How can you invest in stocks online, and where should you start?

Okay, I understand. Here's an article addressing how to invest in stocks online, keeping in mind the specific requests you outlined:

``` Investing in the stock market online has become increasingly accessible, transforming the landscape of personal finance. Gone are the days when stock trading was confined to brokers and physical trading floors. Today, with a few clicks, anyone can participate in the potential growth offered by publicly traded companies. But with this ease comes the crucial responsibility of understanding the process and making informed decisions. So, where do you even begin navigating this digital frontier?

The first step is selecting the right online brokerage platform. Numerous options exist, each with its own fee structure, tools, research resources, and account minimums. Popular choices often include well-established names with years of experience, but newer, app-based platforms have also gained traction by offering commission-free trading and user-friendly interfaces. The key is to carefully compare these platforms. Consider your investment goals. Are you a passive investor looking to build a long-term, diversified portfolio? Or are you more actively engaged and interested in day trading or short-term strategies? A passive investor might prioritize low fees and a wide selection of ETFs (Exchange-Traded Funds), while an active trader would value real-time data, advanced charting tools, and fast order execution.

Furthermore, understanding the fee structure is paramount. While commission-free trading has become more prevalent, other fees might still apply. Look out for account maintenance fees, inactivity fees (if you don't trade for a certain period), transfer fees (if you want to move your account to another brokerage), and potential fees associated with specific types of orders or transactions. Read the fine print and don't hesitate to contact the brokerage's customer support if anything is unclear.

Once you've chosen a brokerage, you'll need to open an account. This typically involves providing personal information, such as your Social Security number (or equivalent identification in your country), address, and employment details. You'll also need to answer questions about your investment experience, risk tolerance, and financial goals. This information helps the brokerage determine your suitability for certain types of investments and ensures they comply with regulatory requirements. It's crucial to answer these questions honestly and accurately. Misrepresenting your financial situation can lead to unsuitable investment recommendations and potentially negative consequences.

After your account is approved, you'll need to fund it. Most brokerages accept various funding methods, including electronic transfers from your bank account, wire transfers, and even checks. The processing time for each method can vary, so factor this in when planning your investments. Once your funds are deposited, you can start researching and selecting stocks.

This is where the real work begins. Investing without knowledge is akin to gambling. Before you buy any stock, it's essential to do your homework. Start by understanding the company's business model: what products or services does it offer? Who are its competitors? What are its growth prospects? Read the company's financial statements, including the income statement, balance sheet, and cash flow statement. These documents provide valuable insights into the company's revenue, expenses, assets, liabilities, and financial performance.

However, financial statements can be complex, so it's helpful to learn how to interpret them. Look for key metrics like revenue growth, profit margins, debt levels, and return on equity. Compare these metrics to those of the company's competitors to get a sense of its relative performance.

Beyond financial analysis, also consider the broader economic environment and industry trends. Is the company operating in a growing or declining industry? Are there any regulatory changes or technological disruptions that could affect its business? Staying informed about these factors can help you make more informed investment decisions.

Don't put all your eggs in one basket. Diversification is a cornerstone of sound investing. Spreading your investments across different companies, industries, and asset classes can help reduce your overall risk. If one investment performs poorly, it won't necessarily derail your entire portfolio. Consider investing in ETFs or mutual funds, which offer instant diversification by holding a basket of stocks or other assets.

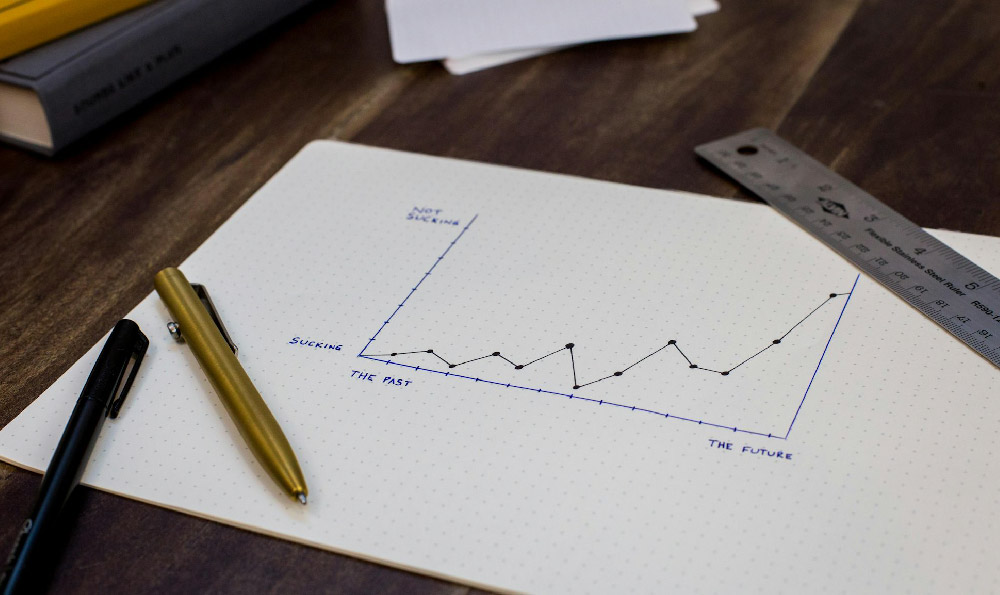

It's also important to have a long-term perspective. The stock market can be volatile in the short term, and it's not uncommon to see prices fluctuate significantly. Don't panic sell during market downturns. Instead, focus on the long-term fundamentals of the companies you've invested in. If their business prospects remain strong, consider holding on to your shares or even buying more at lower prices.

Finally, remember that investing involves risk. There's no guarantee that you'll make money, and you could even lose some or all of your initial investment. Only invest money that you can afford to lose, and don't let emotions cloud your judgment. Develop a clear investment strategy, stick to it, and regularly review your portfolio to ensure it's still aligned with your goals. Continuous learning is crucial. The world of finance is constantly evolving, so stay informed about new investment strategies, market trends, and regulatory changes. Read books, articles, and blogs from reputable sources, and consider taking online courses or attending seminars to enhance your knowledge. Investing online is a powerful tool, but like any tool, it requires skill and knowledge to use effectively. Embrace the learning process, be patient, and make informed decisions, and you'll be well on your way to building a successful investment portfolio. ```