What investments are wise, and which offer top returns?

Navigating the world of cryptocurrency investments requires a blend of sharp intellect, unwavering composure, and a long-term perspective. It's not a get-rich-quick scheme; it's a sophisticated game of understanding market dynamics, analyzing technical indicators, and crafting robust investment strategies. While the allure of high returns is undeniable, the importance of risk management cannot be overstated. Let's explore some prudent investment avenues within the crypto sphere and highlight those that historically have yielded significant returns, always with a strong emphasis on due diligence and responsible investing.

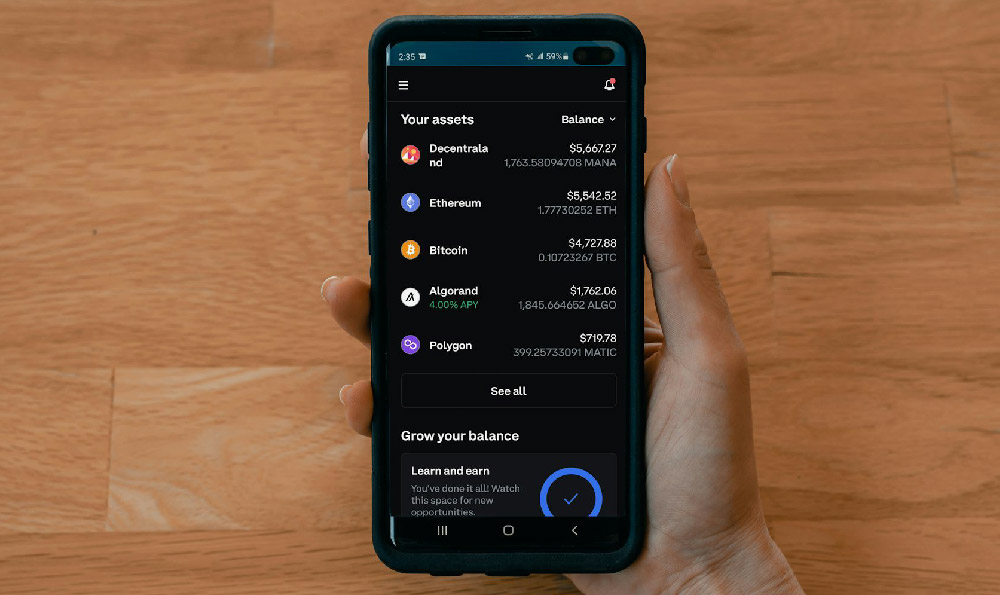

Before diving into specific cryptocurrencies, it's crucial to establish a foundational understanding of different investment categories. Firstly, consider established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). These are often referred to as "blue-chip" cryptocurrencies due to their market dominance, extensive adoption, and relatively lower volatility compared to smaller altcoins. Bitcoin, as the pioneer of cryptocurrency, serves as a digital store of value, similar to gold. Ethereum, on the other hand, provides a platform for decentralized applications (dApps) and smart contracts, making it a cornerstone of the decentralized finance (DeFi) ecosystem. Investing in BTC and ETH provides a relatively stable entry point into the crypto market, offering a balance between potential growth and reduced risk compared to less established assets. These coins, being the oldest and most widely adopted, benefit from robust infrastructure, high liquidity, and strong network effects. While their growth potential might not be as explosive as some smaller projects, their stability and resilience make them a cornerstone of a well-rounded portfolio.

Beyond the giants, the landscape is populated by a plethora of altcoins, each with its unique proposition and potential. Some altcoins focus on specific use cases, such as decentralized storage (Filecoin), privacy (Monero), or supply chain management (VeChain). Others aim to improve upon the scalability or transaction speed of Bitcoin and Ethereum. Identifying promising altcoins requires careful research and a deep understanding of their underlying technology, team, and market potential. Projects with strong fundamentals, a clear roadmap, and a dedicated community are more likely to succeed in the long run. However, remember that altcoins are inherently riskier than Bitcoin and Ethereum. Their market capitalization is smaller, making them more susceptible to price manipulation and volatility.

Decentralized Finance (DeFi) has emerged as a disruptive force in the financial industry, offering a wide range of investment opportunities. DeFi protocols allow users to lend, borrow, trade, and earn interest on their cryptocurrency holdings without the need for intermediaries. Yield farming, for instance, involves providing liquidity to DeFi protocols and earning rewards in the form of governance tokens or interest. Staking, another popular DeFi strategy, involves locking up cryptocurrency holdings to support the operation of a blockchain network and earning rewards in return. While DeFi offers the potential for high returns, it also comes with its own set of risks, including smart contract vulnerabilities, impermanent loss, and regulatory uncertainty. Thoroughly researching the DeFi protocols and understanding the associated risks before investing is paramount. It's also advisable to start with smaller amounts and gradually increase your exposure as you gain more experience.

Non-Fungible Tokens (NFTs) have captured the world's attention, representing unique digital assets like art, collectibles, and virtual real estate. While NFTs can be a speculative investment, they also offer the potential for long-term appreciation, particularly for rare and culturally significant pieces. Investing in NFTs requires a keen understanding of the market trends, the artist or creator behind the NFT, and the underlying value proposition. The NFT market can be highly volatile, and prices can fluctuate dramatically based on hype and sentiment. Diversification is key, and it's important to only invest what you can afford to lose. Furthermore, ensuring the provenance and authenticity of the NFT is critical to avoid purchasing counterfeit or fraudulent assets.

Identifying investments that offer top returns requires a multifaceted approach. It involves analyzing market trends, tracking technical indicators, and evaluating the fundamental strengths of each project. Technical analysis involves studying price charts and trading volumes to identify patterns and predict future price movements. Fundamental analysis involves assessing the project's team, technology, market potential, and overall ecosystem. By combining both technical and fundamental analysis, investors can make more informed investment decisions. However, it's important to remember that past performance is not indicative of future results. The cryptocurrency market is constantly evolving, and what worked in the past may not work in the future.

Crucially, understanding and mitigating risks is fundamental to responsible cryptocurrency investing. Diversification, as mentioned earlier, is a crucial risk management strategy. Spreading your investments across different cryptocurrencies and asset classes can help to reduce your overall portfolio risk. Setting stop-loss orders can help to limit your potential losses in the event of a market downturn. Regularly reviewing your portfolio and rebalancing your holdings can help to ensure that you are aligned with your investment goals and risk tolerance. Protecting your digital assets is another important aspect of risk management. Using strong passwords, enabling two-factor authentication, and storing your cryptocurrencies in a secure wallet can help to prevent theft and hacking.

The cryptocurrency market is rife with scams and fraudulent schemes. Being able to identify and avoid these scams is crucial to protecting your capital. Common scams include pump-and-dump schemes, where promoters artificially inflate the price of a cryptocurrency to lure in unsuspecting investors before dumping their holdings for a profit. Phishing scams involve tricking users into revealing their private keys or login credentials. It's essential to be wary of unsolicited offers, promises of guaranteed returns, and projects with anonymous teams. Always do your own research and never invest in something you don't fully understand.

In conclusion, wise cryptocurrency investments involve a blend of understanding market dynamics, analyzing technical indicators, evaluating fundamental strengths, and implementing robust risk management strategies. While the allure of high returns is undeniable, prioritizing capital preservation and protecting against fraud is paramount. Approach the crypto market with caution, educate yourself continuously, and remember that investing is a marathon, not a sprint. By adopting a disciplined and informed approach, you can navigate the complexities of the crypto landscape and potentially achieve your financial goals.