how to travel the world and earn money

Traveling the world while earning money is a dream that merges adventure with financial pragmatism, offering a unique path to both personal enrichment and economic stability. The modern global economy has opened unprecedented opportunities for individuals to break free from traditional work environments, enabling them to leverage their skills, resources, and creativity to generate income while exploring new horizons. This approach requires more than just a desire to travel—it demands a well-structured strategy that aligns financial planning with the practicalities of life on the move. By understanding the nuances of remote work, digital nomadism, and global investment opportunities, travelers can turn their wanderlust into a sustainable source of wealth.

The foundation of this lifestyle begins with identifying one's core competencies and translating them into portable income streams. For instance, professionals in fields like software development, graphic design, copywriting, or digital marketing can operate from anywhere with an internet connection, making them ideal candidates for remote work. Establishing a freelance platform or joining global online communities allows individuals to connect with clients across the world, creating a flexible income model that supports travel. However, success in this realm hinges on building a reliable reputation, mastering time zone management, and ensuring consistent communication with clients. It is crucial to recognize that while remote work offers freedom, it also demands discipline and proactive networking to sustain income during periods of transition between locations.

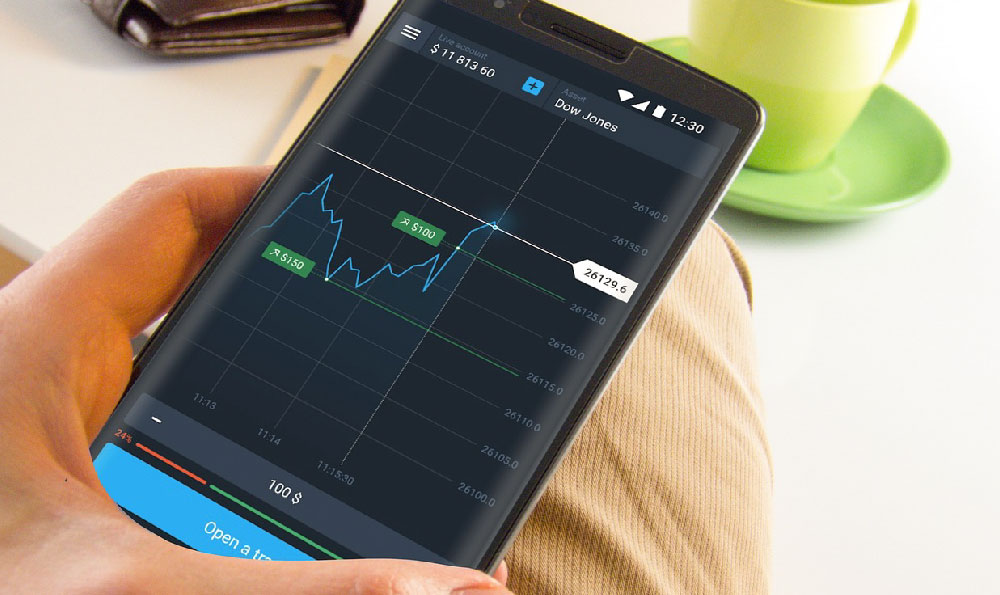

Beyond remote employment, investing in globally accessible assets can provide passive income that complements travel. Real estate crowdfunding platforms enable individuals to invest in properties abroad with minimal capital, earning rental income or capital appreciation without the need for physical presence. Similarly, stock market investments, particularly in dividend-paying companies or ETFs, can generate recurring income that supports long-term travel goals. The key to leveraging these opportunities lies in understanding market dynamics, diversifying portfolios to mitigate risks, and aligning investment choices with one's risk tolerance. For example, investing in international markets requires careful consideration of currency fluctuations, geopolitical risks, and regulatory environments, which can be mitigated through hedging strategies or consulting with financial advisors.

Another avenue is embracing the gig economy, where short-term work opportunities can offset travel costs and even fund extended journeys. Platforms like TaskRabbit, Uber, or Airbnb allow individuals to engage in local jobs or rent out their own accommodations while traveling. These options provide flexibility, but their effectiveness depends on the traveler's ability to adapt to local markets, understand cultural nuances, and manage irregular income. For instance, offering language tutoring or cultural expertise in a destination can create a steady demand for services, while renting out a home in a secondary location can generate rental income without the overhead of maintaining a physical presence in every destination.

The intersection of travel and income generation also involves strategic planning to optimize financial resources. Budgeting for travel requires a balance between lifestyle aspirations and economic realities, necessitating the identification of cost-effective solutions for accommodation, transportation, and daily expenses. For example, opting for hostels, coworking spaces, or shared living arrangements can significantly reduce overhead costs, while utilizing public transportation or carpooling networks minimizes travel expenses. Additionally, establishing an emergency fund and setting financial goals for specific travel milestones ensures that the journey remains financially viable even in the face of unexpected challenges.

For those seeking to combine travel with active income, entrepreneurship presents a compelling option. Starting a business that operates on a global scale, such as a digital product company, online coaching service, or travel-related venture, can provide both autonomy and revenue. However, this path requires market research to identify viable opportunities, a clear business plan to guide operations, and the ability to manage time effectively between business development and travel. For instance, creating a niche in the travel industry—such as a boutique tour agency or a digital nomad community hub—can create recurring income while fulfilling a passion for exploration.

Ultimately, the integration of travel and income generation is not about replacing traditional work but about creating a synergistic relationship between financial goals and personal experiences. This approach requires a mindset shift, where travelers view their journey as an extension of their professional pursuits. By combining the flexibility of remote work, the potential of global investments, and the opportunities within the gig economy, individuals can craft a path that allows them to explore the world while building financial security. The challenges are real, from managing currency risks to navigating visa requirements, but with careful planning, adaptability, and a long-term perspective, these obstacles can be transformed into opportunities for growth. In this way, travel becomes not just a means of escape, but a strategic component of a holistic financial plan.