How Many Days for Part-Time Work: Is It Weekly?

Investing in cryptocurrencies, even on a part-time basis, requires a strategic approach. Thinking about the “number of days” to dedicate weekly immediately highlights the importance of a balanced strategy that combines active management with the acceptance of inevitable market fluctuations. The question isn't simply "how many days," but rather, "how efficiently can I allocate my time to maximize returns and minimize risk?"

Instead of fixating on a specific number of days, one should instead focus on establishing a structured routine that incorporates market analysis, portfolio review, and learning. Let's break down what that routine should look like and how it should be applied regardless of if it's all done in one or spread across multiple days.

Market Analysis: The Foundation of Informed Decisions

Success in the cryptocurrency market relies heavily on understanding the underlying trends and factors influencing price movements. This isn't something you can casually glance at once in a while. It requires a consistent, methodical approach. A key part of this process is news monitoring. Keep up with regulatory changes, technological advancements, and macroeconomic events that could impact the crypto market. Reputable news sources, industry publications, and specialized crypto news aggregators are essential. Consider setting up news alerts for key terms like "Bitcoin," "Ethereum," "crypto regulation," and the names of specific altcoins you're interested in.

Furthermore, fundamental analysis assesses the intrinsic value of cryptocurrencies based on their underlying technology, adoption rates, team strength, and use cases. This involves researching whitepapers, analyzing network activity (transaction volume, active addresses), and evaluating the project's roadmap. For example, if you are considering investing in a new layer-2 scaling solution, you would need to analyze its transaction throughput, security features, and its compatibility with existing blockchains.

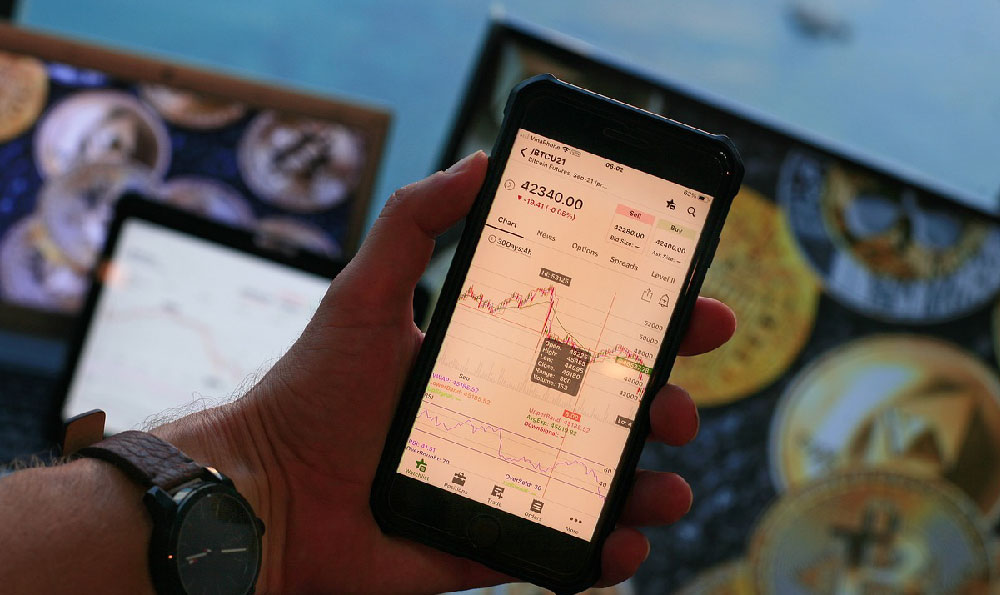

Technical analysis, on the other hand, employs charts and indicators to identify patterns and predict future price movements. This involves studying price charts, volume data, and technical indicators such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence). Technical analysis is particularly useful for identifying entry and exit points for short-term trades. However, it is important to remember that technical analysis is not foolproof and should be used in conjunction with other forms of analysis.

