How to Make Money Discreetly: Is It Possible & How Do You Do It?

Okay, I understand. I will write an article based on the provided title, focusing on the concept of making money discreetly, exploring its feasibility, and offering potential methods, while adhering to the specified requirements regarding length, formatting, and avoiding specific phrases.

Here's the article:

The allure of building wealth quietly, away from prying eyes and public scrutiny, is a common aspiration. The reasons behind this desire are varied, ranging from a simple preference for privacy to more complex motivations such as avoiding unwanted attention, protecting assets, or even managing potential social implications. The question then becomes: is it truly possible to accumulate wealth discreetly, and if so, how can one approach this endeavor?

The short answer is yes, it is possible, though it requires careful planning, a deep understanding of financial instruments, and a commitment to ethical and legal practices. The key lies in leveraging a combination of strategies that prioritize privacy and minimize public exposure of one's financial activities.

One of the foundational elements of discreet wealth building is establishing a solid financial foundation built on traditional, low-profile investment vehicles. Index funds and exchange-traded funds (ETFs) are excellent examples. These diversified investment tools offer exposure to broad market segments without requiring active management or generating excessive publicity. By consistently investing in these types of assets, an individual can steadily grow their wealth over time without attracting significant attention.

Beyond basic investments, real estate can also serve as a discreet wealth-building avenue, provided it's approached strategically. Instead of purchasing properties directly under one's own name, consider utilizing a limited liability company (LLC). This separates personal assets from business assets, providing a layer of privacy. Furthermore, rental income generated from these properties can contribute to a steady stream of revenue without necessarily being tied directly to the individual's primary source of income. Choosing less ostentatious properties in emerging neighborhoods can also contribute to a lower profile.

Diversification is paramount. Avoid putting all your eggs in one basket. Spreading investments across various asset classes, geographies, and industries not only reduces risk but also makes it more difficult for anyone to piece together a comprehensive picture of your overall wealth. Think of it like a mosaic; each individual tile contributes to the overall image, but no single tile reveals the entire design.

Another crucial aspect of discreet wealth accumulation is maintaining a low profile in daily life. This includes avoiding ostentatious displays of wealth, such as luxury cars, extravagant vacations, or overly expensive clothing. Living modestly, even when financially secure, helps to avoid attracting unwanted attention and maintains a sense of normalcy. Furthermore, being mindful of social media presence is crucial. Avoid posting details about purchases or financial activities that could inadvertently reveal information about your wealth.

Engaging professional advisors, such as financial planners and tax accountants, is highly recommended. However, it's crucial to choose these advisors carefully, prioritizing those with a reputation for discretion and confidentiality. Clearly communicate your desire for privacy and ensure that they understand the importance of maintaining your financial information securely. They can also provide guidance on structuring your finances in a way that minimizes public exposure.

Furthermore, consider the power of deferred compensation. If possible, negotiate compensation packages that include deferred income or stock options. These arrangements allow you to delay receiving income and paying taxes on it, potentially reducing your current tax liability and minimizing the appearance of significant income.

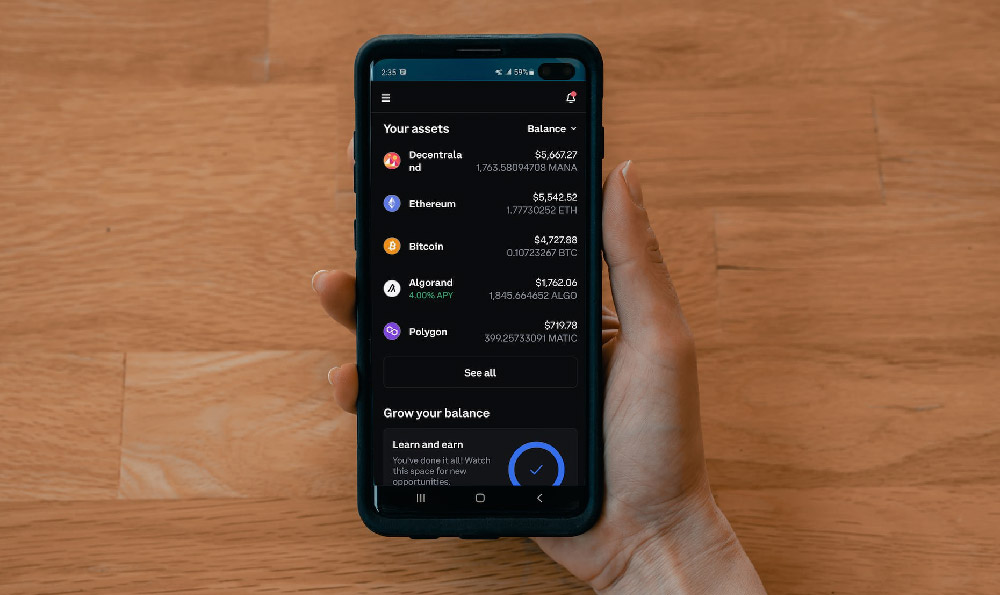

Privacy coins, like Monero or Zcash, are often mentioned in discussions about discreet finance. However, these are inherently risky. While designed to obscure transaction details, the legal landscape surrounding cryptocurrencies is still evolving, and utilizing them may attract unwanted scrutiny from regulatory agencies. They are often associated with illicit activities and should be approached with extreme caution, or avoided altogether. It is crucial to prioritize compliance with all applicable laws and regulations.

Finally, remember that patience and consistency are key. Building wealth discreetly is a marathon, not a sprint. It requires a long-term perspective, disciplined saving habits, and a commitment to maintaining a low profile. By focusing on sound financial principles, diversifying investments, and prioritizing privacy, it is possible to achieve financial security without attracting unnecessary attention. The focus should always be on ethical and legal means of wealth accumulation, ensuring that your financial success is built on a foundation of integrity and compliance.