how to make money fast in gta 5

The allure of rapid financial growth often drives individuals to explore unconventional avenues, whether it's through high-stakes investments or engaging with digital platforms. While the concept of earning money quickly can sometimes lead to risky decisions, understanding the fundamentals of strategic investing—particularly in the realm of cryptocurrencies—can offer a more sustainable path. Here, we delve into a nuanced analysis of how to navigate crypto markets with foresight, balance risk and reward, and avoid pitfalls that could jeopardize financial stability.

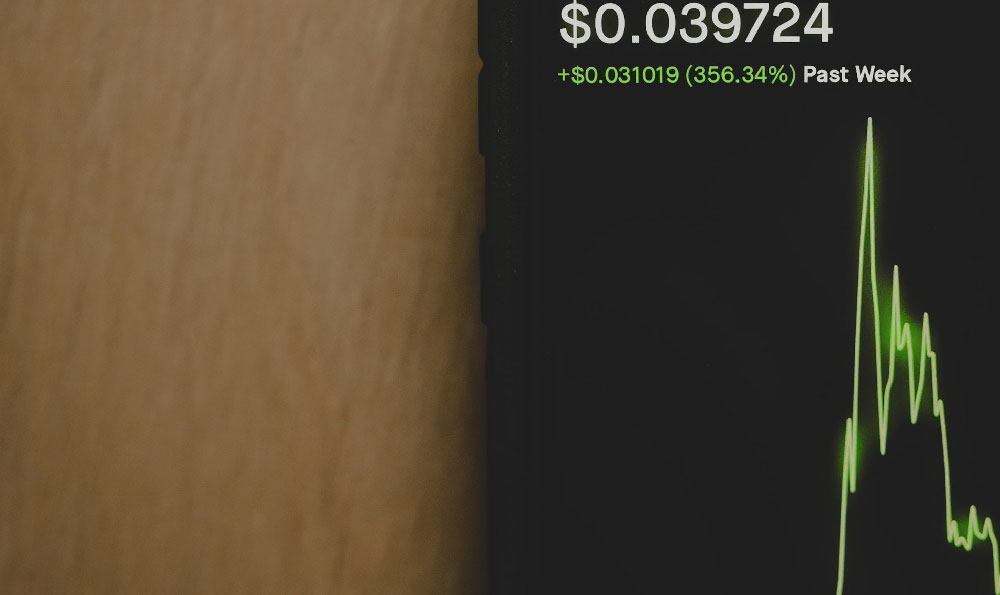

A crucial first step in any investment endeavor is to recognize that crypto markets are inherently volatile and susceptible to rapid price swings. This volatility stems from a combination of factors, including regulatory uncertainty, technological advancements, and speculative behavior. To mitigate risks, investors must adopt a long-term perspective while remaining agile enough to capitalize on short-term opportunities. For instance, while the overnight surge of a particular coin might seem tempting, it is often followed by a sharp decline. Success in this space requires not only technical analysis but also a deep understanding of macroeconomic trends and market psychology.

One effective approach is to diversify investments across different crypto assets. Just as a seasoned investor would spread risk in traditional markets, the same principle applies to digital assets. By allocating funds to a mix of established cryptocurrencies like Bitcoin and Ethereum, as well as emerging projects with strong fundamentals, investors can reduce exposure to any single market fluctuation. Additionally, hedging strategies—such as using derivatives or stablecoins—can further stabilize portfolios. However, it is essential to remember that diversification does not eliminate risk, but it can significantly reduce its impact.

Generating consistent returns in crypto markets also hinges on identifying high-potential projects with robust technical infrastructure and clear use cases. For example, blockchain-based platforms that address real-world problems, such as supply chain management or decentralized finance (DeFi), often attract long-term interest. Investors should evaluate a project's team credibility, technological innovation, and community engagement before committing capital. Moreover, staying informed about industry developments through reliable news sources and analytical reports can provide insights into upcoming trends and opportunities.

Risk management is another cornerstone of successful crypto investing. Establishing clear stop-loss and take-profit levels can help investors protect their capital and lock in gains. For instance, setting a stop-loss at 10% below the purchase price ensures that losses are minimized in the event of a sudden downturn. Similarly, taking profits at 20% above the entry point allows investors to secure returns before potential corrections. However, it is important to avoid knee-jerk reactions and instead base decisions on thorough analysis rather than fear or greed.

Moreover, the importance of liquidity cannot be overstated. While some crypto projects offer high returns, they may also be illiquid, making it difficult to exit positions when needed. Investors should prioritize assets with established trading volumes and robust market structures. For example, Bitcoin and Ethereum trade on major exchanges with deep liquidity, whereas newer projects may have limited trading pairs and high slippage. Ensuring sufficient liquidity allows investors to manage their positions effectively, even in uncertain market conditions.

The psychological aspect of investing also plays a significant role. Maintaining a disciplined mindset and avoiding emotional decisions can prevent costly mistakes. For example, the fear of missing out (FOMO) often drives investors to buy at inflated prices, while panic selling during market corrections can lock in losses. By adhering to a predefined investment strategy and resisting impulsive behavior, investors can foster a more rational decision-making process.

In addition to these core principles, the evolution of crypto markets has introduced new opportunities for innovation. The rise of decentralized finance (DeFi) platforms, non-fungible tokens (NFTs), and staking mechanisms has expanded the range of investment options. Staking, for instance, allows investors to earn passive income by supporting a blockchain network's operations. Similarly, NFTs have created new avenues for investment in digital assets with unique value propositions. However, these opportunities come with their own risks, and investors should conduct thorough due diligence before participating.

Ultimately, achieving significant returns in crypto markets requires a blend of technical expertise, strategic foresight, and emotional discipline. By combining these elements, investors can navigate the complexities of the market with confidence. For example, an investor with a clear understanding of blockchain technology and a solid grasp of market trends can develop a diversified portfolio that balances short-term opportunities with long-term growth potential. At the same time, maintaining a disciplined approach ensures that decisions are made based on analysis rather than speculation.

In conclusion, the path to substantial financial growth through crypto investments is not without challenges. However, by adopting a strategic mindset, diversifying portfolios, and practicing stringent risk management, investors can unlock opportunities that align with their long-term goals. The key lies in staying informed, balancing ambition with caution, and navigating the market with both expertise and patience.