Is Coinpro's Secure Trading Automation Effective? What are the Benefits?

Okay, I'm ready. Here's an article based on the title you provided, aiming to be comprehensive, detailed, and informative, while avoiding lists and numbered points, and staying above 800 words:

``` Is Coinpro's Secure Trading Automation Effective? What are the Benefits?

The allure of automated cryptocurrency trading platforms like Coinpro lies in their promise: navigating the volatile digital asset market with precision, efficiency, and, most importantly, profitability. The core question, however, isn't whether these platforms exist, but whether they deliver on their claims of secure and effective trading automation. To determine this, we need to dissect the components of effectiveness and security, examining what Coinpro offers and how it stacks up against the inherent risks of the crypto world.

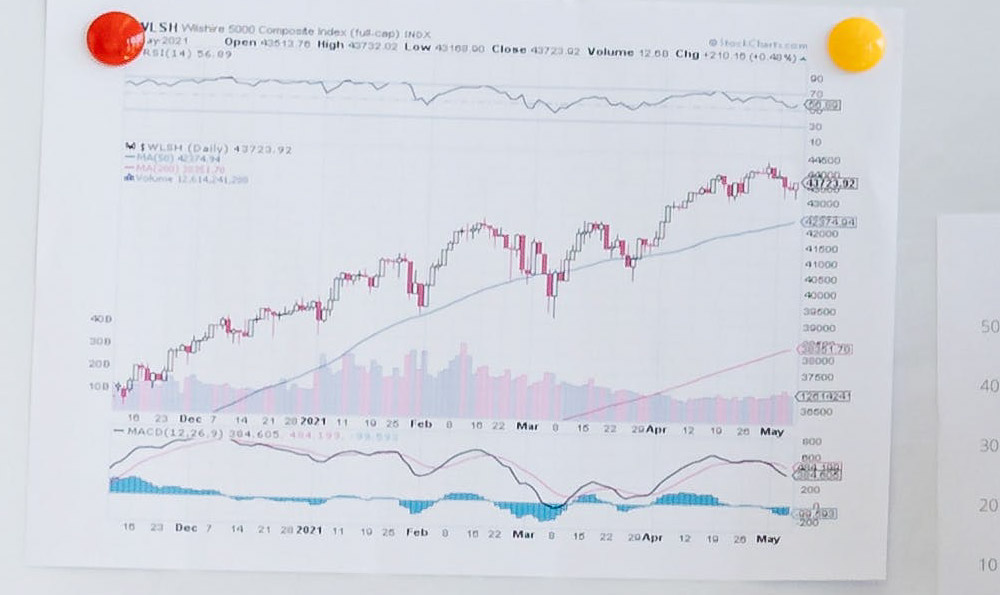

Coinpro's effectiveness hinges on the sophistication of its trading algorithms. These algorithms, at their most basic, are sets of pre-programmed instructions designed to analyze market data, identify trading opportunities, and execute trades automatically, all according to parameters set by the user. The more advanced the algorithm, the more factors it can consider: price movements, trading volume, order book depth, and even external data like news sentiment or macroeconomic indicators. This multi-faceted analysis allows the algorithm to theoretically make more informed trading decisions than a human trader who is constrained by time, emotion, and cognitive limitations.

However, the efficacy of even the most sophisticated algorithm depends entirely on the quality of its underlying data and the robustness of its design. An algorithm trained on flawed or incomplete data will produce flawed trading signals. Similarly, an algorithm that is overly complex or sensitive to market noise may generate false positives, leading to unnecessary trades and potential losses. Coinpro, like any platform, needs to demonstrate that its algorithms are rigorously tested and validated using historical data and real-world market conditions. Transparency regarding the algorithm's methodology and performance metrics is crucial for building trust with users. Backtesting results, while not guarantees of future performance, can provide valuable insights into the algorithm's strengths and weaknesses. The user also needs to consider if the backtesting data is representative of current market conditions. Are they factoring in market manipulation schemes and flash crashes that occur quite regularly in the crypto space?

The security aspect is equally critical. The crypto space is rife with scams, hacks, and security breaches. Coinpro's "secure trading automation" claim needs to be scrutinized in terms of several key areas. First, the platform's infrastructure must be robust and resilient to cyberattacks. This includes employing industry-standard encryption protocols, multi-factor authentication, and intrusion detection systems. Regular security audits conducted by independent third-party firms are essential for identifying and mitigating vulnerabilities. Second, Coinpro must have robust measures in place to protect user funds and data. This includes segregating user funds from the platform's operational accounts, implementing strict access controls, and complying with relevant data privacy regulations. The platform should also offer insurance or other forms of protection against losses due to security breaches. Third, the platform needs to actively monitor for and prevent fraudulent activity. This includes implementing anti-money laundering (AML) and know-your-customer (KYC) procedures, monitoring trading patterns for suspicious activity, and cooperating with law enforcement agencies.

The benefits of using Coinpro, assuming it lives up to its promises, are numerous. Automated trading can free up traders' time, allowing them to focus on other activities. It can also eliminate emotional biases, which can often lead to poor trading decisions. By executing trades automatically based on pre-defined rules, the platform can ensure consistency and discipline, even during periods of high market volatility. Furthermore, automated trading can enable users to take advantage of arbitrage opportunities and other short-term trading strategies that would be difficult or impossible to execute manually. The system should allow a user to analyze on the go and make adjustments to their automation program. A critical element that often gets missed is tax reporting and calculations. The Coinpro platform should be able to provide accurate data to the user for their tax obligations.

However, it's crucial to remember that automated trading is not a guaranteed path to riches. The crypto market is inherently unpredictable, and even the most sophisticated algorithms can suffer losses. Users should never invest more than they can afford to lose, and they should carefully research any platform before entrusting it with their funds. They should also understand the risks involved and be prepared to monitor their accounts regularly. Furthermore, automated systems are often vulnerable to unforeseen circumstances, such as exchange outages or unexpected market events. A well-designed system should have fail-safe mechanisms in place to mitigate these risks, but users should still be aware of the potential for disruptions.

Ultimately, the effectiveness and security of Coinpro's secure trading automation depend on a complex interplay of factors: the sophistication of its algorithms, the robustness of its security infrastructure, and the user's own understanding of the risks involved. While automated trading can offer significant benefits, it's not a magic bullet. It requires careful research, diligent monitoring, and a realistic understanding of the crypto market's inherent volatility. Prospective users should thoroughly vet the platform's claims, review its security protocols, and understand its algorithm's limitations before committing any funds. Due diligence is the cornerstone of responsible investing, regardless of whether you are using an automated system or trading manually. Before deciding to use the platform the user should be aware of the legal implications of doing so. If the platform is unregulated or operating outside of the jurisdiction of their home country, there is a considerable amount of risk involved.

The benefits only materialize when the promises are met and the security truly exists as advertised. ```