NYC Money Makers: What Works, and How Can You Cash In?

Okay, consider me your seasoned guide to navigating the often turbulent, yet potentially lucrative, waters of cryptocurrency investing. Let's dive in.

New York City, a financial hub renowned for its dynamic markets and entrepreneurial spirit, presents a unique environment for cryptocurrency investment. The sheer concentration of talent, capital, and cutting-edge technology creates a fertile ground for innovation and opportunity. However, the key to success in this landscape lies not just in identifying "what works," but also in understanding why it works and how to adapt to the ever-changing tides.

One prevalent strategy employed by savvy NYC "money makers" is a blend of fundamental analysis and technical analysis tailored to the specific nuances of the crypto market. Forget simply replicating strategies designed for traditional equities; digital assets demand a more nuanced approach. Fundamental analysis involves scrutinizing the underlying technology of a cryptocurrency project, assessing its real-world utility, evaluating the strength of its development team and community, and understanding its tokenomics (the economic model governing the token's supply, distribution, and use). This deep dive helps investors identify projects with genuine long-term potential, moving beyond the hype and speculation that often dominate headlines.

For example, instead of just buying into the latest meme coin promising overnight riches, a fundamental analysis-driven investor would research the project's whitepaper, examine its code repository on platforms like GitHub, and analyze the activity of its community on social media and forums. They would also assess the project's scalability, security, and decentralization, comparing it to its competitors and evaluating its potential to disrupt existing industries. Only after a thorough evaluation would they consider investing, and even then, only with a portion of their portfolio allocated to higher-risk assets.

Technical analysis, on the other hand, focuses on interpreting price charts and trading volumes to identify patterns and predict future price movements. While some dismiss technical analysis as "chart reading," it can be a valuable tool for identifying entry and exit points, managing risk, and understanding market sentiment. Skilled traders in NYC often use a combination of technical indicators, such as moving averages, relative strength index (RSI), and Fibonacci retracements, to identify potential buying opportunities when prices are oversold or selling opportunities when prices are overbought.

However, it's crucial to remember that technical analysis is not a crystal ball. It's a tool that can help you make more informed decisions, but it's not foolproof. The crypto market is notoriously volatile and can be influenced by a wide range of factors, including regulatory news, technological breakthroughs, and even social media trends. Therefore, it's essential to use technical analysis in conjunction with fundamental analysis and to always be aware of the risks involved.

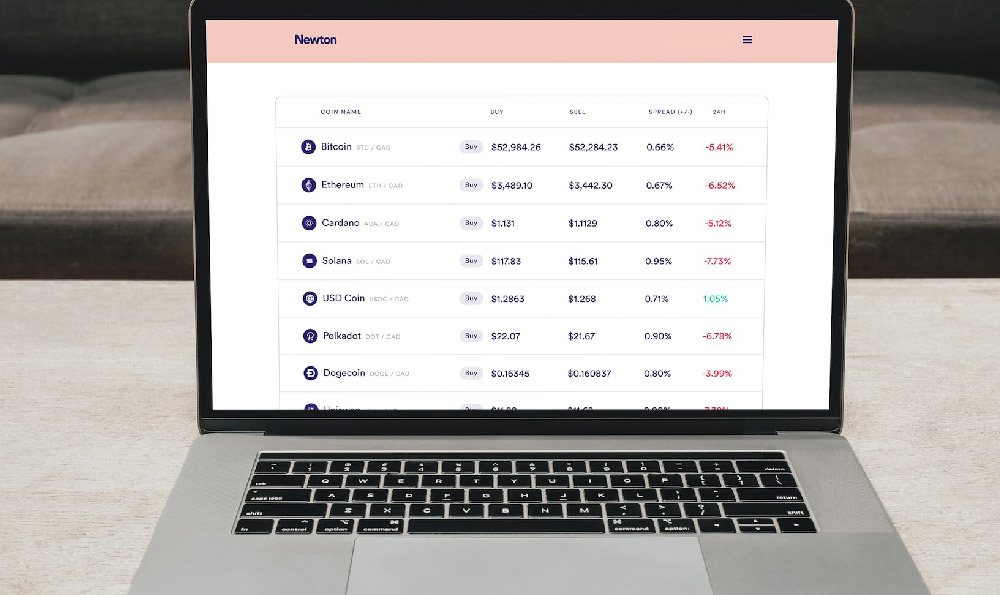

Beyond these core analytical approaches, successful investors in NYC also prioritize diversification. Spreading your investments across a range of cryptocurrencies, each with different use cases and risk profiles, can help mitigate potential losses and increase your overall returns. This doesn't mean blindly investing in every coin that comes along; it means carefully selecting a portfolio of assets that are complementary to each other and that align with your investment goals and risk tolerance. A diversified portfolio might include established cryptocurrencies like Bitcoin and Ethereum, as well as smaller, more innovative projects with the potential for high growth.

Another key to cashing in on the crypto market is staying informed. The cryptocurrency landscape is constantly evolving, with new technologies, regulations, and projects emerging all the time. To stay ahead of the curve, it's essential to follow reputable news sources, attend industry conferences, and engage with the crypto community. This will help you identify emerging trends, understand potential risks, and make more informed investment decisions. Be wary of hype and sensationalized news; focus on credible sources and objective analysis.

Furthermore, successful NYC investors are adept at managing risk. This includes setting clear investment goals, establishing stop-loss orders to limit potential losses, and regularly reviewing your portfolio to ensure it's still aligned with your risk tolerance and investment objectives. It also means being aware of the potential for scams and fraud, which are unfortunately prevalent in the crypto world. Always do your own research before investing in any project, and be wary of promises of guaranteed returns or unrealistic profits. Never invest more than you can afford to lose, and always store your cryptocurrencies in a secure wallet.

Another increasingly popular method is participating in decentralized finance (DeFi) protocols. DeFi offers opportunities to earn yield on your crypto holdings through lending, staking, and providing liquidity to decentralized exchanges. However, DeFi is a complex and rapidly evolving space, and it's important to understand the risks involved before participating. These risks include smart contract vulnerabilities, impermanent loss, and regulatory uncertainty. If you're considering investing in DeFi, it's essential to do your research, understand the underlying technology, and only invest what you can afford to lose.

Finally, and perhaps most importantly, successful cryptocurrency investors in NYC possess a long-term perspective. They understand that the crypto market is volatile and that prices can fluctuate wildly in the short term. They are not driven by fear or greed, but by a belief in the long-term potential of blockchain technology and digital assets. They are willing to hold their investments through periods of market volatility, knowing that the potential rewards outweigh the risks. They understand that building wealth takes time and patience, and they are committed to staying the course, even when the market is uncertain. This long-term perspective, combined with a sound investment strategy and a commitment to risk management, is the key to cashing in on the crypto market and achieving financial success in the long run. Remember, knowledge is power, and in the world of cryptocurrency, staying informed and adaptable is paramount.