How Can a Teen Make Money Fast? What Are the Best Ways?

Okay, I understand. Here's an article addressing the prompt, "How Can a Teen Make Money Fast? What Are the Best Ways?" tailored for a teen audience and incorporating elements of investment and financial responsibility, aiming for at least 800 words and delivered solely in English:

Earning money as a teenager often feels like a race against time. You’ve got bills to pay, dreams to fund, and social lives to maintain. While "fast" money often comes with risks, there are legitimate avenues to explore that can not only pad your wallet but also set you up for financial success in the long run. Before diving into specific methods, it's crucial to establish a foundation of responsible financial habits. This means understanding the difference between needs and wants, budgeting your income, and developing a long-term financial mindset. Think of every dollar earned not just as spending money but as a seed that can grow into something bigger.

One of the most accessible ways to quickly generate income is by leveraging skills you already possess. Consider tutoring younger students in subjects you excel in. Many parents are willing to pay a premium for personalized academic support. Advertising your services locally through community boards, social media groups, or even word-of-mouth can quickly attract clients. Similarly, if you’re adept at creative tasks like graphic design, video editing, or writing, freelance platforms offer a wealth of opportunities. Sites like Fiverr, Upwork (age restrictions apply, research thoroughly), and even specialized freelance marketplaces allow you to offer your services to a global audience. Remember to build a strong portfolio showcasing your best work to increase your chances of landing gigs.

Another time-honored method is engaging in direct selling. This could involve selling products online through platforms like Etsy (with parental supervision if under 18), creating and selling crafts at local markets, or even reselling items you no longer need on platforms like Depop or Poshmark. The key to success in direct selling is identifying a niche market and creating products that cater to their specific needs and desires. Researching trends, understanding your target audience, and providing excellent customer service are crucial for building a sustainable business.

Beyond these active income streams, consider passive income opportunities, albeit recognizing that these often require an initial investment of time and/or capital. Creating and selling digital products is a prime example. This could include creating and selling online courses, e-books, or digital art assets. Once created, these products can generate income with minimal ongoing effort. However, this approach requires a significant upfront investment in creating high-quality content and marketing it effectively.

