How to Make Money Easily

Earning money easily is a common aspiration, yet it often involves navigating through a maze of misconceptions and risks. In today's fast-paced economic environment, a blend of smart strategies and adaptability can unlock opportunities that align with both financial goals and legal boundaries. One of the most sustainable approaches is to cultivate passive income streams, which require minimal ongoing effort once established. This can be achieved through investments such as dividend-paying stocks, rental properties, or licensing intellectual property. For example, a diversified portfolio of blue-chip companies can generate consistent monthly dividends, while a well-located property in a growing market may offer steady rental returns. The key lies in identifying assets that appreciate in value over time and provide regular cash flow, ensuring a balance between risk and reward.

Another avenue lies in the world of digital opportunities, particularly in the rapidly expanding realm of online services and platforms. Many individuals have found success by leveraging their skills in areas like programming, graphic design, or copywriting. Platforms such as Upwork, Fiverr, or even YouTube allow creators to monetize their expertise through freelance work, sponsorships, or ad revenue. For those with a creative streak, developing digital products like e-books, online courses, or templates can yield significant returns with a one-time creation effort. The beauty of these approaches is their scalability; once a product or service is established, it can generate income without requiring constant personal involvement. However, it is important to recognize that even in the digital space, competition is fierce, and success often hinges on niche specialization and consistent quality.

Traditional investments in stocks and bonds remain a cornerstone of wealth-building, despite their perceived lack of ease. A long-term perspective, particularly with index funds or ETFs, can provide compounding returns over time. For instance, investing in a broad-market ETF like the S&P 500 index has historically yielded average annual returns of around 10%, though this varies with market conditions. The power of compounding means that even modest contributions, when reinvested regularly, can grow into substantial sums. It is worth noting that while this method is relatively straightforward, it demands patience, as significant returns often materialize over a decade or more. Diversification is also crucial to mitigate risk, ensuring that the portfolio is not overly exposed to the fluctuations of any single sector or company.

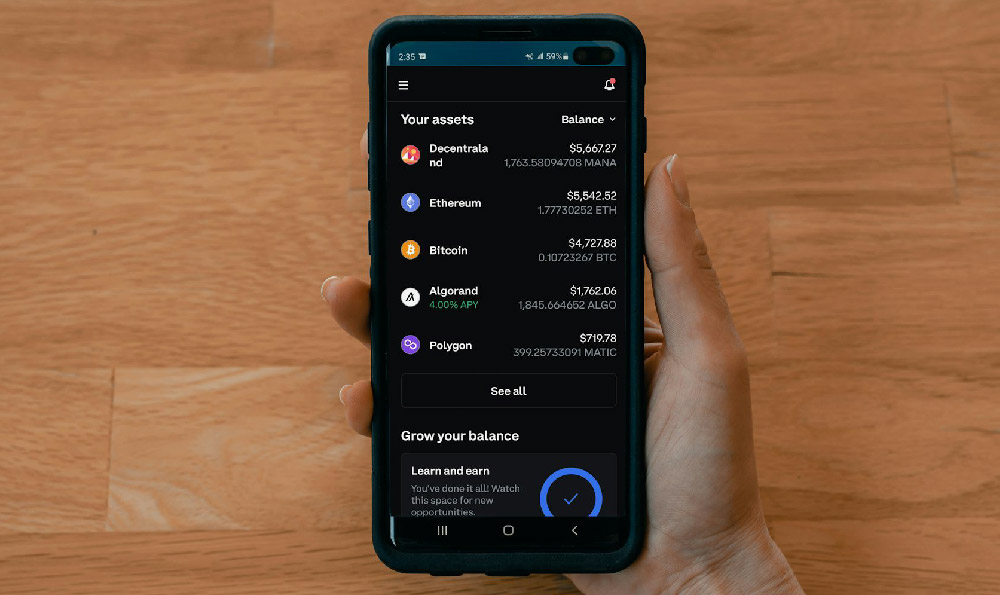

Innovative methods like cryptocurrency and peer-to-peer lending have emerged as modern alternatives, though they come with unique challenges and volatility. Cryptocurrencies such as Bitcoin or Ethereum offer the potential for high returns, but their price swings can make them unpredictable. Similarly, peer-to-peer lending platforms allow individuals to earn interest by investing in loans to others, but this carries credit risk and the possibility of defaults. While these avenues may seem appealing for quick profits, they require a thorough understanding of the underlying technology and market dynamics. Moreover, regulatory scrutiny in certain regions has increased, emphasizing the importance of compliance when exploring such options.

Side hustles and part-time ventures can also contribute to generating additional income, especially when combined with existing earnings. Whether it's selling handmade goods on Etsy, offering consulting services, or participating in affiliate marketing, there are numerous paths to supplement one's income. The success of these ventures often depends on market demand, entrepreneurial acumen, and the ability to adapt to changing trends. For instance, the gig economy has provided opportunities for flexible work, allowing individuals to monetize their time by offering services on platforms like Uber or TaskRabbit. However, it is crucial to maintain a balance between these activities and full-time commitments, ensuring that they do not lead to burnout or financial strain.

Ultimately, the path to earning money primarily involves a combination of strategic planning, patience, and continuous learning. By diversifying income sources and staying informed about market trends, individuals can build a more resilient financial foundation. It is important to remember that ease of earning is often tied to the level of risk involved, and while some methods may offer quicker returns, they may also come with higher volatility or uncertainty. A balanced approach that prioritizes long-term growth and stability is essential for sustainable financial success. By exploring various avenues and adapting to the ever-evolving economic landscape, individuals can unlock profitable opportunities that align with their goals and values.