How Much Does Kai Cenat Earn 2023

Kai Cenat, a prominent figure in the gaming and content creation space, has built a substantial online presence through his YouTube channel and streaming activities. While his primary income streams are rooted in traditional media, such as video production and live streaming, the intersection of his influence with the rise of virtual currencies offers an interesting lens through which to examine contemporary investment trends. Rather than providing a direct analysis of his personal earnings, this discussion will instead explore the broader implications of virtual currency markets in 2023 and how individuals can leverage similar principles of strategic engagement, audience value, and risk management to navigate financial opportunities in this dynamic sector.

The year 2023 marked a pivotal moment for the cryptocurrency market, characterized by both volatility and innovation. Regulatory developments, macroeconomic shifts, and technological advancements created a complex landscape where market participants had to balance opportunities with caution. For those interested in investing in virtual currencies, understanding these factors is critical. The emergence of institutional interest, the adoption of central bank digital currencies (CBDCs), and the integration of blockchain technology into traditional financial systems highlighted the growing legitimacy of digital assets. However, these trends also brought heightened competition and the need for meticulous analysis. Investors who approached the market with a long-term perspective, grounded in fundamental research rather than short-term speculation, were more likely to thrive amidst the uncertainty.

One of the key challenges in 2023 was the fluctuation in cryptocurrency prices, driven by a combination of global economic conditions, investor sentiment, and technological milestones. For example, the continuous development of Layer 2 solutions, such as Lightning Network for Bitcoin and rollups for Ethereum, demonstrated the sector's potential for scalability and efficiency. These advancements often correlate with increased institutional participation, as companies and funds seek to diversify their portfolios. However, the same factors that drove growth also introduced risks, including regulatory scrutiny, market saturation, and the potential for overvaluation. A strategic investor in 2023 would have recognized the importance of aligning investments with projects that demonstrated real-world utility and sustainable growth trajectories, rather than chasing the latest hype.

The integration of artificial intelligence and quantitative analysis into cryptocurrency trading further underscored the demand for data-driven decision-making. In 2023, algorithmic trading strategies became increasingly sophisticated, allowing investors to detect patterns in price movements and market sentiment. Tools such as on-chain analytics, which track transaction volumes and wallet activity, provided deeper insights into the health of a cryptocurrency’s ecosystem. Investors who combined these technologies with a thorough understanding of market fundamentals were better positioned to avoid common pitfalls, such as investing in projects with weak community support or speculative price bubbles. This approach mirrors the principles of value investing, where focus is placed on long-term potential rather than immediate gains.

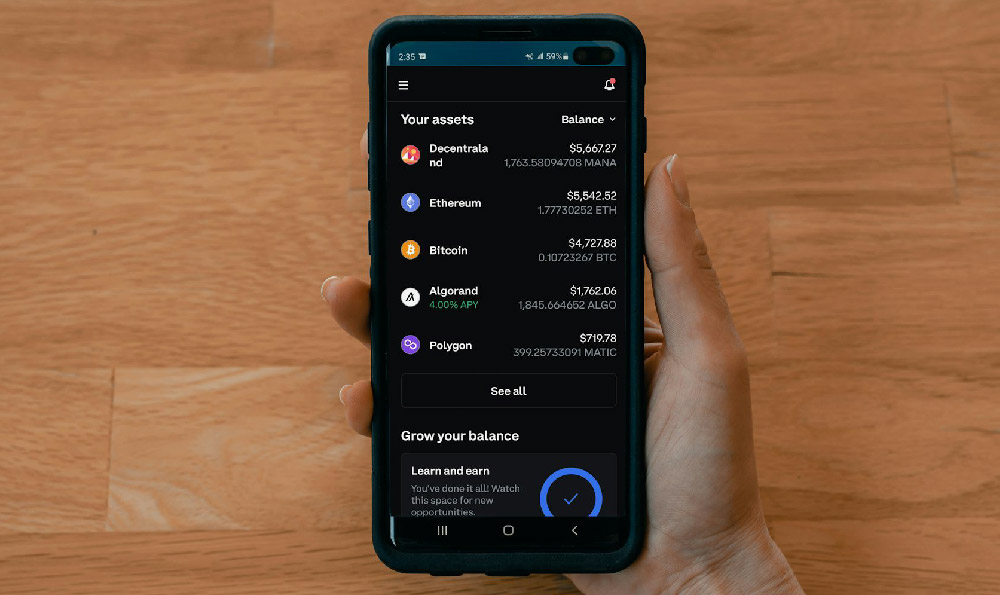

In addition to market analysis, the importance of risk management in 2023 cannot be overstated. The market’s volatility meant that even seemingly stable assets could experience significant swings. For instance, the potential collapse of a major stablecoin or the regulatory crackdown on a popular exchange could have ripple effects across the entire ecosystem. A prudent investor in 2023 would have diversified their portfolio across multiple cryptocurrencies, sectors, and asset classes to mitigate risk. Moreover, they would have prioritized security measures, such as using hardware wallets and avoiding centralized exchanges, to protect their investments from hacking and fraudulent activities.

The role of community engagement also became a defining factor in 2023. Cryptocurrencies with strong, active communities often demonstrated better resilience during market downturns and higher potential for growth. For example, projects that emphasized transparency, governance, and real-world applications tended to attract more institutional and retail investors. This dynamic mirrors the success of content creators like Kai Cenat, who built their following by delivering consistent value and fostering community interaction. For those entering the virtual currency market, the lesson is clear: sustained growth requires not only strong fundamentals but also a committed and engaged user base.

In conclusion, the virtual currency market in 2023 presented a mix of opportunities and challenges, reflecting the broader theme of innovation and risk in modern finance. While Kai Cenat’s earnings are primarily tied to his content creation ventures, the principles of strategic engagement, diversified investment, and risk mitigation remain relevant for anyone exploring virtual currency opportunities. By focusing on projects with strong fundamentals, leveraging advanced analytics, and prioritizing security, individuals can navigate this complex market with confidence. Ultimately, the key to success lies in understanding the interplay between technology, economics, and market psychology, while maintaining a disciplined approach to investment and risk management.