Investing for Quick Profit: Is it Possible, and How?

Investing for quick profit in the volatile world of cryptocurrencies is a siren song that lures many, but few truly navigate its treacherous waters successfully. While the potential for rapid gains undoubtedly exists, it's inextricably linked to significant risk. Understanding the landscape and employing a carefully considered strategy is paramount to increasing your chances of success while mitigating potential losses.

The allure of quick profits often stems from stories of overnight millionaires created during bull markets. While these narratives are compelling, they represent outliers and shouldn't be the foundation of your investment strategy. Instead, focus on developing a realistic understanding of the market's inherent unpredictability and the factors that drive price fluctuations.

One of the most crucial aspects of attempting to achieve quick profits in crypto is recognizing that timing is everything. Identifying projects poised for rapid growth requires a keen eye for market trends, a solid understanding of blockchain technology, and the ability to analyze whitepapers, roadmaps, and team credentials. Pay close attention to emerging narratives within the crypto space, such as developments in decentralized finance (DeFi), non-fungible tokens (NFTs), or layer-2 scaling solutions. Projects addressing real-world problems with innovative solutions are often more likely to experience rapid adoption and price appreciation.

However, simply identifying a promising project isn't enough. You need to delve deeper into its tokenomics – the economic model governing the token's supply, distribution, and use cases. Understand the token's inflation rate, vesting schedules for team and investors, and the overall utility of the token within its ecosystem. A project with poorly designed tokenomics, such as a highly inflationary supply or a lack of genuine utility, is unlikely to sustain significant price appreciation in the long run, even if it initially experiences a pump.

