How to Make Money with Penny Stocks: Effective Strategies, Tips, and Profit Opportunities

Understanding the Basics of Penny Stocks: What They Are and Why They Attract Investors

Penny stocks typically refer to shares of small-cap companies that trade at a low price, often below $5 per share. These stocks are popular among traders and investors seeking high returns with relatively low initial capital, though they come with inherent risks and volatility. The appeal of penny stocks lies in their potential for rapid price movements, which can be driven by factors such as market trends, product innovations, or shifts in public sentiment. However, the same characteristics that make them attractive also expose investors to significant uncertainties. To navigate this market effectively, it is crucial to develop a strategic approach that balances opportunity with caution.

Penny stocks are often listed on over-the-counter (OTC) markets or in the early stages of trading, which can limit liquidity and increase the likelihood of price manipulation. This makes them distinct from traditional equities, which generally have higher market capitalization and more transparent financial disclosures. While major companies like Tesla or Amazon once operated as penny stocks, their current status as market leaders highlights the potential for growth through careful selection and timing. For those considering investing in this sector, understanding the underlying dynamics is essential. Companies with strong fundamentals may offer sustainable value, while those with weak financials might be prone to sudden declines.

Researching and Selecting the Right Penny Stocks: Key Considerations for Success

Before diving into penny stock investments, conduct thorough research to identify companies with promising potential. Start by analyzing financial statements to assess profitability, debt levels, and cash flow. Look for businesses operating in high-growth industries such as technology, renewable energy, or healthcare, which may be more resilient in the long term. Additionally, evaluate the management team's track record and the company’s competitive advantages, such as proprietary technology or unique market positioning. Company news, press releases, and analyst reports can also provide insights into recent developments and future prospects.

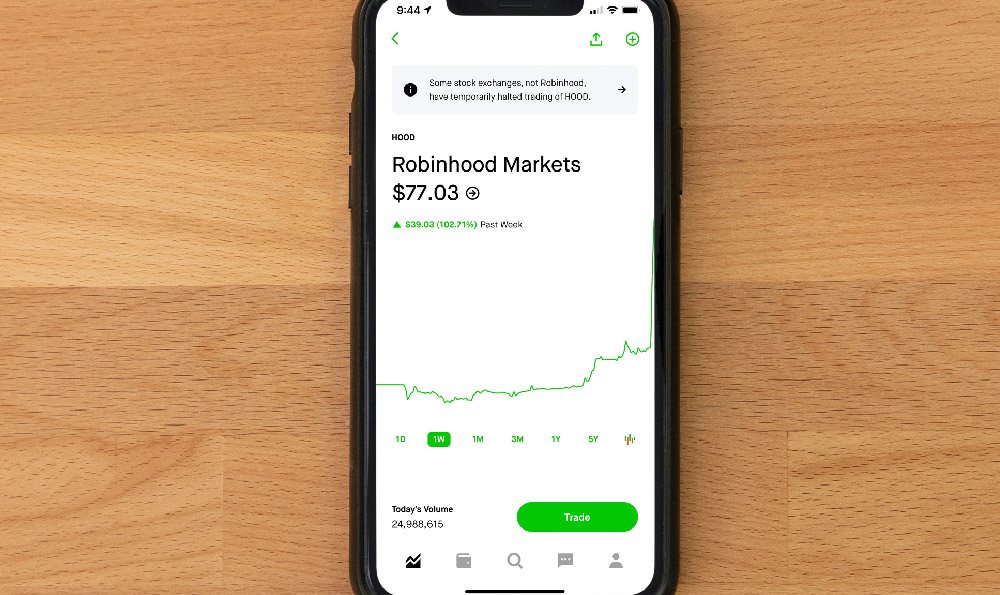

Another critical factor is market sentiment. News about regulatory approvals, partnerships, or product launches can drive significant price fluctuations. For example, a company announcing a breakthrough in a new market segment might see its stock soar in a short period. However, this volatility also means that sudden negative developments, such as lawsuits or financial scandals, can lead to sharp declines. Investors should monitor these trends closely and avoid speculative bets without a clear rationale. Furthermore, consider the stock’s trading volume, as low volume can result in wider spreads and greater difficulty in executing trades at desired prices.

