Grok Investment: Where to Start and What to Consider?

Okay, here's an article on Grok Investment, tailored to your specifications:

Grok, a recently launched AI model by xAI, has undeniably generated considerable buzz, sparking curiosity even beyond the typical tech enthusiasts and reaching into the realm of cryptocurrency investment. While Grok itself isn't directly an investment vehicle, its potential applications and influence within the market demand careful consideration for anyone navigating the digital asset landscape. Understanding how Grok might impact the crypto world and subsequently, your investment strategy, is crucial.

The first step is to disentangle hype from reality. Grok, at its core, is a language model trained on vast amounts of data. This allows it to process information, answer questions, and even generate creative content. In the context of cryptocurrency, Grok could be leveraged for market analysis, sentiment analysis, and even automated trading. Imagine an AI that constantly monitors news articles, social media chatter, and on-chain data to identify emerging trends and potential investment opportunities. This is where the connection between Grok and crypto investment begins to solidify.

However, before diving headfirst into any investment strategy influenced by AI, it's vital to establish a solid foundation of knowledge about the underlying assets themselves. Understanding the fundamentals of Bitcoin, Ethereum, and other prominent cryptocurrencies is paramount. This includes their underlying technology, consensus mechanisms, tokenomics, and real-world use cases. Blindly following AI-driven recommendations without comprehending the assets involved is a recipe for potential disaster.

Next, it's critical to evaluate the data that Grok (or any similar AI tool) uses. The quality and accuracy of the data directly impact the reliability of the insights generated. Crypto markets are notoriously susceptible to manipulation and misinformation, so it's essential to ensure that the data sources feeding the AI are reputable and trustworthy. Consider the potential biases present in the data, as these biases can inadvertently influence the AI's recommendations. For instance, an AI primarily trained on data from a specific crypto exchange might exhibit a bias towards assets listed on that exchange.

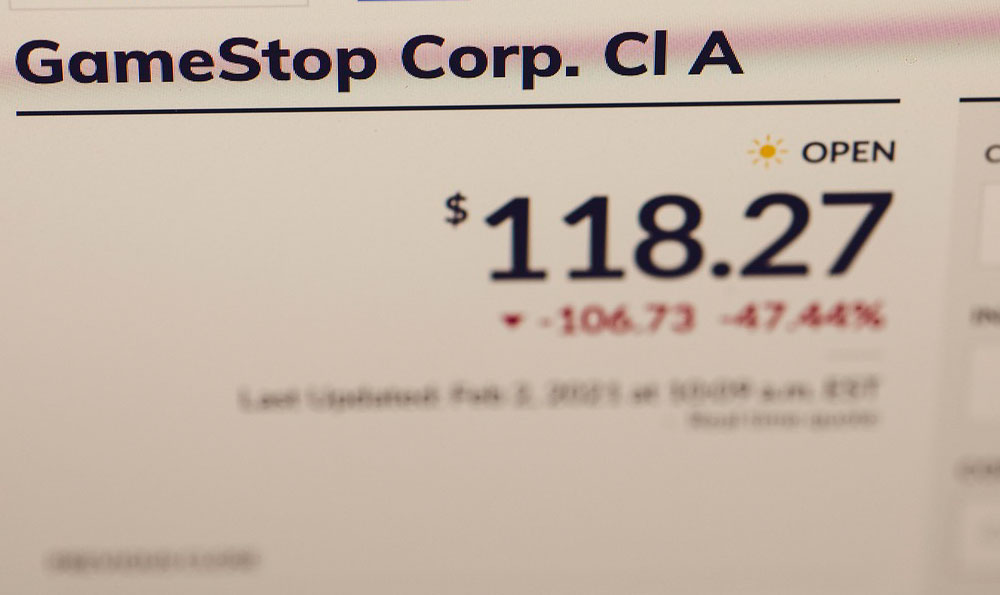

The utilization of Grok, or AI-powered tools in general, necessitates a critical understanding of market dynamics. Crypto markets are volatile and unpredictable, driven by a complex interplay of factors including regulatory developments, technological advancements, and shifts in investor sentiment. While AI can identify patterns and trends, it's essential to remember that it cannot predict the future with absolute certainty. Therefore, it's crucial to maintain a healthy dose of skepticism and to conduct your own independent research to validate any AI-generated recommendations.

Effective risk management is paramount in cryptocurrency investment, and this remains true even when leveraging AI. Diversification is a key principle, spreading your investments across a range of assets to mitigate the impact of any single asset's performance. Setting stop-loss orders can help to limit potential losses by automatically selling an asset if it falls below a certain price. Regularly reviewing and rebalancing your portfolio is also essential to ensure that it aligns with your risk tolerance and investment goals. Never invest more than you can afford to lose, as the inherent volatility of crypto markets means that losses are always a possibility.

Thinking beyond simply relying on Grok to give you investment suggestions, consider ways it could help you learn more about the space or automate tasks to free up time to make better decisions. For example, you could use Grok to summarize complex whitepapers or research reports on different cryptocurrencies, identifying key takeaways and potential risks. You could also use it to automate tasks such as tracking price movements, monitoring social media sentiment, and setting price alerts. By automating these tasks, you can free up your time to focus on more strategic decision-making, such as evaluating the long-term potential of different projects and assessing the overall market landscape.

Protecting your digital assets is another crucial aspect of cryptocurrency investment. Implementing strong security measures is essential to prevent unauthorized access to your accounts and wallets. This includes using strong, unique passwords, enabling two-factor authentication, and storing your private keys in a secure offline wallet (also known as a cold wallet). Be wary of phishing scams and other malicious activities that are common in the crypto space. Never share your private keys or other sensitive information with anyone, and always verify the authenticity of any websites or emails before interacting with them.

The long-term success of your crypto investments hinges on continuous learning and adaptation. The cryptocurrency landscape is constantly evolving, with new technologies, projects, and regulations emerging at a rapid pace. Staying informed about these developments is crucial to making informed investment decisions. Continuously educate yourself about the underlying technologies, market trends, and regulatory environment. This may involve reading industry news, attending conferences, and engaging with other investors and experts in the field.

While Grok and similar AI models offer exciting possibilities for cryptocurrency investment, it's crucial to approach them with a balanced and informed perspective. Remember that AI is a tool, not a magic bullet. By combining AI-driven insights with a solid understanding of market dynamics, effective risk management, and a commitment to continuous learning, you can increase your chances of success in the dynamic world of cryptocurrency. Don’t delegate your decision-making entirely; use AI as a powerful assistant to refine your own informed judgment.