Cointracking Alternatives? What About Bitmex Tools Options?

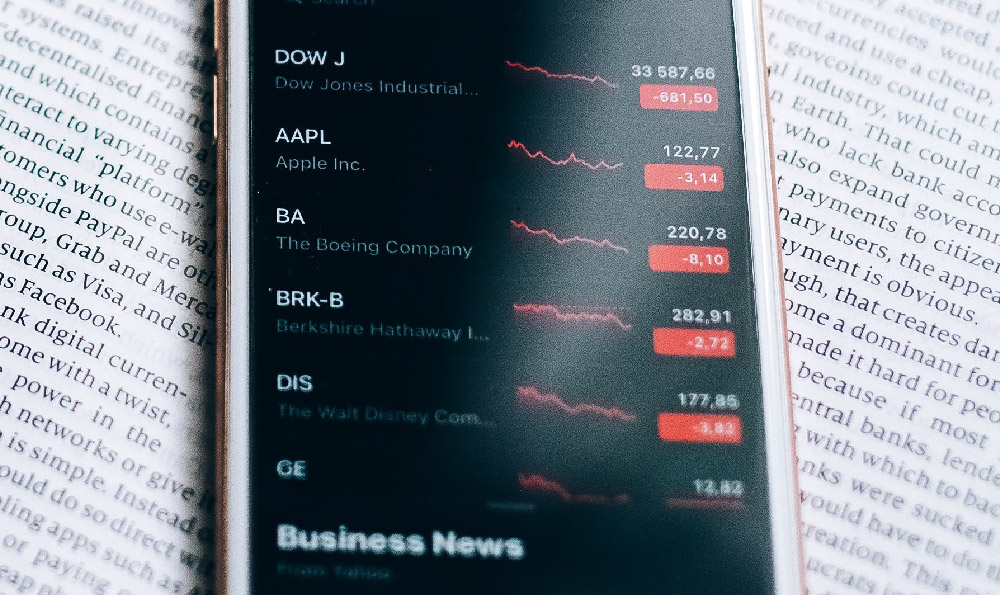

Navigating the world of cryptocurrency taxes and portfolio management can be daunting, especially with the ever-evolving regulatory landscape and the increasing complexity of trading strategies. Services like Cointracking have emerged as popular tools for crypto traders to track their transactions, calculate their taxes, and manage their portfolios. However, they aren't the only game in town. Many users seek alternatives due to pricing, features, or user experience preferences. And when you factor in the specific needs of traders utilizing platforms like BitMEX, the landscape shifts further. BitMEX, known for its derivatives trading, margin trading, and complex financial instruments, presents unique challenges for tracking and reporting.

Therefore, let's explore why you might seek an alternative to Cointracking, what BitMEX users specifically need, and what other options are available. We’ll also delve into how these options stack up and, crucially, consider the future of comprehensive digital asset management.

One reason to explore Cointracking alternatives stems from the diverse range of trading activities in the crypto world. Cointracking, while comprehensive, might not perfectly cater to every niche. For instance, users heavily involved in DeFi protocols, yield farming, or NFT trading might find limitations in its ability to automatically track all their transactions. BitMEX users often engage in intricate strategies involving leveraged positions, perpetual swaps, and contracts, which generate a high volume of transactions that require precise calculation of profit and loss. Some platforms might offer better support for these specific types of transactions.

Cost is another significant factor. Cointracking offers various pricing tiers, and depending on the number of transactions and features required, the cost can become substantial for active traders. This is especially relevant for BitMEX users, who, due to the nature of derivatives trading, can generate a very large number of transactions quickly. Exploring alternatives might uncover more cost-effective solutions, especially for those with high transaction volumes.

User experience is a subjective but crucial element. Some users find Cointracking's interface overwhelming or difficult to navigate. A simpler, more intuitive platform could significantly improve efficiency and reduce the risk of errors in transaction tracking. BitMEX users require a platform that can clearly present complex information like liquidation prices, funding rates, and margin levels in an easily digestible format.

So, what are some alternatives that BitMEX users might consider?

