Investing in El Salvador: What's the Potential and How Do You Do It?

Okay, I understand. Here's an article exploring the potential and process of investing in El Salvador, avoiding a bullet-point structure and direct repetition of the title.

El Salvador, a small Central American nation, has been making headlines in recent years, largely due to its bold embrace of Bitcoin as legal tender. This decision, spearheaded by President Nayib Bukele, has both captivated and concerned the international community, creating a unique landscape for potential investors. While the move carries inherent risks, it also presents opportunities for those willing to navigate the evolving regulatory environment and understand the underlying dynamics of the Salvadoran economy.

The potential upside of investing in El Salvador hinges significantly on the success of the Bitcoin strategy. The government hopes that the adoption of cryptocurrency will attract foreign investment, reduce remittance costs, and promote financial inclusion for a large segment of the population that remains unbanked. This strategy has already begun to show some effect, albeit mixed. Tourist revenue has increased noticeably since the Bitcoin Law was enacted, although it's difficult to directly attribute all of this growth to the cryptocurrency initiative alone. The construction sector is also experiencing a boom, fueled partly by Bitcoin-related infrastructure development and the influx of foreign capital.

However, assessing the true potential requires a more nuanced understanding of the Salvadoran economy. Traditionally reliant on agriculture and remittances, El Salvador has been striving to diversify its economic base. Key sectors showing promise include tourism, manufacturing, and renewable energy. The government is actively promoting foreign investment in these areas through tax incentives, streamlined regulatory processes, and infrastructure development projects. Furthermore, El Salvador's strategic location within Central America makes it an attractive hub for businesses seeking to access regional markets.

Beyond the Bitcoin experiment, several other factors contribute to El Salvador's investment appeal. The country boasts a relatively young and increasingly educated workforce, offering a competitive labor market. The cost of living is also comparatively low, making it an attractive location for both businesses and individuals. Moreover, El Salvador has made progress in improving its security situation, although challenges remain in this area. The government is implementing various initiatives to combat crime and violence, which are critical for fostering a stable and attractive investment climate.

So, how does one actually invest in El Salvador? There are several avenues available, each with its own set of considerations.

Direct investment in businesses is perhaps the most traditional approach. This could involve acquiring an existing Salvadoran company or establishing a new operation. Careful due diligence is essential, including a thorough understanding of local laws, regulations, and business practices. Engaging with local legal and financial advisors is highly recommended to navigate the complexities of the Salvadoran business environment. Sectors like tourism, renewable energy, and manufacturing offer particularly promising opportunities for direct investment.

Real estate is another popular option, especially in coastal areas and urban centers. The demand for housing and commercial properties is growing, driven by both domestic and foreign interest. Investing in real estate can provide a steady stream of rental income or potential capital appreciation. However, it's crucial to conduct thorough property assessments and ensure clear title before investing. Working with reputable real estate agents and lawyers is essential to avoid potential pitfalls.

Investing in Salvadoran government bonds is another possibility, although it comes with its own set of risks. El Salvador's sovereign debt has been subject to significant volatility in recent years due to concerns about the country's financial stability and the Bitcoin experiment. Investors should carefully consider the risks and potential returns before investing in Salvadoran government bonds. Understanding the government's fiscal policies and its ability to service its debt obligations is paramount.

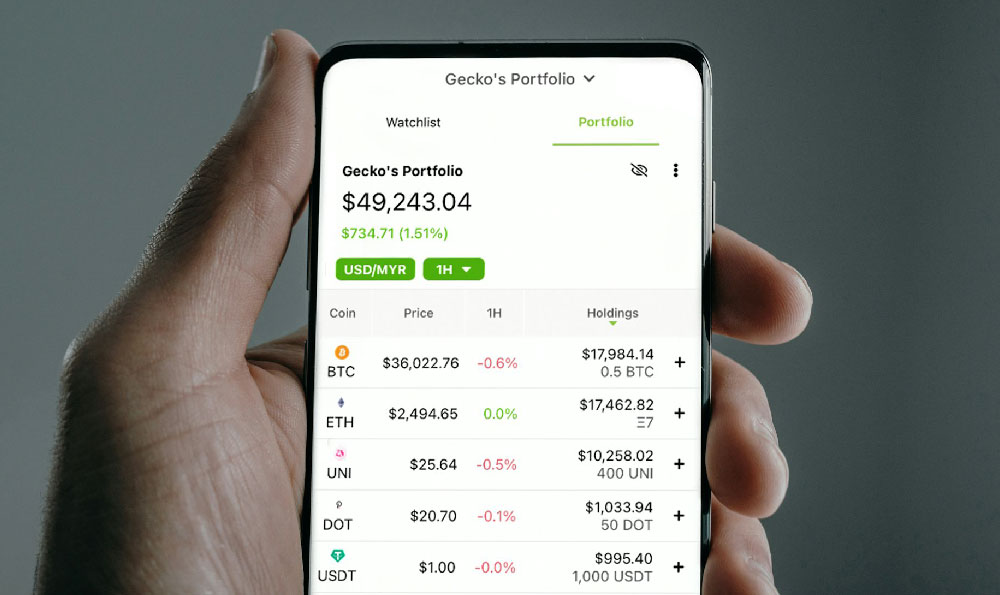

For those interested in the Bitcoin ecosystem, there are also opportunities to invest in Bitcoin-related businesses and projects. This could involve investing in cryptocurrency exchanges, mining operations, or companies developing Bitcoin-related technologies. However, this type of investment carries a higher degree of risk due to the volatility of the cryptocurrency market and the evolving regulatory landscape.

Regardless of the investment strategy chosen, a comprehensive understanding of the risks involved is absolutely crucial. El Salvador faces a number of challenges, including political instability, corruption, and security concerns. The country's reliance on Bitcoin also presents unique risks, as the cryptocurrency market is highly volatile and subject to regulatory uncertainty. Moreover, El Salvador's relationship with international financial institutions, such as the International Monetary Fund (IMF), is complex and could impact its access to funding.

Before making any investment decisions, it's essential to conduct thorough due diligence, seek professional advice, and understand the potential risks and rewards. Consider engaging with organizations like the Salvadoran Chamber of Commerce or the El Salvador Invest agency, which can provide valuable insights and support for foreign investors. Furthermore, staying informed about the latest developments in the Salvadoran economy and regulatory environment is critical for making informed investment decisions.

Investing in El Salvador offers both significant potential and substantial risks. The country's bold embrace of Bitcoin, coupled with its efforts to diversify its economy, presents unique opportunities for investors. However, it's crucial to approach this market with caution, conducting thorough due diligence and seeking expert advice. By understanding the underlying dynamics of the Salvadoran economy and carefully managing the risks involved, investors can potentially reap significant rewards from this emerging market. Success hinges on a clear-eyed assessment of the landscape and a willingness to navigate the challenges alongside the opportunities.