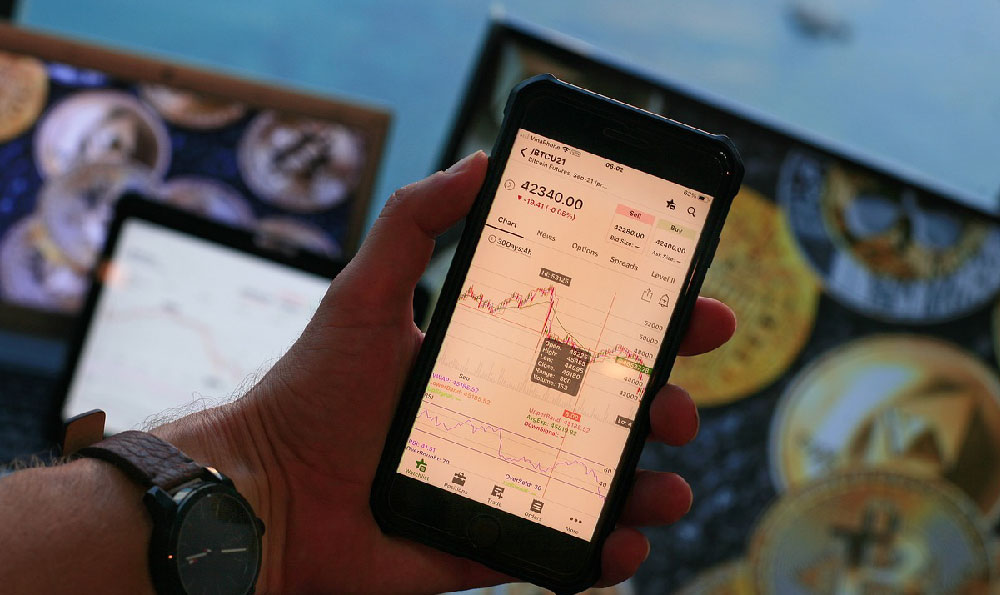

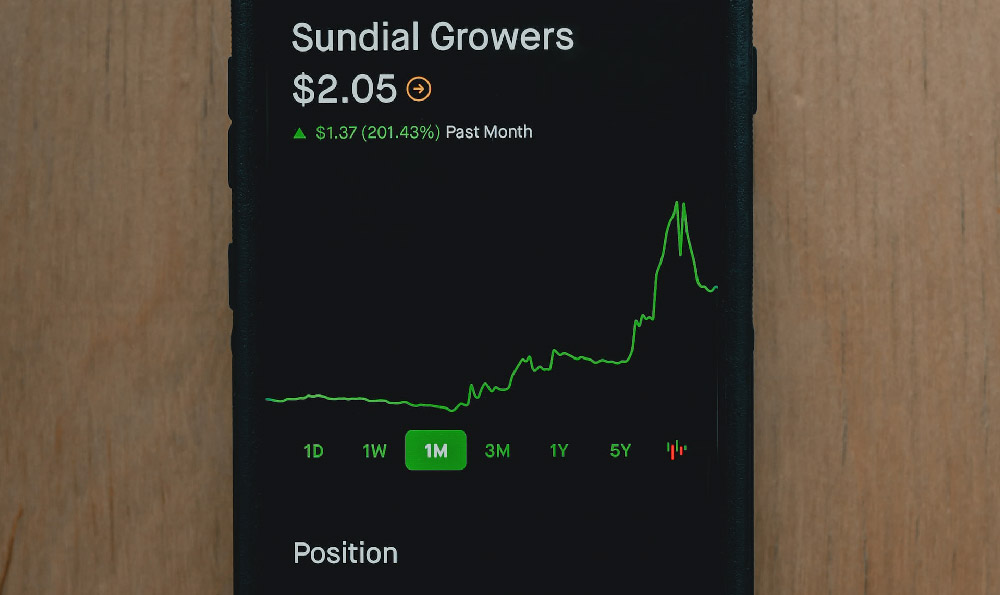

The allure of fast money can often lead to considering investments, including the somewhat controversial world of cryptocurrencies. While the potential for rapid gains exists, it's paramount to approach this market with extreme caution and a deep understanding of the risks involved. Cryptocurrency markets are notoriously volatile, and prices can fluctuate dramatically in a short period. If you are considering investing in cryptocurrencies, start small and only invest money you can afford to lose. Thoroughly research different cryptocurrencies, understand the underlying technology, and be wary of hype and get-rich-quick schemes. Seek guidance from trusted financial advisors and always prioritize long-term investing over short-term speculation.

Furthermore, focus on developing skills that will be valuable in the future job market. Consider taking online courses in areas like coding, data analysis, or digital marketing. These skills are in high demand and can open doors to higher-paying job opportunities in the future. Even volunteer work can be a valuable investment in your future career. It allows you to gain experience, develop new skills, and build your professional network.

Crucially, learn to manage your money effectively. Open a savings account and start saving a portion of every dollar you earn. Even small amounts saved consistently over time can add up to a significant sum. Consider setting financial goals and creating a budget to track your income and expenses. Understanding where your money is going is the first step towards controlling your finances. Also, explore the concept of compound interest. Understanding how your savings can grow over time can be a powerful motivator to save more.

Avoid high-risk investments or ventures that promise unrealistic returns. Be wary of scams and pyramid schemes, which often target young people with promises of easy money. If something sounds too good to be true, it probably is. Before making any investment decisions, seek advice from a trusted adult, such as a parent, teacher, or financial advisor.

Finally, remember that building wealth is a marathon, not a sprint. While it's tempting to chase after fast money, focus on developing a solid foundation of financial knowledge, skills, and habits. This will serve you well throughout your life and help you achieve your long-term financial goals. The best way to make money fast, ultimately, is to make smart decisions and be patient. Learning, growing, and building a strong financial base will provide a far greater return than any fleeting opportunity. Start small, stay informed, and never stop learning. That's the recipe for true and lasting financial success. Remember to always prioritize education and skill development, as these are the most valuable assets you can acquire.