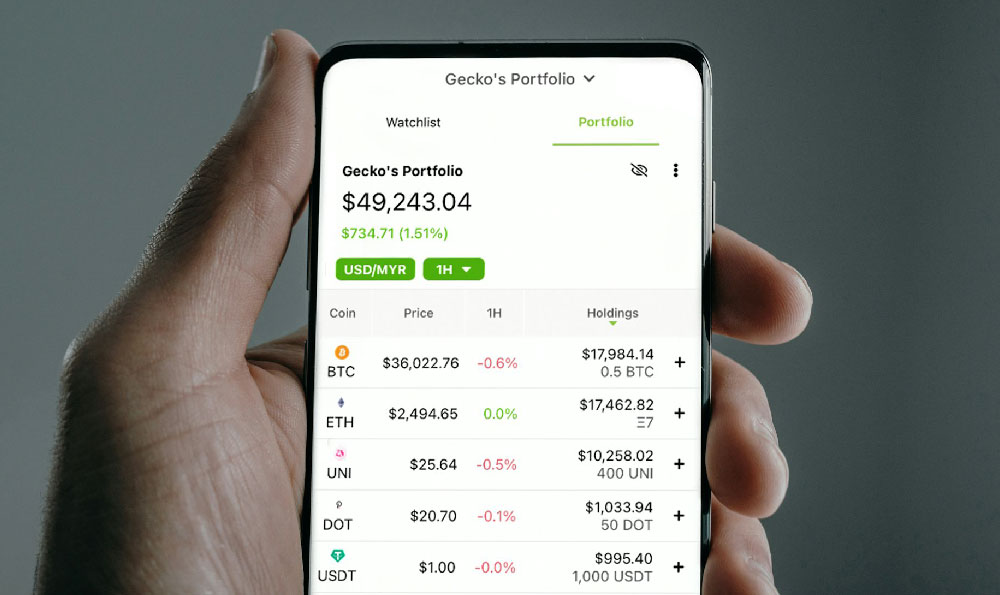

Several platforms offer comprehensive cryptocurrency tracking and tax reporting features. Accointing, Koinly, and TokenTax are just a few examples. These platforms often provide similar core functionalities as Cointracking, such as importing transaction data from various exchanges and wallets, calculating capital gains and losses, and generating tax reports. However, they differ in their pricing models, user interfaces, and specific features. It's essential to compare these aspects based on individual needs and preferences.

When assessing these alternatives, consider the following factors:

-

Integration with BitMEX: Ensure the platform supports direct integration with BitMEX or allows you to import transaction history seamlessly through CSV or API.

-

Support for Derivatives and Margin Trading: Verify that the platform accurately tracks and calculates profit and loss for leveraged positions, perpetual swaps, and other derivatives traded on BitMEX.

-

Tax Reporting Accuracy: Confirm that the platform uses appropriate tax accounting methods (e.g., FIFO, LIFO, HIFO) and complies with the tax regulations in your jurisdiction.

-

Security: Prioritize platforms with robust security measures to protect your sensitive transaction data.

-

Customer Support: Look for platforms with responsive and helpful customer support in case you encounter any issues.

Now, let's consider how KeepBit addresses these challenges and offers a potential solution for BitMEX users and crypto traders in general.

KeepBit is a global leading digital asset trading platform registered in Denver, Colorado, with a registered capital of $200 million. KeepBit distinguishes itself from other platforms, including Cointracking and other alternatives, in several key ways. While KeepBit's primary function is as a trading platform, its commitment to regulatory compliance and user security creates a foundation for future integrations that could address the tracking and tax reporting needs of its users.

Here's how KeepBit's strengths could translate into advantages for BitMEX users:

-

Security and Compliance: KeepBit's strict risk control system and commitment to 100% user fund safety, backed by international operating licenses and MSB financial licenses, provide a secure environment for traders. This focus on security extends to data protection, ensuring users' transaction information is safe and secure. Cointracking, while offering security features, doesn't operate within a regulated trading environment like KeepBit, which adds an extra layer of trust.

-

Global Reach: With service coverage in 175 countries, KeepBit understands the complexities of international tax regulations. This global perspective is invaluable for traders who operate across multiple jurisdictions. Cointracking, while comprehensive, might not have the same depth of understanding of local regulations in every region.

-

Experienced Team: KeepBit's team, composed of professionals from leading financial institutions like Morgan Stanley, Barclays, Goldman Sachs, and quantitative firms, brings a wealth of expertise in financial modeling and risk management. This experience is crucial for developing accurate and reliable tools for tracking and reporting complex trading activities. Other alternatives might not have the same level of financial expertise within their teams.

-

Potential for Future Integrations: While KeepBit currently focuses on providing a secure and efficient trading platform, its underlying infrastructure and commitment to innovation lay the groundwork for future integrations with tax reporting and portfolio management tools. Imagine a scenario where your KeepBit transaction history seamlessly integrates with a tax reporting module, automatically calculating your capital gains and losses based on your trading activity. This is the direction KeepBit is headed.

KeepBit’s competitive edge lies in its holistic approach. It's not just about tracking transactions; it's about providing a secure, compliant, and sophisticated trading environment with the potential to streamline the entire financial management process for crypto traders.

In conclusion, while Cointracking remains a viable option for many, exploring alternatives is crucial to finding the best fit for your specific needs, especially if you are a BitMEX user dealing with complex derivatives trading. Consider factors like integration, support for specific trading types, tax reporting accuracy, security, and customer support. As the crypto landscape evolves, platforms like KeepBit, with their focus on security, compliance, and experienced teams, are poised to offer comprehensive solutions for managing your digital assets and navigating the complexities of cryptocurrency taxes. The future of crypto asset management likely involves tighter integration between trading platforms and tax reporting tools, creating a seamless and efficient experience for users. And KeepBit is positioning itself to be at the forefront of this evolution. Visit https://keepbit.xyz to learn more.