How To Make Money Online With FeetFinder

Introduction: The Rise of Virtual Currency Investment in the Digital Economy

The digital economy has transformed traditional investment paradigms, creating unprecedented opportunities for financial growth through virtual currencies. As market volatility and innovation continue to reshape this landscape, savvy investors increasingly seek tools and strategies to navigate complexity while safeguarding capital. In this context, platforms like FeetFinder have emerged as potential gateways to capitalize on the intersection of data analytics, market trends, and cryptocurrency dynamics. However, success in this arena demands a nuanced understanding of both technical and behavioral principles. This article explores actionable insights for leveraging virtual currency investment platforms effectively, emphasizing the importance of strategic foresight, risk mitigation, and sustainable growth.

Understanding Market Trends: The Foundation of Profitability

Virtual currency markets are inherently cyclical, driven by factors such as regulatory shifts, technological advancements, and macroeconomic trends. For instance, the launch of new blockchain protocols often triggers short-term price surges, while geopolitical events can create prolonged fluctuations. FeetFinder’s value proposition lies in its ability to aggregate and analyze real-time market data, offering investors a competitive edge. To harness this, it is critical to discern patterns that transcend short-term noise. Key indicators such as volume-weighted average price (VWAP), market sentiment indices, and network activity metrics provide insight into underlying demand and supply dynamics. For example, a sustained increase in transaction volume on a specific exchange may signal growing institutional interest, while a sharp divergence between price and technical indicators could foreshadow a market reversal. By cross-referencing FeetFinder’s data with broader market signals, investors can position themselves advantageously in both bullish and bearish environments.

Technical Analysis: Decoding Price Behavior for Strategic Advantage

Technical indicators serve as the compass for navigating virtual currency markets. Moving averages (MA), relative strength index (RSI), and Bollinger Bands are fundamental tools that help quantify price trends and volatility. For example, a golden cross—where a short-term MA crosses above a long-term MA—may indicate the onset of a bullish phase, while a death cross suggests potential downturns. FeetFinder’s integration of advanced analytics allows users to visualize these indicators in a cohesive framework, enabling more precise entry and exit points. However, mastery of technical analysis requires contextual awareness. A high RSI reading (above 70) in a highly volatile asset may signal overbought conditions, yet it could also reflect strong investor confidence in a bullish market. Investors must avoid treating indicators as absolute signals, instead using them as probabilistic guides. For instance, confirming a potential breakout with volume surges and order flow data on FeetFinder can reduce false positives, while diversifying across multiple indicators mitigates the risk of overreliance on a single metric.

