How to Make a Ton of Money: Is It Possible? What's the Secret?

The pursuit of substantial wealth, the kind that allows for genuine financial freedom and the pursuit of passions, is a goal shared by many. While the notion of making a “ton of money” can seem like an unrealistic dream reserved for the lucky few, the truth is that it's achievable for a much wider range of individuals through a combination of strategic planning, disciplined execution, and a willingness to embrace calculated risks. There's no single "secret" to instant riches, but rather a confluence of factors that contribute to long-term wealth accumulation.

One crucial element is understanding the power of compounding. Often referred to as the "eighth wonder of the world," compounding allows your investments to generate earnings, which in turn generate more earnings. This snowball effect can dramatically accelerate wealth creation over time. To harness this power, early investment is key. The sooner you start, the more time your money has to grow exponentially. This requires a commitment to saving and investing a portion of your income regularly, even if it seems insignificant at first. Consistency is paramount.

Beyond simply saving, strategic investment is crucial. Merely keeping your money in a savings account will likely not generate the returns necessary to achieve substantial wealth. Diversification is another cornerstone of successful investing. Spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities, can help mitigate risk and maximize potential returns. Different asset classes perform differently in various economic conditions, so a diversified portfolio can provide a buffer against market volatility.

Investing in the stock market has historically provided strong returns over the long term. While stocks can be volatile in the short term, they offer the potential for significant growth over time. Consider investing in a mix of individual stocks and index funds or exchange-traded funds (ETFs) that track the performance of broad market indices. Index funds offer instant diversification and can be a cost-effective way to gain exposure to the overall market. Thoroughly research companies before investing in individual stocks, analyzing their financial performance, growth potential, and competitive landscape.

Real estate can also be a valuable asset class for wealth building. Investing in rental properties can provide a stream of passive income, and the value of real estate tends to appreciate over time. However, real estate investment requires significant capital and involves responsibilities such as property management and tenant relations. Thoroughly research the local real estate market before investing and consider factors such as location, property condition, and potential rental income.

Another avenue for wealth creation is starting your own business. Entrepreneurship can be a challenging but highly rewarding path. Building a successful business requires hard work, dedication, and a willingness to take risks. However, the potential for financial gain is significant. If you have a marketable idea, a strong work ethic, and a passion for building something from scratch, entrepreneurship may be the right path for you. Develop a comprehensive business plan, secure funding, and be prepared to adapt to the ever-changing market landscape.

Developing high-income skills is essential for maximizing your earning potential. Whether it's acquiring advanced technical skills, mastering sales and marketing, or becoming an expert in a specific field, investing in your own skills and knowledge can significantly increase your income. Consider pursuing advanced education, certifications, or training programs that are in demand in the job market. Networking and building relationships with other professionals in your field can also open doors to new opportunities.

Furthermore, managing your finances effectively is critical for wealth accumulation. Creating a budget, tracking your expenses, and reducing unnecessary spending can free up more money for saving and investing. Avoid accumulating high-interest debt, such as credit card debt, as it can quickly erode your wealth. Focus on paying off debt aggressively and building a solid financial foundation. Seek out financial literacy resources to improve your understanding of personal finance and investing.

Staying informed about market trends and economic conditions is also crucial for making informed investment decisions. Follow reputable financial news sources, read books and articles on investing, and consider consulting with a financial advisor. A financial advisor can provide personalized guidance based on your individual financial situation and goals. However, be sure to choose a qualified and trustworthy advisor who has your best interests at heart.

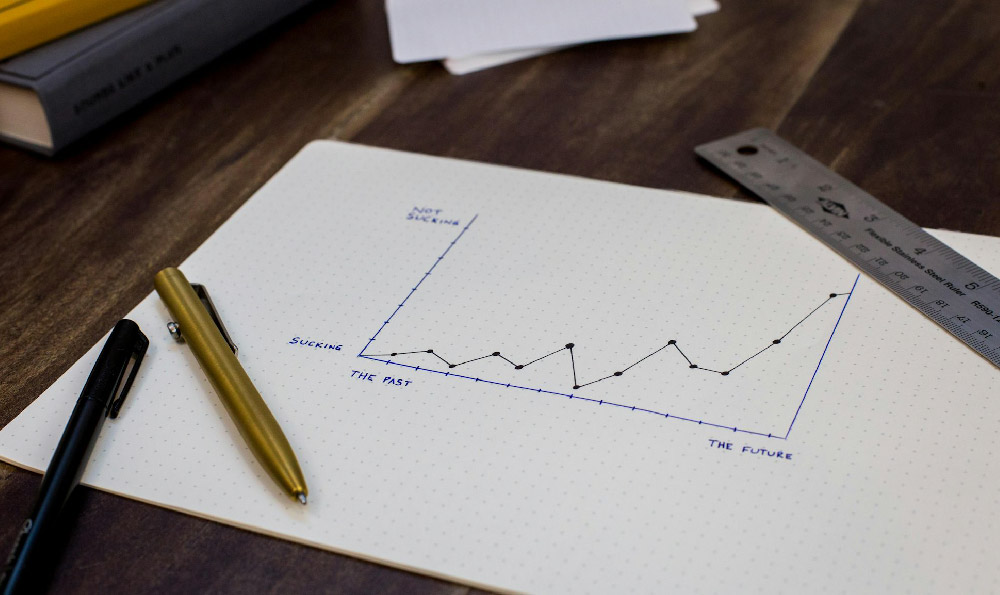

Finally, it's important to cultivate a positive mindset and maintain a long-term perspective. Building substantial wealth takes time and effort, and there will inevitably be setbacks along the way. Don't get discouraged by short-term market fluctuations or business challenges. Stay focused on your goals, learn from your mistakes, and remain committed to your long-term financial plan.

In conclusion, while there's no magic formula for making a "ton of money," it's certainly within reach for those who are willing to put in the work and make smart financial decisions. By embracing the power of compounding, investing strategically, developing high-income skills, managing your finances effectively, and maintaining a long-term perspective, you can significantly increase your chances of achieving financial freedom and building substantial wealth over time. The journey may be challenging, but the rewards are well worth the effort.