Can I really earn doing nothing? How to make money passively?

The allure of earning money while seemingly doing nothing is a powerful one. It's the siren song of financial freedom, the promise of escaping the traditional 9-to-5 grind. The reality, however, is nuanced. While completely passive income might be a myth, creating streams of income that require minimal ongoing effort is absolutely achievable with the right strategies and a bit of upfront work.

The cornerstone of generating passive income lies in building or acquiring assets that generate revenue without your constant direct involvement. Think of it like planting a tree: it requires initial effort – preparing the ground, planting the sapling, watering and nurturing it – but once established, it provides shade and perhaps even fruit with relatively little further intervention.

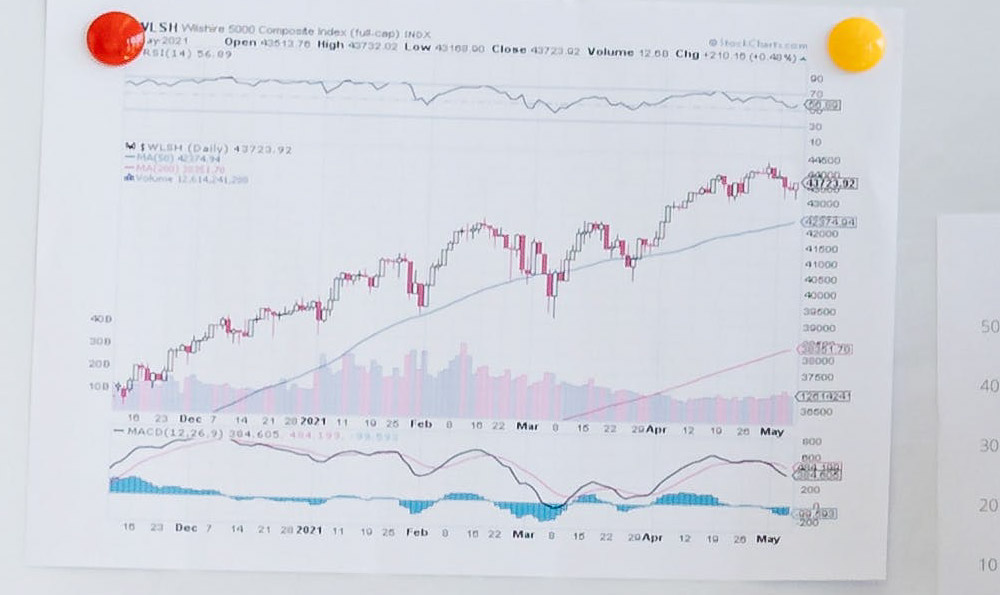

One of the most time-tested avenues for passive income is investing in the stock market, particularly dividend-paying stocks or index funds. Dividend stocks represent ownership in companies that regularly distribute a portion of their profits to shareholders. Index funds, on the other hand, provide broad market exposure, mitigating risk through diversification and allowing you to benefit from overall economic growth. While stock market investments carry inherent risks, such as market fluctuations, carefully researching and selecting fundamentally sound companies or low-cost index funds can generate a steady stream of dividend income over the long term. Reinvesting those dividends further compounds your returns, accelerating the growth of your portfolio. The key here is to adopt a long-term perspective and resist the urge to react emotionally to short-term market volatility. A well-diversified portfolio, built on solid fundamentals and held patiently, is more likely to generate sustainable passive income.

Real estate investing is another popular option, but it often demands more active management than simply buying stocks. However, with strategic planning, you can minimize your involvement. Renting out properties provides a recurring income stream, but it also entails responsibilities like finding tenants, handling repairs, and managing finances. One way to lessen the workload is to hire a property manager. A good property manager will handle tenant screening, rent collection, maintenance requests, and even eviction proceedings, freeing you from the day-to-day operational burdens. While this comes at a cost, it significantly reduces the time and effort required to manage the property, allowing you to enjoy a more passive income stream. Another approach is to invest in Real Estate Investment Trusts (REITs), which are companies that own and manage income-producing real estate. REITs allow you to benefit from the real estate market without directly owning or managing properties. They distribute a significant portion of their income to shareholders, making them an attractive option for passive income seekers.

Creating and selling digital products is a rapidly growing area for generating passive income. If you possess expertise in a particular field, you can create online courses, ebooks, software, or templates and sell them through platforms like Teachable, Udemy, or your own website. The initial effort involves creating high-quality content and marketing it effectively. Once the product is launched, it can generate income for years to come with minimal ongoing effort. While you might need to update the content periodically to keep it relevant, the core earning potential lies in the scalability of digital products: you can sell them to an unlimited number of customers without incurring significant additional costs. Think about documenting a process you've perfected at work, teaching a skill you've honed over years, or creating a resource that solves a common problem. By packaging your knowledge and expertise into a digital product, you can tap into a global market and generate a continuous stream of revenue.

Affiliate marketing is another popular avenue for passive income, where you earn a commission for promoting other companies' products or services. You can create a blog, YouTube channel, or social media presence and recommend products or services to your audience. When someone purchases a product through your unique affiliate link, you earn a percentage of the sale. The key to success in affiliate marketing is building a loyal audience and promoting products that are relevant to their interests. While it requires effort to create engaging content and build a following, once established, your platform can generate passive income through affiliate commissions. Choose products you genuinely believe in and that offer value to your audience. Transparency and authenticity are crucial for building trust and maintaining a long-term sustainable income stream.

Peer-to-peer lending (P2P lending) provides another avenue. Platforms connect borrowers with individual investors. You can lend money to borrowers through these platforms and earn interest on the loans. While P2P lending offers the potential for higher returns than traditional savings accounts, it also carries higher risk. It's crucial to carefully assess the creditworthiness of borrowers and diversify your investments across multiple loans to mitigate the risk of default. Research different P2P lending platforms and understand their lending criteria, fees, and default rates before investing.

Earning passive income isn't about getting rich quick or doing absolutely nothing. It requires upfront effort, strategic planning, and a willingness to learn and adapt. However, by building or acquiring income-generating assets, you can create streams of revenue that require minimal ongoing effort, freeing up your time and providing you with greater financial flexibility. Remember to diversify your income streams and reinvest your earnings to accelerate your progress toward financial freedom. Before venturing into any passive income stream, conduct thorough research, understand the associated risks, and seek professional financial advice if needed. The journey to passive income requires patience, discipline, and a long-term perspective, but the rewards – financial freedom and the ability to pursue your passions – are well worth the effort. The initial "planting" might take some work, but the "harvest" can be enjoyed for years to come.