Is making money without working possible, and if so, how?

The allure of earning income without traditional labor, often referred to as passive income, is a powerful motivator for many exploring the world of finance. While the term "without working" might be an oversimplification – as initial effort and ongoing management are almost always required – the underlying principle of generating income streams that demand minimal direct involvement is undeniably achievable, particularly within the realm of cryptocurrencies and related investment strategies.

The possibility hinges on leveraging the unique characteristics of the digital asset market. Unlike traditional employment, where income is directly tied to hours worked, cryptocurrency offers a multitude of avenues for creating income streams that can potentially operate with limited active management. However, it is crucial to understand that this pursuit is not without risk and demands a strategic, informed approach.

One prominent avenue is cryptocurrency staking. Many blockchain networks utilize a "Proof of Stake" consensus mechanism, rewarding users for holding and "staking" their cryptocurrency holdings. Staking essentially involves locking up your coins to help validate transactions on the network, and in return, you receive newly minted coins as a reward. The annual percentage yield (APY) on staking can vary significantly depending on the cryptocurrency, the staking platform, and the lock-up period. While the initial effort involves researching and selecting appropriate cryptocurrencies and platforms, the ongoing work is minimal, often requiring just periodic monitoring. The key here is due diligence: thoroughly investigate the project's fundamentals, security, and long-term viability before committing your funds. A seemingly high APY might be indicative of a risky or unsustainable project.

Another avenue is yield farming, a more complex and potentially lucrative strategy that involves providing liquidity to decentralized finance (DeFi) platforms. In essence, you deposit your cryptocurrency into a liquidity pool, enabling trading on the platform. In return, you receive a portion of the transaction fees generated by the pool, often paid in the platform's native token. While yield farming can offer significant returns, it also carries significant risks, including impermanent loss (where the value of your deposited assets can decline relative to holding them separately) and smart contract vulnerabilities. Successfully navigating yield farming requires a deep understanding of DeFi protocols, risk management, and the ability to monitor market conditions constantly. Furthermore, the complexity of these platforms often necessitates more "work" than simply depositing funds; strategies may need to be adjusted to optimize returns and mitigate risks as market dynamics shift.

Cryptocurrency lending offers another path, where you lend your crypto holdings to borrowers and earn interest. Platforms facilitating crypto lending act as intermediaries, connecting lenders and borrowers and managing the lending process. Interest rates can be higher than those offered by traditional savings accounts, making it an attractive option for generating passive income. However, it's vital to assess the creditworthiness of the borrowers (or the platform's risk management protocols) and the security of the lending platform. Consider the potential for defaults and the security measures in place to protect your funds. Diversification across multiple lending platforms can also help mitigate risk.

Beyond these strategies, cryptocurrency-related affiliate marketing offers a more indirect approach. By promoting cryptocurrency exchanges, wallets, or other related products, you can earn commissions on each referral. This requires effort in creating content, building an audience, and promoting the products, but once established, it can generate a relatively passive income stream.

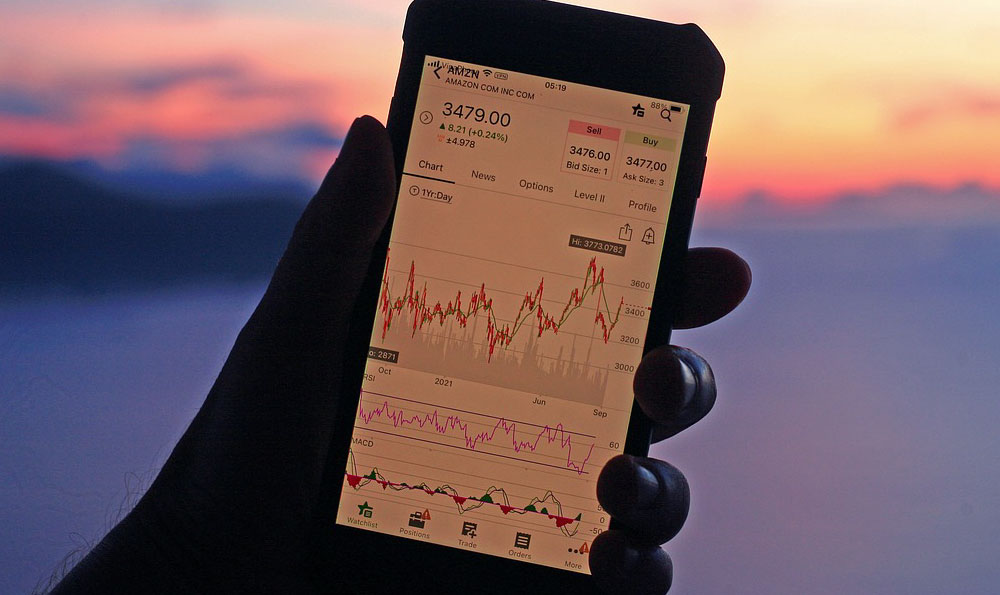

Automated trading bots can also be employed to execute trades based on predefined parameters, potentially generating profits without constant manual intervention. However, developing and deploying effective trading bots requires technical skills, a thorough understanding of trading strategies, and ongoing monitoring to ensure the bot performs as expected. The cryptocurrency market's volatility demands robust risk management and the ability to adapt the bot's parameters to changing market conditions.

The concept of decentralized autonomous organizations (DAOs) offers another interesting, albeit longer-term, possibility. Contributing to a DAO, even in a limited capacity, can potentially generate rewards or ownership tokens that appreciate in value over time. However, this requires a commitment to the DAO's mission and a willingness to contribute to its development.

Ultimately, generating income from cryptocurrencies that approaches the ideal of "without working" demands a balanced approach. It necessitates an upfront investment of time in learning about the various strategies, carefully assessing the associated risks, and developing a solid investment plan. Ongoing management, even if minimal, is essential to monitor performance, adapt to market changes, and protect your investments. Diversification across different income streams and rigorous risk management are crucial for long-term success.

Therefore, while the dream of effortless income through cryptocurrencies is alluring, a realistic understanding of the effort, risks, and ongoing management required is paramount. The potential for financial growth exists, but it is reserved for those who approach the market with knowledge, discipline, and a commitment to continuous learning. Remember that no investment is risk-free, and the cryptocurrency market is particularly volatile. Always do your own research and never invest more than you can afford to lose. The pursuit of passive income in the cryptocurrency space is a journey, not a destination, and requires constant adaptation and refinement.