Real-Time Trade Logs: What Are They, and Why Do You Need One?

Real-time trade logs are an indispensable tool for anyone serious about participating in the cryptocurrency market, or indeed, any financial market. They represent a comprehensive, time-stamped record of every transaction you execute, providing a clear and verifiable audit trail of your trading activity. Understanding what they are and the critical role they play is foundational to responsible and potentially profitable trading.

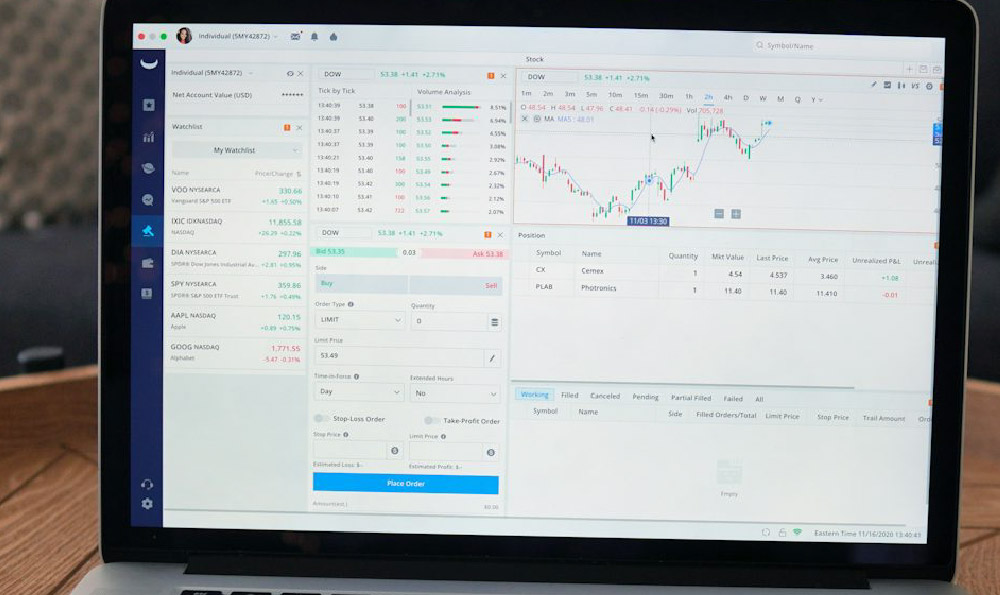

At its core, a real-time trade log is simply a detailed account of each trade you make. For each transaction, it should capture a wealth of information including, but not limited to: the specific cryptocurrency traded (e.g., Bitcoin, Ethereum, Litecoin), the date and time the trade was executed (down to the millisecond in some cases), the type of trade (buy or sell), the quantity of cryptocurrency involved, the price at which the trade was executed, the exchange or platform used, the fees associated with the transaction, and any notes or justifications for making the trade. Sophisticated trade logs might even integrate with charting software or news feeds to provide contextual information alongside the raw transaction data.

The benefits of maintaining a meticulous real-time trade log are multifaceted. First and foremost, it facilitates accurate performance tracking. It's remarkably easy to lose sight of your overall portfolio performance when actively trading, especially across multiple exchanges. A trade log allows you to objectively assess your trading strategies. By analyzing your past trades, you can identify patterns in your behavior, pinpoint what works and what doesn't, and refine your approach accordingly. Are you consistently successful trading certain cryptocurrencies or during particular market conditions? Are there specific trading patterns that consistently lead to losses? The trade log reveals these insights, enabling data-driven decision-making. Without this granular data, you're essentially flying blind, relying on intuition rather than evidence.

Beyond performance tracking, a trade log is crucial for risk management. By recording your position sizes and exposure to different cryptocurrencies, you gain a clearer understanding of your overall risk profile. This allows you to proactively manage your portfolio, rebalancing positions as needed and avoiding overexposure to any single asset. It also aids in setting appropriate stop-loss orders and take-profit targets, crucial for protecting your capital and maximizing potential gains. A well-maintained trade log can also illuminate the psychological factors influencing your trading decisions. By reflecting on your reasoning for each trade, you can identify biases, emotional responses, or impulsive behaviors that may be detrimental to your performance. This self-awareness is paramount to developing a disciplined and objective trading mindset.

Another key advantage is tax reporting. Cryptocurrency taxation remains a complex and evolving landscape. Tax authorities require detailed records of all your cryptocurrency transactions for capital gains calculations. A comprehensive trade log simplifies this process, providing all the necessary information in an organized and readily accessible format. This can save you significant time and effort when filing your taxes and minimize the risk of errors or omissions. It also provides a solid defense in case of an audit, demonstrating your diligence and transparency.

Furthermore, trade logs are vital for dispute resolution. If you encounter any issues with an exchange or platform, such as unauthorized transactions or incorrect trade executions, your trade log serves as concrete evidence to support your claims. It provides a clear record of your activity, allowing you to demonstrate discrepancies and seek resolution.

The methods for creating and maintaining trade logs vary. Some traders prefer manual methods, using spreadsheets or dedicated note-taking software. While this approach offers flexibility, it can be time-consuming and prone to errors. A more efficient and reliable option is to utilize specialized trading journal software or platforms. These tools automatically import trade data from various exchanges, provide advanced analytical features, and generate comprehensive reports. Many exchanges also offer their own historical trade data exports, which can be imported into spreadsheets or trading journal software.

Regardless of the method you choose, consistency is paramount. You must diligently record every trade, no matter how small, to ensure the accuracy and completeness of your log. It's also important to regularly back up your trade log to prevent data loss. Consider using cloud-based storage or multiple backup locations to safeguard your records.

Moreover, consider the privacy implications. Trade logs contain sensitive financial information, so it's crucial to protect them from unauthorized access. Use strong passwords, enable two-factor authentication, and consider encrypting your trade log files.

In conclusion, real-time trade logs are not merely optional for cryptocurrency traders; they are a cornerstone of responsible trading practices. They provide invaluable insights into your performance, facilitate effective risk management, simplify tax reporting, and offer protection in case of disputes. By embracing the discipline of meticulous record-keeping, you empower yourself to make informed decisions, optimize your trading strategies, and navigate the complex world of cryptocurrency investing with greater confidence. Failing to maintain a comprehensive trade log is akin to navigating a ship without a compass – you may eventually reach your destination, but the journey will be far more perilous and uncertain.