The time dedicated to market analysis depends on your trading style and investment goals. A day trader will need to dedicate significantly more time to monitoring the market than a long-term investor. However, regardless of your trading style, it is crucial to allocate sufficient time to stay informed and make informed decisions. Aim to set aside several hours each week for dedicated market research. This time can be divided into shorter sessions throughout the week or concentrated on one or two days, depending on your schedule.

Portfolio Review: Tracking Performance and Adapting to Change

Regular portfolio review is essential for managing risk and maximizing returns. This involves tracking the performance of your investments, identifying underperforming assets, and rebalancing your portfolio to maintain your desired asset allocation.

Start by tracking the performance of each cryptocurrency in your portfolio. Monitor their price movements, trading volume, and any relevant news or events. Use a spreadsheet or a dedicated portfolio tracking tool to keep track of your gains and losses. This will help you identify which assets are performing well and which are not.

Then, compare the performance of your portfolio to relevant benchmarks, such as the Bitcoin Dominance Index or the total cryptocurrency market capitalization. This will help you assess whether your portfolio is outperforming or underperforming the market. If your portfolio is consistently underperforming, it may be time to re-evaluate your investment strategy.

Lastly, rebalancing involves adjusting your asset allocation to maintain your desired risk profile. For example, if your portfolio has become overweight in Bitcoin due to its strong performance, you may want to sell some Bitcoin and invest in other cryptocurrencies to reduce your exposure to a single asset. The frequency of rebalancing depends on your risk tolerance and investment goals. Some investors rebalance their portfolios quarterly, while others rebalance more frequently.

Allocate a specific time each week or month for portfolio review and rebalancing. This will help you stay on track and make informed decisions about your investments.

Continuous Learning: Staying Ahead of the Curve

The cryptocurrency market is constantly evolving, with new technologies, regulations, and investment opportunities emerging all the time. To stay ahead of the curve, it is essential to commit to continuous learning. This involves reading books, articles, and research reports, attending webinars and conferences, and following industry experts on social media.

There are many resources available for learning about cryptocurrencies. Reputable websites, educational platforms, and online courses offer comprehensive information on blockchain technology, cryptocurrency investing, and trading strategies. Consider subscribing to newsletters and following industry experts on social media to stay up-to-date on the latest developments.

Engage with the crypto community by participating in online forums, attending meetups, and connecting with other investors. This will provide you with valuable insights and perspectives. The crypto community is known for its collaborative spirit, and you can learn a great deal by interacting with other members.

Setting aside dedicated time for learning is crucial. This could involve reading a book on blockchain technology, taking an online course on cryptocurrency investing, or attending a webinar on a new trading strategy. Even just an hour or two a week dedicated to learning can significantly improve your understanding of the market.

Risk Management: Protecting Your Capital

Risk management is paramount in cryptocurrency investing. Cryptocurrencies are highly volatile assets, and it is crucial to implement strategies to protect your capital. This includes diversifying your portfolio, setting stop-loss orders, and using leverage cautiously. Never invest more than you can afford to lose. Diversification involves spreading your investments across multiple cryptocurrencies to reduce your exposure to any single asset. Stop-loss orders automatically sell your assets when they reach a certain price, limiting your potential losses. Leverage amplifies both your potential gains and losses, and it should be used with extreme caution.

The "Number of Days" Illusion: It's About the Quality, Not the Quantity

Ultimately, the optimal "number of days" to dedicate to part-time crypto investing is the number that allows you to consistently execute the above strategies effectively. It's not about rigidly sticking to a predetermined schedule; it's about building sustainable habits that align with your investment goals and risk tolerance. You may find that dedicating a single, concentrated day allows you to focus deeply, while others might prefer shorter, more frequent sessions. The key is consistency and dedication to learning, analyzing, and managing your investments. Don't get bogged down in a fixed number of days; instead, focus on the quality of time you spend and the effectiveness of your investment strategy. Remember, in the volatile world of cryptocurrency, knowledge and preparation are your greatest assets.