Is Bitcoin a Wise Investment, or a Risky Gamble?

Bitcoin: Navigating the Hype and Reality of Digital Gold

The allure of Bitcoin is undeniable. Stories of overnight millionaires, the promise of decentralized finance, and the sheer novelty of a digital currency have propelled it into the mainstream consciousness. However, separating the potential from the peril requires a dispassionate assessment, avoiding the pitfalls of both blind faith and unwarranted dismissal.

Instead of framing Bitcoin as a binary choice between a wise investment and a risky gamble, a more nuanced understanding recognizes its inherent volatility and potential for both significant gains and substantial losses. Like any asset class, its suitability depends entirely on individual circumstances, risk tolerance, and investment goals.

One of the primary factors driving Bitcoin's price is scarcity. With a hard cap of 21 million coins, it possesses a fixed supply unlike traditional fiat currencies, which can be inflated by central banks. This inherent scarcity, coupled with increasing adoption, fuels the argument that Bitcoin is a store of value, often compared to gold. Proponents believe that as inflation erodes the purchasing power of fiat currencies, Bitcoin will serve as a hedge against economic uncertainty, preserving and even growing wealth over time.

The technology underpinning Bitcoin, the blockchain, is another compelling argument for its long-term viability. The decentralized and immutable nature of the blockchain offers transparency and security, potentially revolutionizing industries beyond just finance. From supply chain management to voting systems, the applications are vast, and Bitcoin's role as the native cryptocurrency of the most established blockchain network gives it a significant advantage.

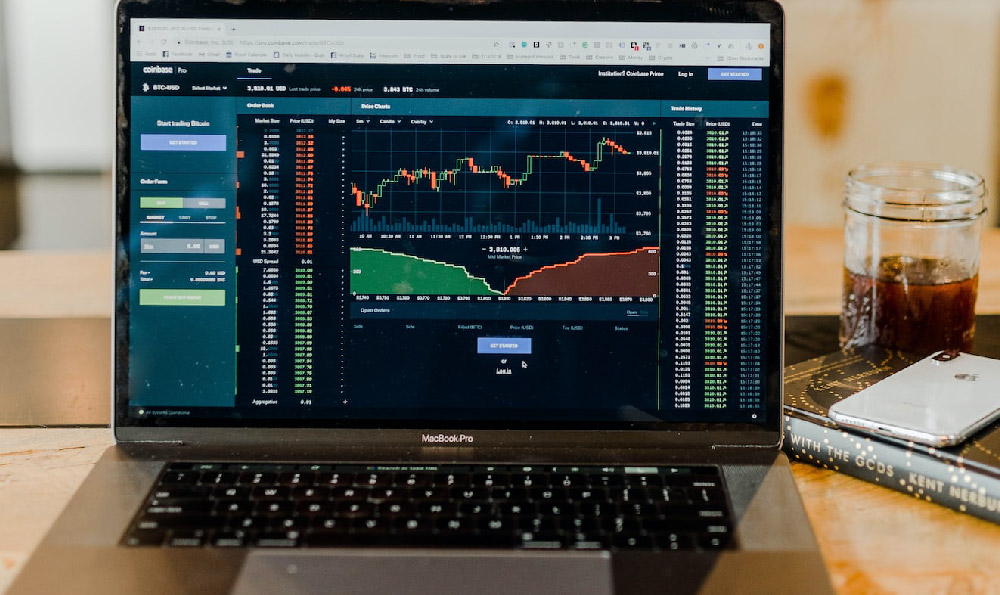

However, the path to widespread adoption is fraught with challenges. Bitcoin's price volatility is legendary. Dramatic swings of 20% or more in a single day are not uncommon, making it a nerve-wracking investment for the faint of heart. This volatility stems from a combination of factors, including regulatory uncertainty, market manipulation, and speculative trading. News events, social media sentiment, and the actions of influential individuals can all trigger significant price fluctuations.

Furthermore, the regulatory landscape surrounding Bitcoin remains unclear in many jurisdictions. Governments around the world are grappling with how to classify and regulate cryptocurrencies, and potential bans or restrictive regulations could significantly impact Bitcoin's value. The evolving legal framework adds an element of uncertainty that investors must consider.

Another concern is the environmental impact of Bitcoin mining. The process of verifying transactions on the blockchain requires significant computing power, consuming vast amounts of energy. While efforts are being made to transition to more sustainable energy sources, the environmental footprint of Bitcoin remains a valid criticism.

Beyond these macroeconomic factors, individuals considering investing in Bitcoin must also address the practical aspects of security and storage. Unlike traditional bank accounts, Bitcoin holdings are vulnerable to hacking and theft if not properly secured. Using strong passwords, enabling two-factor authentication, and storing Bitcoin in a cold wallet (an offline storage device) are essential steps to protect against loss.

So, how does one determine if Bitcoin is a suitable investment?

Firstly, assess your risk tolerance. Are you comfortable with the possibility of losing a significant portion of your investment? If not, Bitcoin may not be the right choice.

Secondly, define your investment goals. Are you looking for short-term gains or long-term appreciation? Bitcoin is generally considered a long-term investment, but its volatility makes it unsuitable for short-term speculation for the uninitiated.

Thirdly, conduct thorough research. Don't rely on hype or social media trends. Understand the technology, the market dynamics, and the regulatory environment.

Fourthly, diversify your portfolio. Don't put all your eggs in one basket. Bitcoin should be part of a well-diversified investment strategy that includes other asset classes, such as stocks, bonds, and real estate.

Fifthly, start small. Don't invest more than you can afford to lose. Begin with a small amount and gradually increase your holdings as you become more comfortable with the market.

Finally, remain vigilant and informed. The cryptocurrency market is constantly evolving. Stay up-to-date on the latest news, trends, and regulations.

In conclusion, Bitcoin is not a simple equation. It presents both opportunities and risks. Its potential as a store of value, a hedge against inflation, and a disruptive technology is undeniable. However, its volatility, regulatory uncertainty, and security risks must be carefully considered. By approaching Bitcoin with a clear understanding of its inherent characteristics, a realistic assessment of your risk tolerance, and a commitment to responsible investment practices, you can navigate the complexities of the digital currency landscape and potentially benefit from its long-term growth potential. Whether it proves to be a wise investment or a risky gamble ultimately depends on your individual approach and diligence. Prudence and continuous learning are your best allies in this nascent and transformative financial frontier.