Implementing Risk Management Techniques: Protecting Your Investments in the Volatile Market

Given the high risk associated with penny stocks, establishing a robust risk management strategy is vital. One approach is to set strict stop-loss orders, which automatically sell a stock if it falls below a specified price, limiting potential losses. Another technique involves diversifying your portfolio across multiple companies, reducing the impact of any single stock’s underperformance. Investors should also avoid overexposure by allocating only a small percentage of their total capital to this market, ensuring they can withstand downturns without jeopardizing their overall financial health.

Market volatility requires a disciplined mindset. Avoid emotional trading by sticking to a defined plan and resisting the urge to chase rapid gains. Instead, focus on long-term fundamentals and short-term catalysts that align with your investment goals. For instance, if you’re targeting short-term profits, look for stocks with upcoming earnings reports or regulatory changes that could trigger price increases. Conversely, for long-term investments, prioritize companies with strong financials, sustainable growth, and a loyal customer base.

Strategies for Profitability: Leveraging Trends, News, and Market Conditions

Profit opportunities in penny stocks often stem from market trends and news-driven events. Traders can capitalize on momentum by identifying stocks that are breaking out due to strong performance or positive sentiment. Tools like technical analysis—focusing on price patterns, volume spikes, and moving averages—can help predict potential rebounds or crashes. For example, a stock showing a bullish divergence in its trendline might signal a short-term buying opportunity, while a bearish cross in the candlestick chart could indicate a sell signal.

News events also play a pivotal role. Companies involved in mergers, acquisitions, or product launches may experience immediate price movements that can be exploited strategically. However, not all news is equally impactful. Prioritize information from credible sources, such as official filings, reputable financial analysts, or verified market reports. Additionally, pay attention to market conditions, such as interest rates, economic indicators, or geopolitical events, which can influence sentiment and create volatility.

Diversification and Long-Term Potential: Balancing Short-Term Gains with Sustainability

While short-term trading can yield quick profits, long-term investors should focus on companies with strong fundamentals and sustainable growth. Diversifying across multiple sectors can mitigate the risk of market corrections or industry-specific downturns. For example, investing in both tech and renewable energy stocks can provide exposure to different areas of innovation, reducing dependency on a single market trend. Patience and consistency are key in the long term, as successful penny stock investments often require time to mature.

Adapting to Market Changes: Staying Informed and Responsive

The market for penny stocks is dynamic and requires constant adaptation. Regularly update your knowledge by following financial news, participating in investor forums, and reviewing company updates. Software tools that track market sentiment, volume changes, and news events can enhance decision-making. Staying informed also allows investors to react swiftly to market shifts, whether exploiting a sudden bullish trend or avoiding a bearish correction.

Psychology of Trading: Overcoming Emotions for Consistent Results

Investing in penny stocks demands emotional discipline. Avoid the pitfalls of greed and fear by adhering to a predefined plan and not reacting to short-term price swings. For example, a stock’s sharp increase might tempt investors to sell prematurely, missing potential further growth. Conversely, a sudden drop could lead to panic selling, locking in losses. Maintaining a long-term perspective and focusing on fundamentals can help investors make rational decisions.

Common Mistakes to Avoid: Overtrading and Lack of Research

Many investors struggle with penny stocks due to common mistakes such as overtrading and inadequate research. Overtrading often results in high transaction costs and reduced profits, especially in a volatile market where frequent trades can lead to margin calls or forced liquidations. Conversely, lack of research can lead to investing in companies with unclear prospects or poor governance, increasing the risk of financial loss. Striking a balance between active monitoring and informed decisions is critical for long-term success.

By combining thorough research, disciplined risk management, and strategic adaptability, investors can navigate the complexities of the penny stock market. While the path to profitability is challenging, it also offers unique opportunities for those who approach it with caution and expertise. The key lies in understanding the broader market dynamics, leveraging available tools, and maintaining a clear focus on both short-term and long-term goals.