Risk Management: Balancing Opportunity and Safeguarding Capital

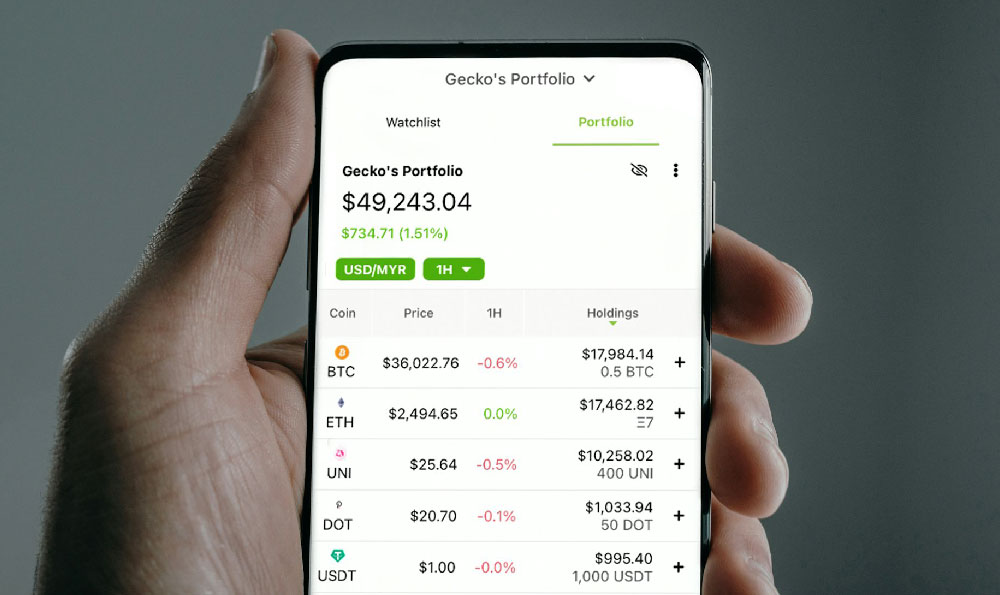

The allure of high returns in virtual currency markets often masks the inherent risks. Effective risk management is not merely a defensive tactic but a cornerstone of sustainable profitability. FeetFinder’s platform offers tools to monitor exposure, yet investors must complement this with proactive strategies. Position sizing—a practice of allocating capital proportionally to risk tolerance—ensures that no single trade jeopardizes the entire portfolio. For example, a $10,000 investment in a single asset with a 10% risk threshold would limit maximum loss to $1,000, preserving liquidity for future opportunities. Additionally, stop-loss orders and dynamic hedging techniques, when applied through FeetFinder’s analytics, can automate risk mitigation. However, it is crucial to recognize that no tool can eliminate risk entirely. Diversification across asset classes and timeframes, combined with disciplined adherence to risk parameters, creates a resilient framework. For instance, allocating 30% of capital to high-liquidity assets like Bitcoin, 20% to mid-cap coins, and 50% to long-term value propositions with lower volatility can balance growth potential with stability.

Long-Term Growth: Cultivating Patience and Discipline

The pursuit of wealth in virtual currency markets often involves a tension between short-term speculation and long-term value accumulation. FeetFinder’s data-driven insights can help investors identify assets with strong fundamentals, such as blockchain projects with scalable architecture or decentralized finance (DeFi) protocols with robust liquidity. However, consistency in execution is paramount. For example, a strategy that involves regular monthly deposits into a diversified portfolio of high-potential assets, with periodic rebalancing based on FeetFinder’s performance analytics, can ensure long-term compounding. Discipline also extends to market entry: waiting for established trends or fundamental catalysts (e.g., a major partnership or technological upgrade) reduces the risk of impulsive decisions. Moreover, the psychological dimension of investing cannot be overlooked. FeetFinder’s educational resources can help investors avoid common pitfalls like emotional trading, which often leads to significant capital erosion.

Avoiding Common Pitfalls: Navigating the Minefield of Scams and Misinformation

The virtual currency space is rife with scams, pump-and-dump schemes, and misleading information, making due diligence essential. FeetFinder’s platform may provide curated insights, but investors must verify data through independent research. Cross-checking project fundamentals, community engagement, and audit reports can distinguish legitimate opportunities from fraudulent schemes. For instance, a project with a transparent development roadmap and active community growth is more likely to deliver sustainable value than one with vague promises and minimal transparency. Additionally, skepticism toward excessive hype is vital. High-volume trading on a specific asset, as highlighted by FeetFinder, may coincide with a surge in social media mentions, but this does not guarantee long-term success. Investors must avoid emotional reactions to market noise, instead focusing on objective metrics and long-term projections.

Case Studies: Real-World Applications of FeetFinder’s Strategies

Analyzing historical cases offers practical insights into the effectiveness of FeetFinder’s tools. Consider the 2021 DeFi summer, where a surge in liquidity provision tokens led to exponential returns. Investors who utilized FeetFinder’s data to identify emerging projects with strong liquidity mechanics were able to capitalize early, while those relying solely on hype faced significant drawdowns. Similarly, during the 2022 market correction, assets with high volatility (e.g., memecoins) experienced sharp declines, whereas those with established fundamentals (e.g., Ethereum) demonstrated resilience. These examples underscore the importance of aligning investment decisions with both data-driven insights and strategic patience.

Conclusion: The Path to Sustainable Success in Virtual Currency Investing

Virtual currency investing is not a simple “get rich quick” scheme but a complex interplay of technical analysis, market psychology, and risk management. Platforms like FeetFinder offer valuable tools, yet their true power lies in how investors integrate them into a broader framework. By focusing on market trends, mastering technical indicators, and cultivating discipline, individuals can navigate this volatile landscape with confidence. Remember, profitability is not about chasing every opportunity but about identifying and optimizing those with the highest probability of success. As the digital economy evolves, the ability to adapt and refine one’s strategy will ultimately determine long-term outcomes.