Investing in Crypto: How and Why?

Okay, I understand. I will craft an article addressing the allure and mechanics of cryptocurrency investment, adhering to your requirements regarding length, style, and the absence of specific phrases. Here's the article:

The world of finance is constantly evolving, and few developments have captured the imagination and sparked as much debate as cryptocurrency. From Bitcoin's pioneering entrance to the proliferation of altcoins and decentralized finance (DeFi) applications, the digital asset landscape presents both immense opportunities and significant risks. Understanding the “how” and “why” behind investing in crypto is crucial for anyone considering venturing into this dynamic domain.

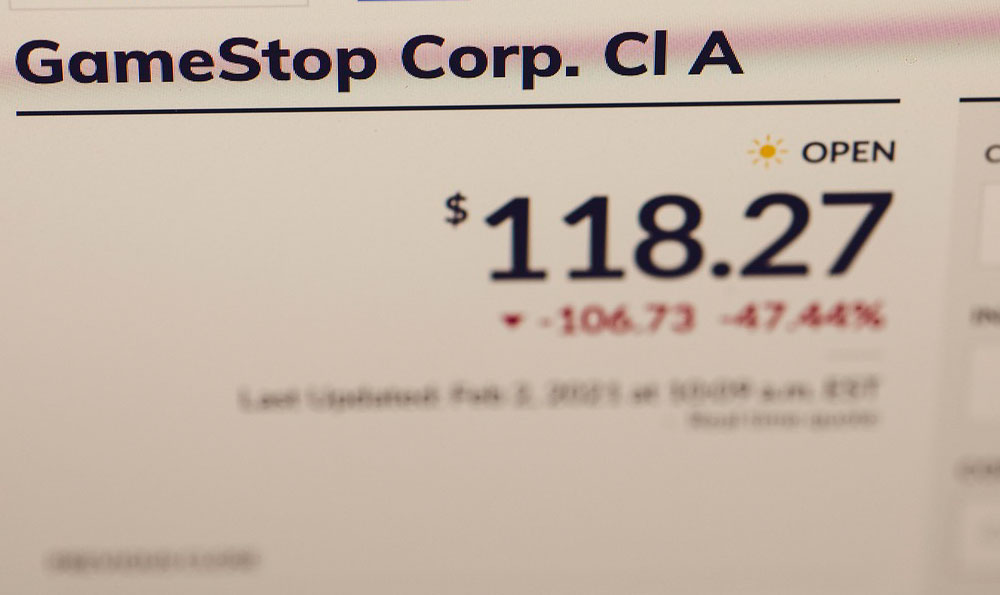

One of the primary reasons people are drawn to cryptocurrency is the potential for high returns. Traditional investment vehicles like stocks and bonds often deliver steady but relatively modest gains. Crypto, on the other hand, has seen instances of explosive growth, turning small investments into fortunes in a short period. This potential for outsized returns is particularly attractive to younger investors and those seeking to diversify their portfolios beyond conventional assets. Furthermore, the inherent volatility of the crypto market can be exploited by skilled traders who can capitalize on price swings and short-term market fluctuations. However, it's essential to acknowledge that high potential returns come hand-in-hand with equally high risks.

Another compelling factor is the promise of decentralization. Traditional financial systems are heavily controlled by governments and institutions. Cryptocurrencies, built on blockchain technology, aim to circumvent these intermediaries and create a more democratic and transparent financial system. This resonates with individuals who distrust centralized authorities and seek greater control over their assets. The decentralized nature of crypto also makes it resistant to censorship and manipulation, offering a haven for those living in countries with oppressive regimes or unstable economies. The technology allows individuals to engage in peer-to-peer transactions without the need for banks or other financial institutions, reducing transaction fees and increasing efficiency.

However, the path to crypto investing is not without its challenges. The first crucial step involves understanding the technology. While you don't need to be a blockchain expert, a basic grasp of how cryptocurrencies work, how transactions are verified, and the concepts of wallets and private keys is essential. There are numerous online resources, from educational websites to YouTube tutorials, that can provide this foundational knowledge. Neglecting this aspect can leave you vulnerable to scams and errors.

Choosing the right cryptocurrency is another critical decision. Bitcoin remains the most well-known and widely adopted cryptocurrency, but there are thousands of other options, each with its own unique features and potential. Ethereum, for example, is the foundation for many decentralized applications (dApps) and smart contracts. Other altcoins focus on specific niches, such as privacy, scalability, or supply chain management. Researching the underlying technology, team, and market capitalization of each cryptocurrency is crucial before investing. Avoid falling prey to hype or "get rich quick" schemes, and always conduct thorough due diligence.

Selecting a reliable and secure exchange is paramount. Crypto exchanges are online platforms where you can buy, sell, and trade cryptocurrencies. Reputable exchanges implement robust security measures to protect user funds from hacking and theft. Look for exchanges that offer two-factor authentication, cold storage of assets, and insurance policies to cover potential losses. Popular exchanges include Coinbase, Binance, Kraken, and Gemini, but it's always prudent to research their track record and user reviews before entrusting them with your money.

Once you've chosen an exchange, you need to fund your account. This typically involves linking your bank account or credit card. Keep in mind that cryptocurrency transactions are often irreversible, so double-check all details before confirming a transfer. Consider starting with a small amount of money that you're comfortable losing, especially if you're new to crypto investing. This allows you to learn the ropes without risking a significant portion of your savings.

Managing risk is arguably the most important aspect of crypto investing. The market is highly volatile, and prices can fluctuate dramatically in short periods. Avoid investing more than you can afford to lose, and diversify your portfolio across multiple cryptocurrencies. This helps to mitigate the impact of any single asset performing poorly. Consider using stop-loss orders to automatically sell your assets if they reach a certain price level, limiting potential losses.

Furthermore, staying informed about the latest news and developments in the crypto space is essential. Regulatory changes, technological advancements, and market trends can all significantly impact the value of cryptocurrencies. Follow reputable news sources, industry experts, and online communities to stay up-to-date. Be wary of misinformation and scams, and always verify information before making any investment decisions.

Storing your cryptocurrency securely is another crucial consideration. While exchanges offer convenient storage options, they are also vulnerable to hacking. For long-term holdings, consider using a hardware wallet, which is a physical device that stores your private keys offline. This provides an extra layer of security against online attacks. Alternatively, you can use a software wallet, which is an application that stores your private keys on your computer or mobile device. Choose a reputable software wallet with strong security features.

Finally, understanding the tax implications of cryptocurrency investments is essential. Depending on your jurisdiction, you may be required to pay taxes on capital gains from selling cryptocurrencies. Consult with a tax professional to ensure that you are complying with all applicable tax laws.

Investing in crypto can be both exciting and rewarding, but it's crucial to approach it with caution and a well-informed strategy. By understanding the technology, choosing the right assets, managing risk, and staying informed, you can increase your chances of success in this dynamic and rapidly evolving market. Remember, thorough research and a disciplined approach are your best defenses against the inherent risks of cryptocurrency investment.