How to Earn Money: What Are Your Best Strategies?

Navigating the world of cryptocurrency investment requires a blend of strategic planning, diligent research, and a healthy dose of risk management. There's no guaranteed path to riches, but adopting informed strategies can significantly increase your chances of success and mitigate potential losses. Instead of chasing fleeting trends or relying on speculative hype, let's delve into some foundational approaches that emphasize long-term growth and sustainability.

One of the cornerstone strategies for earning money in the crypto space is diversification. Avoid putting all your eggs in one basket. The crypto market is notoriously volatile, and relying solely on a single cryptocurrency exposes you to significant risk. Spread your investments across a variety of assets, including established coins like Bitcoin and Ethereum, as well as promising altcoins with strong fundamentals and innovative use cases. Diversification doesn't eliminate risk entirely, but it significantly reduces the impact of any single asset's performance on your overall portfolio. Consider diversifying not just across different cryptocurrencies, but also across different sectors within the crypto ecosystem, such as decentralized finance (DeFi), non-fungible tokens (NFTs), and layer-2 scaling solutions. This ensures you are exposed to various growth opportunities.

Beyond diversification, a thorough understanding of market fundamentals is crucial. Don't invest in a cryptocurrency simply because you heard it's "the next big thing." Conduct your own research (DYOR) on each project you consider. Analyze the whitepaper, which outlines the project's goals, technology, and team. Assess the team's expertise and track record. Evaluate the tokenomics, including the total supply, distribution, and potential for inflation. Examine the project's community support and adoption rate. A strong project should have a clear use case, a solid team, a well-defined roadmap, and a growing community of users. Furthermore, understanding the broader macroeconomic environment is important. Factors like interest rates, inflation, and regulatory developments can all significantly impact the crypto market.

Another effective strategy is dollar-cost averaging (DCA). This involves investing a fixed amount of money at regular intervals, regardless of the asset's price. For example, you might invest $100 in Bitcoin every week. When the price is low, you'll buy more Bitcoin, and when the price is high, you'll buy less. Over time, this strategy can help you smooth out the volatility and reduce the risk of buying at a peak. DCA is particularly well-suited for long-term investors who are looking to build a position in a cryptocurrency gradually.

Staking and yield farming are also viable options for generating passive income in the crypto space. Staking involves holding cryptocurrency in a wallet to support the operations of a blockchain network and earning rewards in return. Yield farming involves lending or borrowing cryptocurrency on decentralized finance (DeFi) platforms to earn interest or other rewards. Both staking and yield farming can be profitable, but they also come with risks. Staking risks may involve lock-up periods where you cannot access your assets, and the potential for price fluctuations during that time. Yield farming risks include impermanent loss, which occurs when the value of your deposited assets changes significantly compared to the value of the rewards you earn. Before engaging in staking or yield farming, thoroughly research the platform, understand the associated risks, and only invest what you can afford to lose.

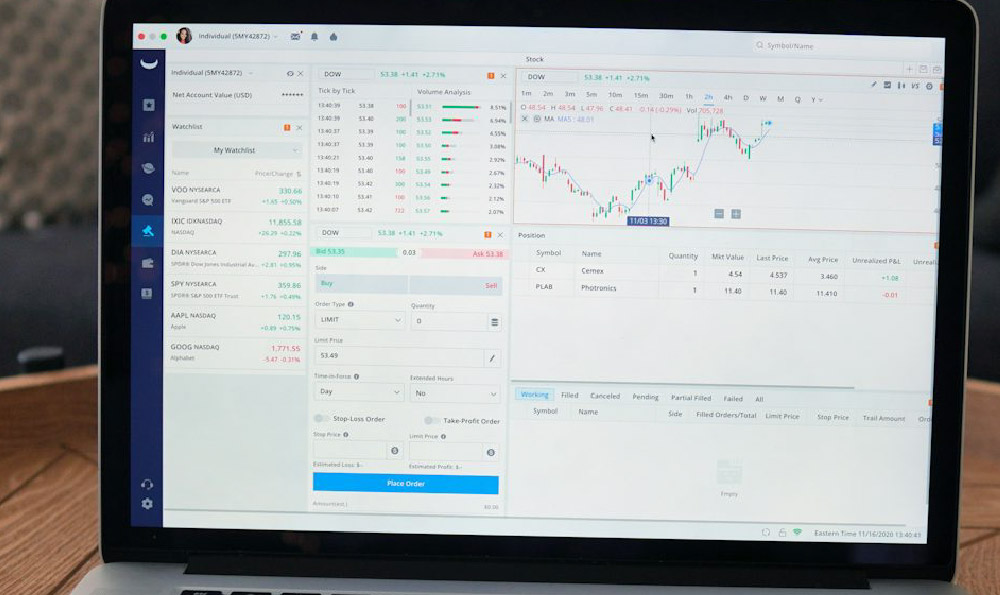

Actively managing your portfolio is paramount. Regularly review your investments, assess their performance, and make adjustments as needed. The crypto market is constantly evolving, and new opportunities and risks emerge frequently. Don't be afraid to rebalance your portfolio to maintain your desired asset allocation. Also, it is important to learn technical analysis. While not a foolproof method, it provides insight into potential entry and exit points based on historical price movements and trading volume. Recognizing patterns and trends can help you make more informed trading decisions. But it’s equally important to remember that past performance is not indicative of future results, and technical analysis should be used in conjunction with fundamental analysis.

Crucially, risk management should be a top priority. Never invest more than you can afford to lose. The crypto market is highly volatile, and prices can fluctuate dramatically in short periods. Set stop-loss orders to limit potential losses on your trades. Protect your private keys and seed phrases with utmost care. Use strong passwords, enable two-factor authentication (2FA), and store your keys offline in a cold wallet whenever possible. Be wary of scams and phishing attempts. Never share your private keys with anyone, and always double-check the URLs of websites before entering your credentials.

Finally, stay informed and continuously learn. The crypto space is constantly evolving, with new technologies, regulations, and trends emerging regularly. Follow reputable news sources, read industry reports, attend conferences, and engage with the crypto community to stay up-to-date on the latest developments. Continuous learning is essential for navigating the complexities of the crypto market and making informed investment decisions. By combining a disciplined approach with continuous learning and a strong focus on risk management, you can increase your chances of earning money in the dynamic and ever-evolving world of cryptocurrency. Remember that patience, persistence, and a long-term perspective are key to success in this space.