. For the astute cryptocurrency investor, understanding the significance of execution logs and making informed decisions about their export is non-negotiable.

Execution logs, at their core, are a comprehensive record of all trading activities undertaken on a platform. They detail every buy and sell order, the price at which the order was executed, the time of execution, the quantity of assets traded, and any associated fees. This data is a goldmine of information, enabling traders to dissect their past performance, identify patterns, refine their strategies, and, critically, comply with potential regulatory requirements. Ignoring these logs is akin to navigating a complex maze blindfolded – you're essentially trading in the dark, without the ability to learn from your mistakes or optimize your approach.

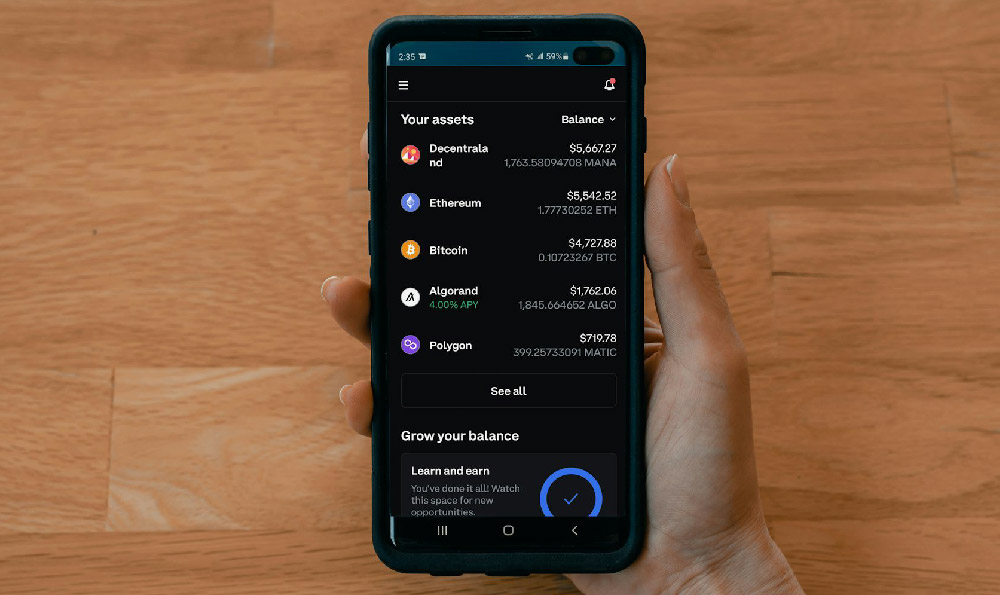

The decision to export execution logs from Keepbit, or any other trading platform, isn't a binary one. It's a nuanced consideration that requires weighing the benefits against the potential risks. One of the most compelling reasons to export these logs is for in-depth analysis. While the platform itself may offer some basic analytical tools, exporting the data allows you to leverage more sophisticated software, spreadsheets, or custom-built algorithms to uncover hidden insights. You can track your win-loss ratio across different assets, identify the optimal times of day to trade, and assess the impact of various market conditions on your portfolio. This level of granular analysis empowers you to make more informed trading decisions, ultimately leading to improved profitability.

Beyond personal analysis, exported execution logs are vital for tax compliance. Cryptocurrency taxation is a complex and evolving landscape, and accurately reporting your gains and losses is crucial to avoid penalties. Having a detailed record of every transaction, including the purchase price, sale price, and any associated fees, simplifies the tax preparation process and provides a solid audit trail in case of an inquiry from tax authorities. Relying solely on memory or incomplete records is a recipe for disaster, potentially leading to inaccurate reporting and substantial financial repercussions.

Furthermore, exported logs serve as a crucial backup in case of platform failures, data breaches, or account compromises. While cryptocurrency exchanges invest heavily in security, they are not impervious to attacks. If your account is hacked or the platform experiences a catastrophic event, you may lose access to your trading history. Having a secure backup of your execution logs ensures that you can reconstruct your trading activity and recover your funds, mitigating the potential financial damage.

However, exporting execution logs also introduces potential security risks that must be carefully addressed. These logs contain sensitive financial information that, if compromised, could be used for malicious purposes. Therefore, it's imperative to store exported logs securely, employing robust encryption methods and restricting access to authorized personnel only. Avoid storing logs on public cloud storage services or unencrypted devices, as these are prime targets for hackers. Consider using a dedicated hardware wallet or a secure cloud storage solution with end-to-end encryption.

Another critical consideration is data privacy. Execution logs contain personally identifiable information, such as your trading history and account details. It's essential to comply with data privacy regulations, such as GDPR, and obtain explicit consent from users before exporting or sharing their data. Anonymizing the data before sharing it with third-party analysts or researchers can further mitigate privacy risks.

The format in which the logs are exported also matters. Keepbit, like other platforms, likely offers various export options, such as CSV, JSON, or XML. Choose a format that is both compatible with your analytical tools and relatively easy to secure. CSV files, while widely compatible, are plain text and therefore less secure than encrypted formats like JSON or XML. Consider the trade-offs between convenience and security when selecting the export format.

Before exporting any data, thoroughly review Keepbit's terms of service and privacy policy to understand your rights and responsibilities. Ensure that you are compliant with all applicable regulations and that you are not violating any terms of service. If you are unsure about any aspect of the export process, consult with a legal professional or a cryptocurrency tax expert.

In conclusion, the decision to export execution logs from Keepbit is a strategic one that should be approached with careful consideration. While the benefits of exporting logs for analysis, tax compliance, and data backup are undeniable, it's crucial to address the potential security and privacy risks. By implementing robust security measures, complying with data privacy regulations, and carefully selecting the export format, you can harness the power of execution logs to enhance your trading performance and protect your financial assets. Remember, in the dynamic world of cryptocurrency, informed decision-making is the key to long-term success.