Financial Advisors' Average Salary: How Much Do They Earn?

Financial Advisors' Average Salary: How Much Do They Earn?

The financial advisory sector has become a cornerstone of modern wealth management, offering individuals and businesses strategic guidance to navigate complex markets and achieve long-term financial goals. As the demand for expert counsel grows, questions about the earning potential of financial advisors naturally arise. Understanding the average salary in this field, while also recognizing the factors that influence it, is essential for anyone considering a career in this domain or evaluating collaboration opportunities with professionals.

Global data reveals that the average salary for financial advisors varies significantly depending on location, specialization, and operational structure. In the United States, for example, the Bureau of Labor Statistics (BLS) reported a median annual wage of approximately $90,000 for financial advisors in 2022. However, this figure is not static—it fluctuates due to economic cycles, regulatory changes, and technological advancements reshaping the industry. In Europe, salaries tend to be lower, ranging from €45,000 to €75,000, while in Asia, particularly in countries like Singapore and South Korea, financial advisors often command higher earnings, reflecting the region’s rapid financial growth and increasing client demand. These disparities highlight the importance of geographic context when assessing earning potential.

The compensation of financial advisors is deeply intertwined with their expertise and the value they deliver. For instance, those specializing in high-net-worth individuals or institutional clients typically earn more than generalists due to the complexity of their portfolios and the extensive time spent on personalized planning. Conversely, advisors with a focus on robo-advisory services or digital platforms may see lower base salaries but benefit from performance-based incentives, such as commissions from managed assets. The intersection of technology and traditional advisory services is creating new revenue streams, allowing professionals to diversify their income beyond conventional fees.

Beyond geographic and specialized factors, the size of the client base plays a pivotal role in determining earnings. Independent advisors, who operate their own firms, often report higher average salaries compared to those affiliated with larger institutions. This is largely due to the ability to negotiate fees freely and retain a larger portion of commissions. However, independent advisors face greater overhead costs and responsibility for marketing, which can offset some of their financial gains. In contrast, advisors working within firms may benefit from structured support systems, such as access to research tools, client acquisition programs, and brand recognition, which can enhance their earning capacity.

The impact of education and certification on salary cannot be overstated. While a bachelor’s degree in finance, economics, or business is typically the minimum requirement, professionals with advanced degrees or specialized training often command premium rates. Certifications like the Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP) are particularly valuable, as they signal a commitment to ethical standards and industry-specific knowledge. These credentials not only increase credibility but also open doors to higher-paying roles, especially in corporate or institutional settings where expertise is critical.

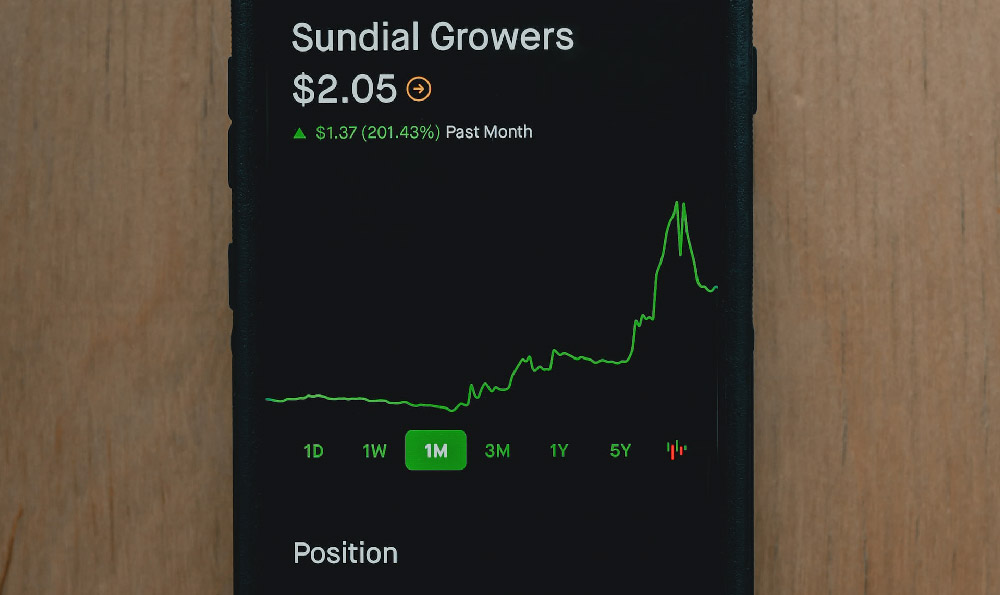

Another crucial aspect is the evolving role of technology in financial advising. The rise of digital platforms has shifted the industry toward performance-based compensation models, where advisors are rewarded for generating wealth through strategic investments. This creates a dynamic where salary potential is closely tied to the market performance of their recommendations, incentivizing continuous learning and adaptability. However, it also underscores the risks associated with over-reliance on market returns, as poor performance can directly affect income.

For financial advisors, the potential for growth is vast but demands a strong foundation in financial literacy, risk management, and client trust. Those who establish a robust client base and leverage technology to enhance efficiency often see substantial annual growth, with salaries increasing by 10% to 20% over time. Conversely, those who lack clear strategies or fail to address market volatility may struggle with stagnant earnings or financial instability. The key to sustainable success lies in balancing market-driven incentives with comprehensive risk assessment to ensure long-term client satisfaction.

Transparency in financial advising is equally vital, as it builds trust and ensures clients are fully informed about potential returns and risks. Advisors must avoid overpromising or misrepresenting investment outcomes, as these practices can erode credibility and result in financial loss for both parties. Ethical standards and regulatory compliance are not just legal necessities—they are critical to maintaining profitability and a positive reputation in the industry.

The financial advisory landscape is also influenced by macroeconomic trends, such as inflation rates, interest changes, and market volatility. During periods of economic uncertainty, clients may seek more conservative strategies, which can affect the types of services advisors provide and, consequently, their earning potential. Conversely, during market expansions, advisors with expertise in growth-oriented investments may see increased demand and higher commissions. Staying attuned to these trends allows professionals to adjust their strategies and maximize earnings.

For those aspiring to enter the field, the path to financial success begins with building a solid educational foundation and gaining hands-on experience. Internships, mentorship programs, and entry-level roles in financial institutions can provide critical insights into market dynamics and client needs. Additionally, staying updated on regulatory changes and technological innovations ensures advisors remain competitive and relevant in an ever-evolving industry.

The financial advisory profession is not without its challenges. While the average salary is competitive, success requires a combination of skill, diligence, and adaptability. Advisors who can effectively manage risk, provide personalized guidance, and maintain transparency are more likely to achieve long-term financial stability and growth. The integration of technology and traditional advice, coupled with a commitment to continuous learning, positions financial advisors to thrive in both stable and volatile market conditions.

Ultimately, the earning potential of financial advisors is a reflection of their ability to balance expertise with ethical responsibility. As the industry continues to evolve, professionals who remain agile and informed will not only secure higher salaries but also contribute to the broader goal of empowering clients to achieve financial independence. The journey to a successful career in financial advising requires patience, strategic planning, and a deep understanding of both market forces and human behavior—factors that ultimately dictate not only income but also long-term financial resilience.