Investing in Gold Online: Where and How?

Investing in gold online has become increasingly popular, offering investors a convenient way to diversify their portfolios and potentially hedge against economic uncertainty. However, navigating the online gold market requires careful consideration and a solid understanding of available options, associated risks, and best practices. Knowing where to invest and how to do it effectively is crucial for success.

One of the primary considerations is selecting a reputable platform. The online gold market is populated with various players, including online bullion dealers, brokers offering gold-backed ETFs (Exchange Traded Funds) or mutual funds, and even cryptocurrency platforms that offer tokens pegged to the price of gold. Each option has its own set of advantages and disadvantages.

Online bullion dealers like APMEX, JM Bullion, and SD Bullion are well-established and offer a wide selection of physical gold products, including coins, bars, and rounds. Investing through these dealers allows you to directly own the physical gold. The process typically involves creating an account, selecting the desired products, and paying via various methods, such as bank wire, credit card, or cryptocurrency. A key advantage is tangible ownership, providing a sense of security for many investors. However, storage is a significant consideration. You will need to arrange for secure storage, either at home (which carries security risks) or through a third-party vaulting service, which incurs additional fees. Transportation and insurance also need to be considered. Furthermore, when you decide to sell, you will need to arrange for shipping or transportation of the gold back to the dealer, which can also be costly and time-consuming. Therefore, carefully compare prices across different dealers, factoring in premiums (the price above the spot price of gold), shipping costs, and any applicable sales taxes.

Gold-backed ETFs provide an alternative way to invest in gold without the hassle of physical storage. These ETFs, such as GLD (SPDR Gold Trust) and IAU (iShares Gold Trust), hold physical gold in vaults and offer shares to investors. The price of the ETF shares typically tracks the spot price of gold. The advantage of gold ETFs is liquidity. Shares can be easily bought and sold on stock exchanges, providing flexibility and quick access to your investment. The expense ratios, which represent the annual cost of managing the fund, are generally low, making them a cost-effective option for many investors. However, you don't directly own the gold; you own shares that represent a claim on a portion of the fund's gold holdings. Also, while ETFs generally track the gold price, discrepancies can occur due to factors such as supply and demand. Therefore, research the specific ETF and understand its tracking performance and expense ratio before investing. Consider also mutual funds that invest in gold mining companies. While correlated to the price of gold, these funds are also influenced by the performance of the underlying companies, adding another layer of risk.

Another emerging option involves investing in gold-backed cryptocurrencies or tokens. These digital assets are pegged to the value of gold, with each token theoretically representing a certain fraction of an ounce of gold stored in a vault. Examples include PAX Gold (PAXG) and Tether Gold (XAUT). The appeal of these tokens is their divisibility and ease of transfer. You can buy and sell fractions of a token, making it accessible to investors with limited capital. These tokens are also often tradeable on cryptocurrency exchanges, providing liquidity. However, it's essential to carefully vet the issuer of the token and understand the underlying storage arrangements for the gold. Scrutinize the audit reports and verify the issuer's claims regarding gold reserves. The regulatory landscape for gold-backed cryptocurrencies is still evolving, so be aware of the potential risks associated with investing in this emerging asset class. Furthermore, the fees associated with trading these tokens can be higher than those associated with traditional gold ETFs.

Before making any investment in gold online, it is crucial to conduct thorough research and due diligence. Start by understanding your own investment goals and risk tolerance. Are you looking for a short-term hedge against inflation, or a long-term store of value? This will help you determine the appropriate type of gold investment. Research the platform or dealer you plan to use. Check their reputation, read reviews, and verify their credentials. Look for companies that are transparent about their fees, storage arrangements, and security protocols. Don't be afraid to ask questions and seek clarification on any aspect of the investment process.

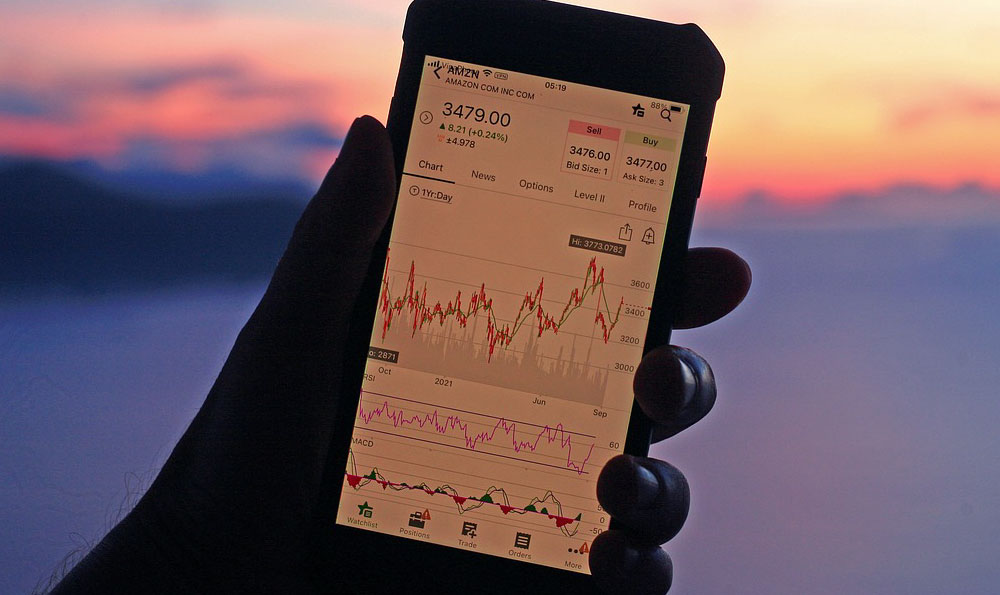

Another key consideration is the timing of your investment. Gold prices can be volatile and influenced by various factors, including economic conditions, geopolitical events, and currency fluctuations. While it is impossible to predict the future price of gold with certainty, you can use technical analysis and fundamental analysis to assess potential entry points. Technical analysis involves studying price charts and patterns to identify trends and potential support and resistance levels. Fundamental analysis involves evaluating the underlying economic factors that could affect the demand and supply of gold. Consider dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of the price. This can help to mitigate the risk of buying gold at a peak and smooth out the overall cost of your investment over time.

Finally, remember that gold should be just one component of a diversified investment portfolio. Don't put all your eggs in one basket. Diversification helps to reduce overall risk and improve the potential for long-term returns. Consult with a qualified financial advisor to develop a comprehensive investment plan that takes into account your individual circumstances and goals. Investing in gold online can be a rewarding experience, but it requires careful planning, due diligence, and a sound understanding of the market. By following these guidelines, you can increase your chances of success and achieve your financial goals. Remember, knowledge is power, and informed decisions are essential for navigating the complex world of online gold investing.