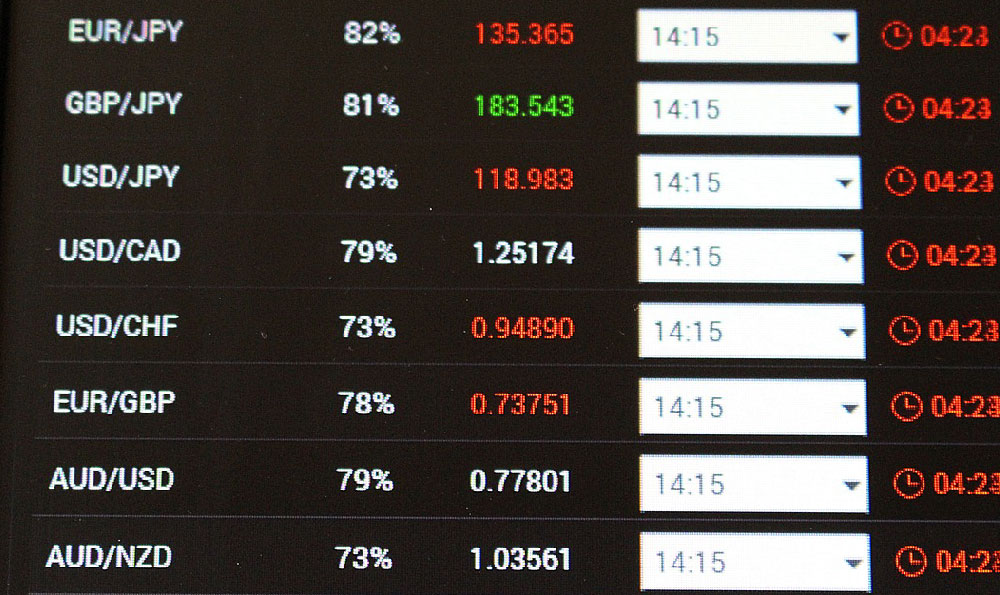

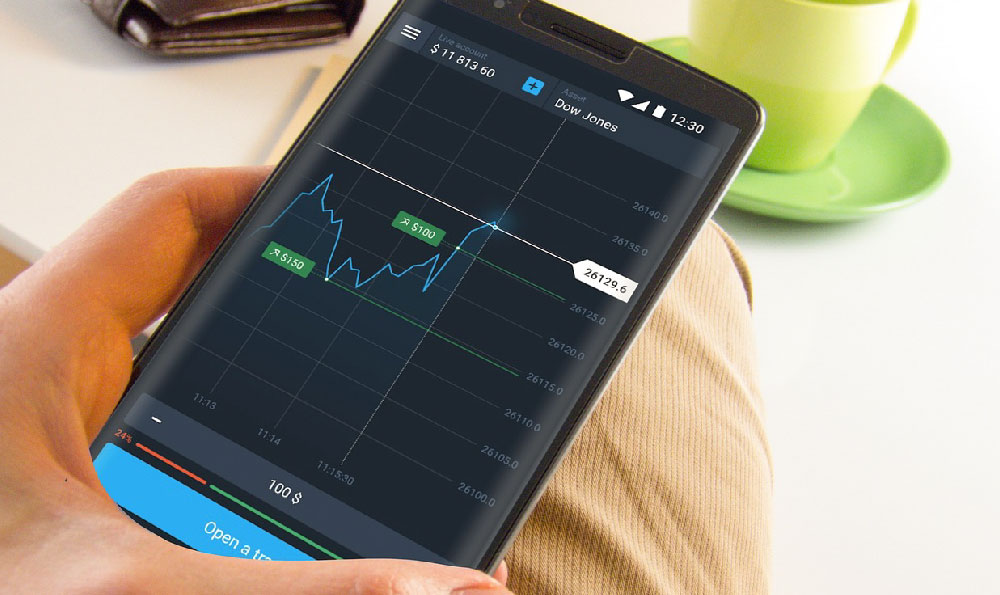

Technical analysis is another valuable tool in the arsenal of a crypto investor seeking quick profits. Studying price charts, volume patterns, and technical indicators can help you identify potential entry and exit points. Common indicators include Moving Averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD). While technical analysis can provide valuable insights, it's important to remember that it's not foolproof. The crypto market is often driven by sentiment and news events, which can override technical signals.

A well-defined risk management strategy is non-negotiable when pursuing quick profits in crypto. This includes setting realistic profit targets and stop-loss orders. A stop-loss order is an instruction to your exchange to automatically sell your holdings if the price falls to a certain level, limiting your potential losses. Determine your risk tolerance before investing and never invest more than you can afford to lose. The high volatility of the crypto market means that even carefully considered investments can experience significant drawdowns.

Diversification, while often associated with long-term investing, also plays a crucial role in mitigating risk when pursuing quick profits. Spreading your capital across multiple projects reduces your exposure to the potential failure of any single investment. However, be mindful of over-diversification, which can dilute your gains and make it more difficult to manage your portfolio effectively.

Beyond individual projects, it's essential to stay informed about broader market trends and regulatory developments. Regulatory changes can have a significant impact on the crypto market, both positive and negative. Keep abreast of news from regulatory bodies such as the Securities and Exchange Commission (SEC) in the United States and other relevant agencies worldwide.

Be wary of hype and FOMO (fear of missing out). The crypto market is often susceptible to speculative bubbles and pump-and-dump schemes. Avoid investing in projects solely based on social media hype or endorsements from influencers. Always conduct your own research and make informed decisions based on your own analysis.

Furthermore, recognize the importance of security. Protect your cryptocurrency holdings by using strong passwords, enabling two-factor authentication (2FA), and storing your private keys securely in a hardware wallet. Phishing scams and hacks are prevalent in the crypto space, so be vigilant and never share your private keys with anyone.

While the pursuit of quick profits in crypto is tempting, it's crucial to approach it with caution, discipline, and a healthy dose of skepticism. Treat it as a high-risk, high-reward endeavor, and never deviate from your pre-defined investment strategy. Remember that sustainable success in the crypto market requires a combination of knowledge, skill, and a bit of luck. Instead of solely focusing on quick gains, consider building a long-term investment portfolio alongside your shorter-term trading activities. A diversified portfolio with a mix of established cryptocurrencies and promising altcoins can provide a more balanced approach to wealth creation in the crypto space. Finally, continuously educate yourself about the ever-evolving crypto landscape. The more you learn, the better equipped you'll be to navigate the market's complexities and make informed investment decisions.