How to Invest? & How to Profit from the Stock Market?

Okay, I understand. Here's an article addressing the question of how to invest and how to profit from the stock market, written as a knowledgeable investment advisor would, aiming for depth and avoiding bullet points or numbered lists.

Investing wisely and profiting from the stock market requires a blend of knowledge, discipline, and a long-term perspective. It's not a get-rich-quick scheme but rather a strategic approach to building wealth over time. Understanding the fundamental principles and tailoring your approach to your risk tolerance and financial goals are paramount.

One of the first steps in navigating the investment landscape is defining your objectives. Are you saving for retirement, a down payment on a house, your children's education, or simply seeking to grow your wealth? The timeframe for achieving these goals will significantly impact the types of investments you should consider. For long-term goals, like retirement, you can typically afford to take on more risk, potentially allocating a larger portion of your portfolio to stocks. Shorter-term goals, conversely, necessitate a more conservative approach, favoring investments like bonds or money market accounts that offer greater stability.

Once your goals are clear, assess your risk tolerance. This involves understanding how comfortable you are with the possibility of losing money in exchange for the potential for higher returns. Risk tolerance is not a static attribute; it can fluctuate based on your age, financial situation, and even your emotional disposition. Conservative investors prioritize preserving capital and are willing to accept lower returns. Aggressive investors, on the other hand, are more comfortable with volatility and seek higher growth potential, even if it means greater potential losses.

Diversification is a cornerstone of successful investing. Spreading your investments across different asset classes, industries, and geographic regions helps to mitigate risk. Avoid putting all your eggs in one basket. For example, instead of investing solely in technology stocks, consider diversifying into healthcare, consumer staples, and international markets. Diversification reduces the impact of any single investment's performance on your overall portfolio. Index funds and Exchange Traded Funds (ETFs) are excellent vehicles for achieving broad diversification at a low cost. These funds track a specific market index, such as the S&P 500, and provide exposure to a wide range of companies.

Another vital element of profiting from the stock market lies in understanding the difference between investing and speculating. Investing involves purchasing assets with the intention of holding them for the long term, based on fundamental analysis of the underlying business. Speculation, in contrast, focuses on short-term price movements and often relies on technical analysis or market sentiment. While speculation can sometimes yield quick profits, it's inherently riskier than investing and more akin to gambling. Warren Buffett, one of the most successful investors of all time, famously said, "Be fearful when others are greedy, and greedy when others are fearful." This embodies the principle of value investing, which involves identifying undervalued companies with strong fundamentals and holding them until their market value reflects their true worth.

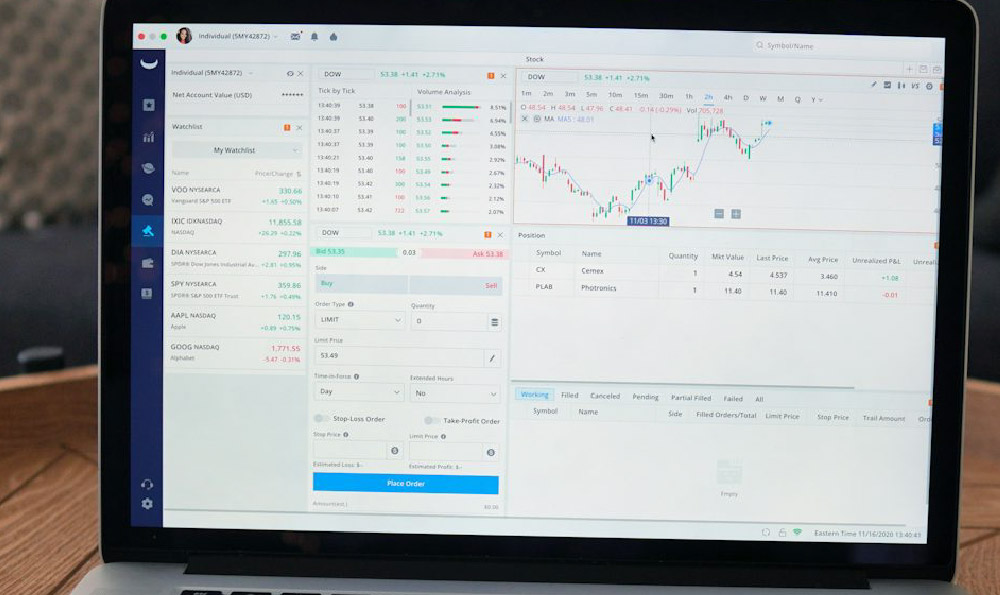

Fundamental analysis involves scrutinizing a company's financial statements, including its revenue, earnings, debt, and cash flow. It also entails assessing the company's competitive position, industry trends, and management team. By understanding the underlying business, you can make informed decisions about whether to invest in its stock. Technical analysis, on the other hand, focuses on charting historical price and volume data to identify patterns and predict future price movements. While technical analysis can be useful for short-term trading, it's less reliable for long-term investing.

A buy-and-hold strategy, coupled with regular rebalancing, is often a successful approach for long-term investors. Buy-and-hold involves purchasing investments and holding them for an extended period, regardless of short-term market fluctuations. Rebalancing involves periodically adjusting your portfolio to maintain your desired asset allocation. For example, if your target allocation is 60% stocks and 40% bonds, you would rebalance your portfolio whenever those percentages deviate significantly from your target. Rebalancing helps to ensure that you're not taking on too much risk and allows you to buy low and sell high.

Dollar-cost averaging is another valuable strategy for mitigating risk and taking emotion out of the equation. This involves investing a fixed amount of money at regular intervals, regardless of the stock price. When prices are low, you buy more shares; when prices are high, you buy fewer shares. Over time, this strategy can help you to achieve a lower average cost per share than if you tried to time the market.

Beyond individual stocks, consider the benefits of investing in mutual funds managed by professional fund managers. These funds offer diversification and expertise, but they also come with fees. Carefully evaluate the fund's expense ratio, past performance (keeping in mind that past performance is not indicative of future results), and investment strategy before investing. Low-cost index funds and ETFs are often a good choice for investors who want to minimize fees and achieve broad market exposure.

Tax-advantaged investment accounts, such as 401(k)s and Individual Retirement Accounts (IRAs), can also significantly enhance your returns. These accounts offer tax benefits, such as tax-deferred growth or tax-free withdrawals, which can help you to accumulate wealth more quickly. Understand the rules and regulations governing these accounts and take full advantage of their benefits.

Finally, remember that investing is a marathon, not a sprint. There will be periods of market volatility and uncertainty. Resist the urge to make impulsive decisions based on fear or greed. Stay disciplined, stick to your investment plan, and focus on the long term. Seek advice from a qualified financial advisor if you need help developing or managing your investment strategy. With knowledge, patience, and discipline, you can navigate the complexities of the stock market and achieve your financial goals. Continuous learning and adapting to changing market conditions are key to sustained success.