How Much Money is Enough? What Defines Wealth?

The age-old question of "How much money is enough?" is deceptively simple, yet it delves into the very core of our values, aspirations, and ultimately, our definition of wealth. The answer is not a fixed number, but rather a dynamic and deeply personal concept that shifts with our life stages, priorities, and individual circumstances. To truly understand what constitutes "enough," we must first disentangle the complex relationship between money, happiness, and true wealth.

Money, undeniably, plays a crucial role in providing for our basic needs and enhancing our quality of life. It affords us security, access to healthcare, education, and experiences that broaden our horizons. However, the relentless pursuit of more money often leads to a hedonic treadmill, where increased income brings only temporary satisfaction before the desire for even more wealth resurfaces. Studies have shown that happiness tends to increase with income, but only up to a certain point. Beyond that, the correlation weakens considerably, suggesting that happiness is not solely dependent on accumulating vast sums of money.

This is where the concept of true wealth comes into play. True wealth extends far beyond the tangible assets we possess. It encompasses our physical and mental well-being, our relationships with loved ones, our sense of purpose, and our contribution to the world around us. It is about living a fulfilling life aligned with our values, rather than simply accumulating material possessions.

Defining "enough" therefore requires a profound introspection. It necessitates a clear understanding of our values, our life goals, and what truly brings us joy. What are our aspirations? What kind of lifestyle do we desire? What legacy do we want to leave behind? Once we have a clear picture of what we want to achieve in life, we can begin to estimate the financial resources required to support our goals.

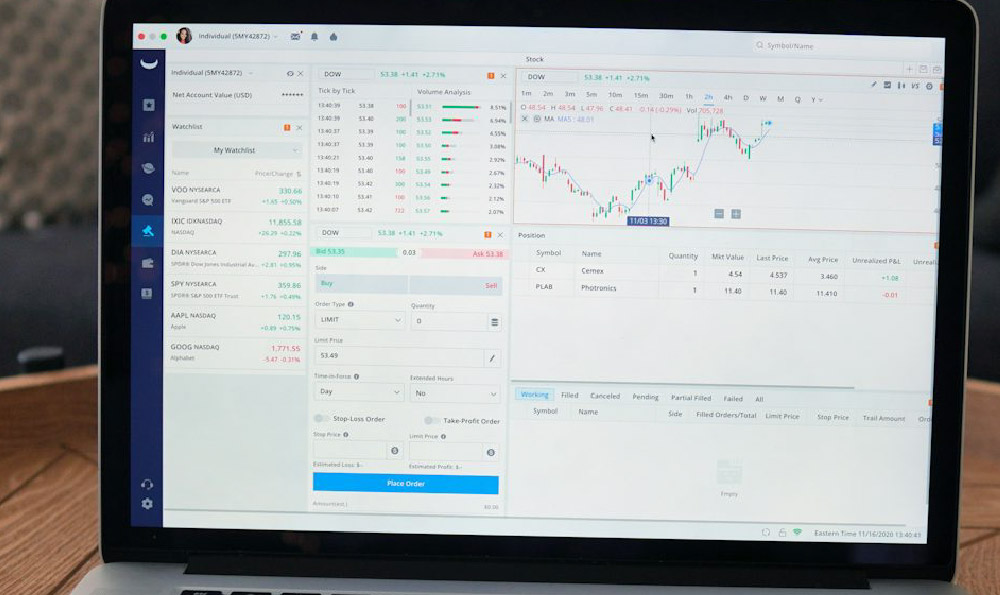

This process involves several key considerations. Firstly, we must assess our current financial situation. This includes calculating our net worth, tracking our income and expenses, and identifying any debts or liabilities. A comprehensive understanding of our current financial standing is crucial for developing a realistic and achievable financial plan.

Secondly, we need to define our short-term, medium-term, and long-term financial goals. These goals could include buying a home, starting a family, saving for retirement, traveling the world, or supporting charitable causes. Each goal should be specific, measurable, achievable, relevant, and time-bound (SMART). By setting clear and well-defined goals, we can create a roadmap for our financial journey and track our progress along the way.

Thirdly, we must estimate the cost of achieving each of our financial goals. This requires careful research and planning. For example, if our goal is to retire comfortably, we need to estimate our living expenses in retirement, taking into account factors such as inflation, healthcare costs, and potential long-term care needs.

Fourthly, we need to develop a comprehensive financial plan that outlines how we will achieve our financial goals. This plan should include strategies for saving, investing, and managing debt. It should also consider potential risks and challenges, such as market volatility, unexpected expenses, or job loss.

The investment portion of the financial plan is particularly crucial. It requires careful consideration of our risk tolerance, time horizon, and investment goals. Diversification is key to mitigating risk and maximizing returns. A well-diversified portfolio should include a mix of asset classes, such as stocks, bonds, and real estate.

However, investing should not be viewed as a get-rich-quick scheme. It requires patience, discipline, and a long-term perspective. It is important to avoid making impulsive decisions based on short-term market fluctuations. Instead, we should focus on building a solid foundation of investments that will grow steadily over time.

Beyond the numbers, "enough" also involves a conscious effort to cultivate gratitude and contentment. It is about appreciating what we already have, rather than constantly chasing after more. Practicing mindfulness and focusing on the present moment can help us to appreciate the simple joys of life and reduce our desire for material possessions.

Furthermore, "enough" involves giving back to the community and making a positive impact on the world. This could involve volunteering our time, donating to charitable causes, or simply being kind and compassionate to others. Contributing to something larger than ourselves can provide a sense of purpose and fulfillment that money cannot buy.

In conclusion, the definition of "enough" is not a static number but a dynamic concept shaped by our values, aspirations, and life goals. True wealth encompasses far more than just money; it includes our physical and mental well-being, our relationships, our sense of purpose, and our contribution to the world. Defining "enough" requires introspection, careful planning, and a conscious effort to cultivate gratitude, contentment, and a commitment to making a positive impact. It is about living a fulfilling life aligned with our values, rather than simply chasing after more material possessions. Ultimately, "enough" is not a destination but a journey, a continuous process of self-discovery and growth. It’s about understanding that true wealth lies not in how much we accumulate, but in how we live.