Investing: Yes or No? A Smart Move?

Investing in cryptocurrencies: navigating the digital frontier. The allure of cryptocurrencies like Bitcoin, Ethereum, and countless altcoins has captivated investors worldwide. Promises of high returns and decentralized finance fuel the hype, yet the volatile nature of this asset class demands careful consideration. The question of whether cryptocurrency investment is a "smart move" lacks a simple "yes" or "no" answer. The suitability of cryptocurrency investments hinges on individual financial goals, risk tolerance, and understanding of the underlying technology.

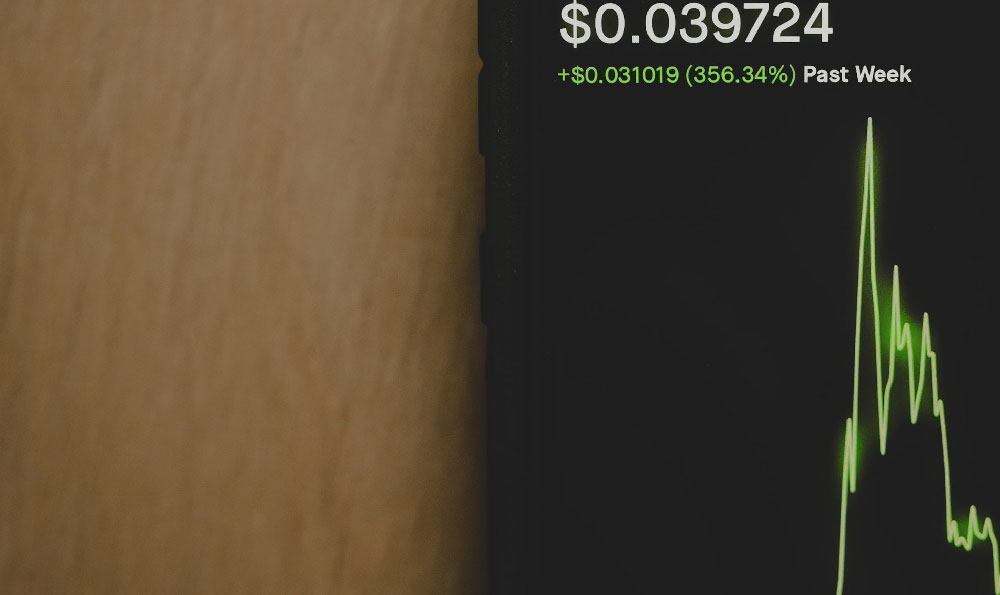

One cannot ignore the impressive growth trajectory of certain cryptocurrencies. Early adopters of Bitcoin, for example, have reaped substantial rewards. However, past performance is not indicative of future results, and chasing overnight riches is a recipe for disaster. Before diving in, a thorough self-assessment is crucial. Are you comfortable with the possibility of losing a significant portion of your investment? Can you withstand the emotional rollercoaster of market fluctuations? A rational approach, grounded in realistic expectations, is essential.

Understanding the fundamental principles of blockchain technology and the specific cryptocurrency you are considering is paramount. Cryptocurrencies are not created equal. Some projects boast innovative solutions to real-world problems, while others are merely speculative bubbles waiting to burst. Researching the project's whitepaper, understanding its use case, evaluating the team behind it, and assessing its community support are vital steps in determining its long-term viability. Consider the tokenomics – how the cryptocurrency is distributed, its supply cap, and any mechanisms for incentivizing holders. A well-designed tokenomic model can contribute to a project's sustainability.

Market analysis plays a pivotal role in informed investment decisions. Technical analysis, involving the study of price charts and trading volumes, can help identify potential entry and exit points. However, technical analysis is not foolproof and should be used in conjunction with other forms of analysis. Fundamental analysis, on the other hand, focuses on the intrinsic value of the cryptocurrency project. This involves assessing its market position, adoption rate, and competitive landscape. Keeping abreast of industry news, regulatory developments, and macroeconomic trends is crucial for anticipating market shifts.

Diversification is a cornerstone of risk management in any investment portfolio, and cryptocurrencies are no exception. Allocating a small percentage of your overall investment portfolio to cryptocurrencies can mitigate the impact of potential losses. Spreading your cryptocurrency investments across different projects can further reduce risk. Avoid putting all your eggs in one basket, especially in a market as unpredictable as cryptocurrency.

Choosing a reputable cryptocurrency exchange is critical. Conduct thorough research on the exchange's security measures, transaction fees, and customer support. Opt for exchanges with strong security protocols, such as two-factor authentication and cold storage of funds. Be wary of exchanges with limited trading volume or a history of security breaches. Always enable two-factor authentication on your exchange account to protect your funds from unauthorized access.

Navigating the regulatory landscape is another critical consideration. Regulations surrounding cryptocurrencies vary widely across jurisdictions and are constantly evolving. Staying informed about the legal and tax implications of cryptocurrency investments in your region is essential. Failure to comply with regulations can result in penalties or legal repercussions.

Beware of common investment pitfalls. Pump-and-dump schemes, where individuals artificially inflate the price of a cryptocurrency before selling it for a profit, leaving unsuspecting investors with losses, are rampant in the cryptocurrency space. Avoid participating in such schemes and be wary of promises of guaranteed returns. Similarly, be skeptical of initial coin offerings (ICOs) or initial exchange offerings (IEOs) that lack transparency or have unrealistic goals. Thoroughly vet any new cryptocurrency project before investing, and never invest more than you can afford to lose.

Cold storage, which involves storing your cryptocurrency offline, is the most secure way to protect your funds from hacking. Hardware wallets, which are physical devices that store your private keys offline, are a popular option for cold storage. While hot wallets, which are connected to the internet, offer greater convenience for trading, they are also more vulnerable to security breaches. Regularly back up your wallet and keep your private keys safe and secure. Never share your private keys with anyone.

Cryptocurrency investment is not a passive endeavor. It requires ongoing monitoring, research, and adaptation. Stay informed about market trends, project developments, and regulatory changes. Be prepared to adjust your investment strategy as needed. The cryptocurrency market is dynamic and constantly evolving, and a flexible approach is essential for long-term success.

In conclusion, whether investing in cryptocurrencies is a "smart move" depends entirely on your individual circumstances and preparedness. By understanding the risks, conducting thorough research, diversifying your portfolio, choosing secure exchanges, and staying informed about the regulatory landscape, you can increase your chances of success in the cryptocurrency market. Approach cryptocurrency investments with a rational mindset, and always remember that responsible investing is key to achieving your financial goals. It's not about getting rich quick; it's about building wealth responsibly and sustainably.