How to Make Money with Degrees of Lewdity

Investing in the financial markets can be a complex endeavor, requiring a nuanced understanding of risk, return, and market dynamics. While traditional approaches emphasize stability and long-term growth, many investors seek alternative strategies that challenge conventional wisdom. These strategies often involve leveraging market inefficiencies, capitalizing on subtle shifts in economic conditions, or exploring niche opportunities that others overlook. The phrase "degrees of lewdity" in this context is likely a metaphor for the varying levels of risk and reward that different investment paths offer, highlighting the importance of balancing bold moves with prudence.

The allure of high-risk investments lies in their potential for substantial returns, but they come with unique challenges that must be carefully navigated. For instance, trading in volatile assets like cryptocurrencies or leveraged derivatives can amplify profits, yet these strategies often demand a deeper comprehension of market volatility. Investors who are unprepared for the rapid fluctuations in such markets may find themselves facing significant losses. Similarly, engaging in high-leverage trading requires not only financial acumen but also robust risk management techniques to safeguard capital. While some may view these approaches as dangerous, they can also be tools for those who are willing to accept the risks and plan accordingly.

Diversification remains a cornerstone of any effective investment strategy, but it is not always the most lucrative. Certain investors capitalize on concentrated bets in specific sectors or assets, aiming to maximize gains. This approach requires meticulous analysis of market trends, economic indicators, and industry-specific factors that could influence outcomes. However, it is important to recognize that not all investors are suited for this method. High leverage and volatility can create opportunities for those with expertise, yet they may also lead to catastrophic consequences for the uninitiated. The key to success lies in understanding the "degrees of lewdity" in one’s investment choices and aligning them with personal risk tolerance and financial goals.

Another angle is the strategic use of market sentiment to identify underpriced or overpriced assets. For example, during periods of economic uncertainty, certain industries may experience rapid decline or unexpected growth. Scarce investors analyze these shifts and position their portfolios to profit from market misjudgments. This involves not only identifying emerging trends but also timing entry and exit points with precision. However, such strategies require access to real-time data, advanced analytical tools, and a deep understanding of macroeconomic cycles. The potential rewards are significant, but the risk of miscalculating market trends remains high.

In recent years, alternative investment avenues have gained popularity, offering investors new ways to navigate the "degrees of lewdity" in the financial landscape. These include real estate crowdfunding, peer-to-peer lending, and private equity opportunities that provide higher returns but require greater due diligence. For instance, real estate investments have shown promise in volatile markets, with some property values appreciating sharply despite broader economic downturns. Similarly, peer-to-peer lending platforms can offer competitive interest rates, though they demand careful evaluation of borrower creditworthiness and risk exposure. These strategies highlight the potential for unconventional outlets in the financial markets, but they also underscore the importance of understanding the underlying mechanics and risks.

Additionally, the power of compounding and long-term growth should not be underestimated, even in the face of short-term volatility. Strategies that focus on capital preservation, such as value investing or dividend-paying stocks, may offer consistent returns over time, whereas more aggressive approaches like speculative trading can lead to rapid gains or losses. The "degrees of lewdity" in this case refer to the trade-off between immediate rewards and long-term stability, emphasizing the need for a balanced perspective.

Ultimately, success in the financial markets depends on a combination of knowledge, experience, and strategic decision-making. While some may pursue high-risk options for the potential of high rewards, others may opt for more measured approaches that prioritize gradual growth. The key is to recognize that each investment path carries its own "degrees of lewdity," and investors must assess these factors carefully before committing resources. Whether through leveraging market volatility, exploring alternative investments, or optimizing compounding strategies, the goal is to navigate the financial landscape with clarity and purpose.

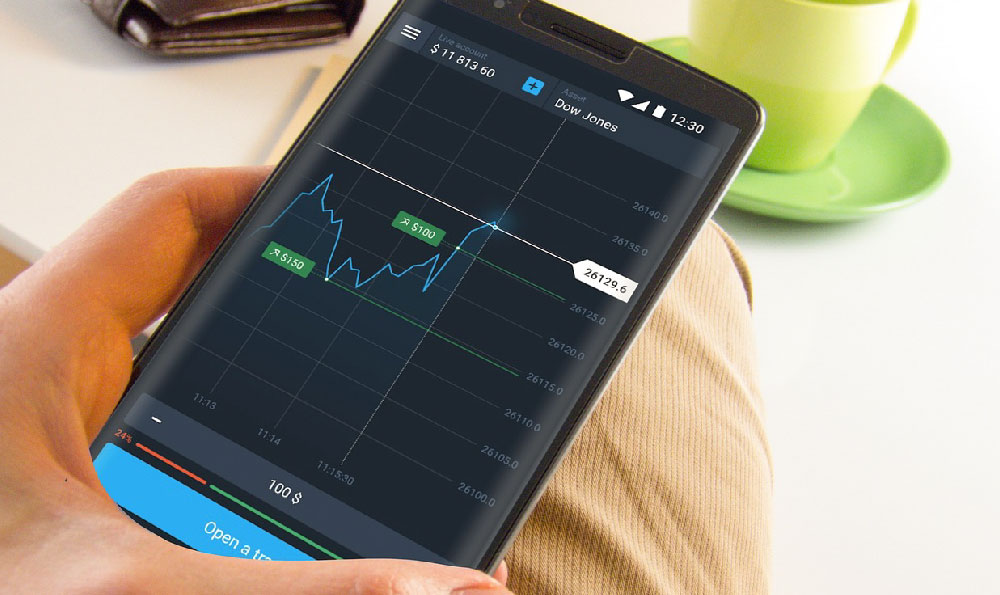

The digital age has introduced new tools and platforms that allow investors to access diverse markets and strategies. Online trading systems, algorithmic trading, and mobile apps have transformed how people engage with financial instruments, offering both convenience and opportunities for profit. However, these tools also require a strong foundation in financial literacy and the ability to manage digital risks, such as cybersecurity threats or platform reliability. Investors who are willing to embrace these technological advancements while maintaining a critical eye can find themselves at the forefront of the financial market's evolution.

In conclusion, the financial markets are a multifaceted environment where risk and reward coexist in varying degrees. Whether through high-risk ventures or more conservative strategies, investors must navigate this landscape with both courage and caution. By leveraging market opportunities, analyzing trends, and employing sophisticated techniques, individuals can position themselves to profit from the "degrees of lewdity" in their chosen investment paths. The challenge lies not only in identifying the right opportunities but also in understanding the risks involved and making informed decisions that align with personal financial objectives.