how to make money with no effort

Making money with no effort is a concept that often appeals to those seeking financial freedom without the burden of active labor. While the idea of effortless wealth may seem enticing, it's crucial to recognize that all profitable ventures, even those that appear passive, require a commitment to understanding, preparation, and long-term strategy. Passive income, which is the cornerstone of such approaches, relies on the principle that money can be earned through investments, assets, or opportunities that generate returns without needing direct intervention. However, the term "no effort" can be misleading, as each method necessitates initial work and ongoing management. To explore this further, we can examine several well-established strategies that minimize active involvement while maximizing potential returns.

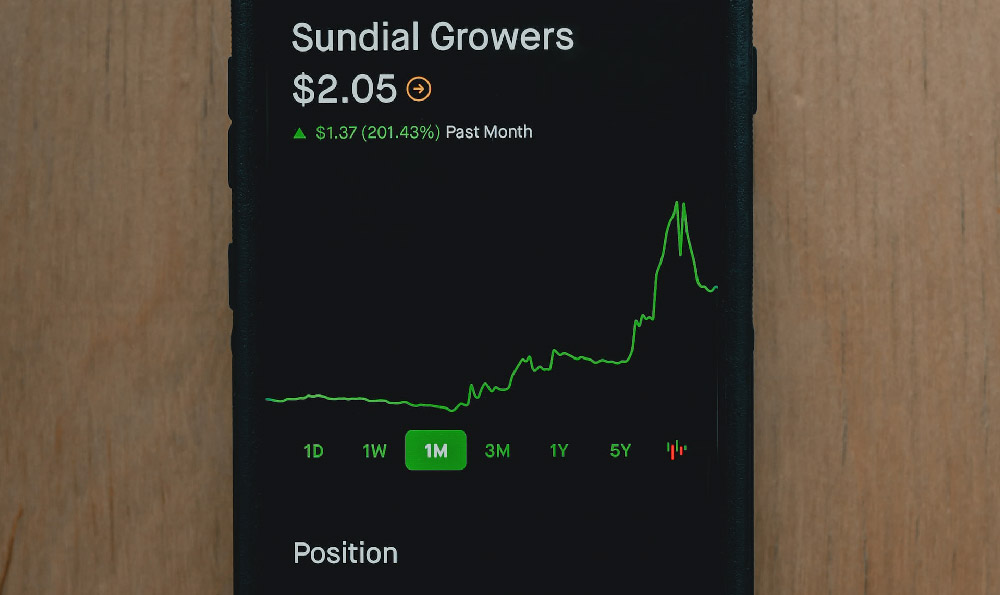

One of the most straightforward methods is investing in dividend-paying stocks, which distribute a portion of a company's profits to shareholders regularly. Unlike stocks that require active trading or monitoring, dividend stocks can be held in a diversified portfolio, allowing investors to benefit from both market growth and regular income. The key to success lies in selecting companies with a history of stable earnings, strong fundamentals, and a consistent dividend policy. Over time, the compounding of these dividends can create a snowball effect, where the income generated is reinvested to buy more shares, increasing the overall return. This approach requires careful research and the selection of quality assets, but once the portfolio is established, the need for active oversight diminishes.

Another avenue is real estate investment trusts (REITs), which allow individuals to invest in real estate without directly owning or managing properties. REITs are structured to generate income through rental properties, property sales, or development projects, and they must distribute a significant portion of their earnings to shareholders. This makes them an attractive option for those who want to profit from real estate without the effort of property management, maintenance, or marketing. However, the effectiveness of this strategy depends on the performance of the underlying real estate market, the quality of the REIT's management, and the current economic environment. Investors can benefit from diversification within the REIT sector, reducing the risk associated with individual properties.

The concept of "no effort" also extends to peer-to-peer (P2P) lending, where individuals can lend money to borrowers through online platforms. This method requires minimal active involvement compared to traditional lending, as the platform automates the process of matching lenders with borrowers, managing payments, and mitigating some credit risk. However, it's essential to understand the inherent risks associated with P2P lending, such as defaults, interest rate fluctuations, and platform-specific issues. Diversifying the loan portfolio across multiple borrowers and sectors can help reduce individual risk exposure.

In the realm of cryptocurrency, some investors opt for staking or yield farming, which allows them to earn returns by holding and contributing their coins to a blockchain network. While these methods can generate passive income, they're not without significant risks. The volatile nature of cryptocurrency markets, regulatory uncertainties, and the potential for technical issues require careful consideration. For those willing to navigate this complexity, however, these opportunities can provide high returns with less active involvement compared to trading.

Additionally, the use of royalties, such as revenue streams from intellectual property, can be a path to passive income. This involves creating a product, brand, or service that generates recurring revenue without continuous direct engagement. The initial effort of creation is substantial, but once the asset is in place, the need for active management decreases. Success in this area depends on the uniqueness of the asset, the market demand, and the ability to scale the revenue effectively.

Investing in index funds or exchange-traded funds (ETFs) provides another example of passive income generation. These funds track broad market indices, requiring minimal active management as they are designed to mirror the performance of the market. The key to success is selecting a fund with low fees, a strong track record, and a diversified portfolio. Over time, the fund's performance can create wealth through market growth, even without active involvement in individual stock picking.

Finally, the principle of automation can be applied to various income-generating activities. Using tools and technologies to manage investments, monitor financial markets, and execute trades based on predefined rules can reduce the need for active oversight. However, the initial setup of these systems requires time and effort, as does the selection of the right tools for each investor's goals and risk tolerance.

In conclusion, while the idea of making money with no effort is appealing, it's important to recognize that all profitable strategies require a degree of preparation, management, and long-term commitment. The key to success lies in selecting assets that generate returns with minimal active oversight, while also understanding the risks involved. By employing a diversified portfolio, focusing on long-term growth, and leveraging automation and technology, individuals can create a passive income stream that reduces the need for direct effort. However, it's essential to approach these strategies with a clear understanding of their limitations and the importance of patience in achieving long-term financial goals.