How to Make Money Daily? What Are the Best Ways to Earn Cash Fast?

Okay, here's an article exploring various strategies for generating daily income and quick cash, keeping in mind the need for feasibility, legality, and a balanced perspective:

Beyond the 9-to-5: Unveiling Pathways to Daily Income and Rapid Cash Generation

The quest for financial freedom often begins with the desire for more immediate control over our income. While long-term investments and traditional employment provide stability, the allure of daily income and the ability to quickly generate cash are powerful motivators. However, navigating this landscape requires a critical eye, understanding both the opportunities and the potential pitfalls. This exploration delves into several strategies, examining their practicality, risk levels, and potential rewards, all while emphasizing the importance of ethical and legal considerations.

One readily accessible avenue for daily income generation is the realm of online freelancing. The digital marketplace has democratized access to a vast array of projects, catering to diverse skill sets. Platforms connecting freelancers with clients seeking writers, graphic designers, virtual assistants, programmers, and consultants have proliferated. The key to success here lies in identifying your niche, developing a strong online portfolio, and consistently delivering high-quality work. Daily earnings, though not guaranteed, are attainable by proactively seeking out and completing short-term assignments. The initial hurdle involves building a reputation and establishing a consistent stream of clients, which often requires patience and persistence. However, once a solid foundation is established, the potential for a reliable daily income stream is significant. Furthermore, mastering in-demand skills like SEO writing or specific software proficiencies can substantially increase your earning potential in this domain.

The gig economy also presents numerous avenues for generating quick cash. Ride-sharing services, food delivery apps, and task-based platforms offer the flexibility to earn income on demand. These options are particularly appealing for individuals seeking to supplement their existing income or fill short-term financial needs. The earning potential is directly correlated to the time and effort invested, but the immediate payout provides a tangible reward for each shift or completed task. Strategic timing, such as working during peak hours, can significantly boost earnings. It's crucial, however, to factor in expenses such as vehicle maintenance, fuel costs, and self-employment taxes when evaluating the true profitability of these ventures.

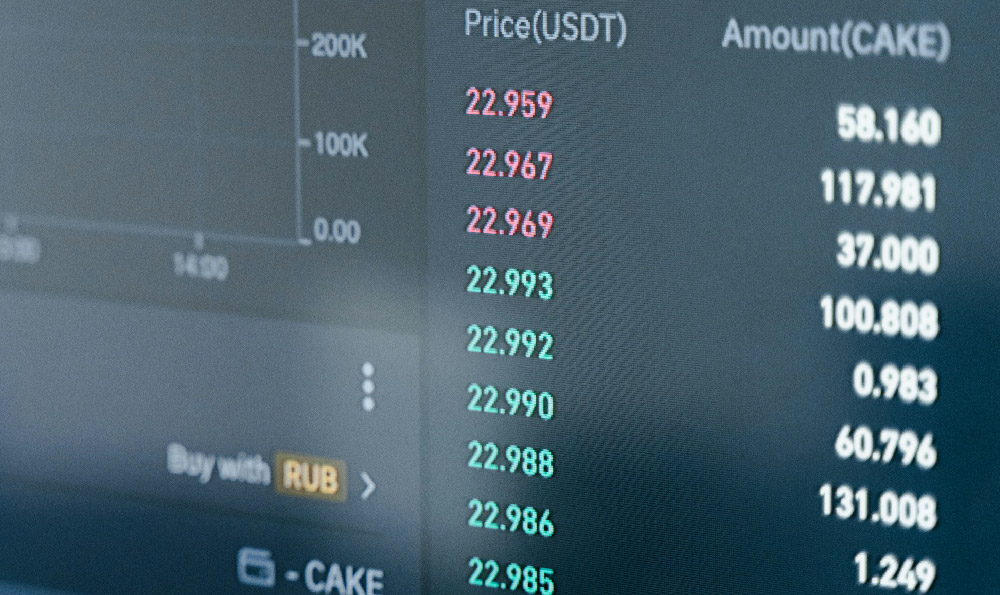

Moving beyond purely labor-based income, exploring opportunities in the digital asset space is also worth considering, albeit with careful consideration of risk. Day trading, for example, involves actively buying and selling stocks, currencies, or cryptocurrencies within a single day with the goal of profiting from short-term price fluctuations. This approach requires a deep understanding of market dynamics, technical analysis, and risk management. The potential for rapid gains is undeniable, but the risk of substantial losses is equally significant. Success in day trading demands discipline, emotional control, and a well-defined trading strategy. A more cautious approach involves exploring options like staking or yield farming in the cryptocurrency space. These methods allow you to earn rewards by holding and "locking up" your cryptocurrency holdings to support the network. While the returns may not be as immediate or substantial as day trading, they offer a relatively passive way to generate income on your existing digital assets. Thorough research and understanding of the specific protocols and associated risks are paramount before engaging in any of these activities.

Another avenue to consider is leveraging existing skills and knowledge to create and sell digital products. Online courses, e-books, templates, and software tools are all examples of digital products that can generate passive income once created. The initial investment involves the time and effort required to develop the product, but the potential for ongoing sales with minimal additional effort is significant. Effective marketing and promotion are crucial for driving traffic and generating sales. Platforms like Udemy, Skillshare, and Etsy provide established marketplaces for reaching potential customers. Furthermore, creating a blog or building an email list can help establish a direct connection with your target audience and facilitate ongoing sales.

Furthermore, the world of online surveys and micro-tasks, while not a path to riches, can offer a modest daily income. Numerous platforms compensate users for completing surveys, testing products, or performing small online tasks. The pay per task is typically low, but the cumulative earnings can be worthwhile for individuals with spare time. While these activities may not provide a substantial income, they offer a low-barrier-to-entry way to generate some extra cash each day.

Finally, remember the power of resourcefulness and creativity. Selling unwanted items online, offering local services like pet-sitting or gardening, or even participating in paid research studies can all provide avenues for generating quick cash. The key is to identify unmet needs in your local community and leverage your skills and resources to provide solutions.

In conclusion, generating daily income and quick cash requires a multifaceted approach. There are numerous avenues available, ranging from online freelancing and the gig economy to digital asset strategies and the creation of digital products. The key is to carefully evaluate the risks and rewards associated with each option, align your strategies with your skills and interests, and prioritize ethical and legal considerations. Remember that building a sustainable income stream takes time and effort, and consistent learning and adaptation are essential for success in the ever-evolving landscape of financial opportunities. Focus on building skills that are in demand, offering high-quality services or products, and consistently seeking out new opportunities. The path to financial freedom is not a sprint, but a marathon, requiring discipline, persistence, and a willingness to adapt to changing circumstances.