How to Invest Money? And Can It Be Done Fast?

Investing money wisely is a journey, not a sprint. The allure of quick riches often clouds judgment, leading to risky decisions with potentially devastating consequences. While the dream of rapid wealth accumulation is tempting, a more prudent and sustainable approach focuses on long-term growth, diversification, and a thorough understanding of risk. Before diving into specific investment vehicles, it's crucial to lay a solid foundation by assessing your financial situation, defining your goals, and establishing a risk tolerance level.

The first step involves a comprehensive overview of your current financial landscape. This includes compiling a detailed inventory of your assets (savings, investments, real estate) and liabilities (debts, loans, mortgages). Understanding your net worth—the difference between your assets and liabilities—provides a baseline for measuring your progress. Equally important is analyzing your income and expenses. Track your spending habits to identify areas where you can cut back and allocate more funds towards investments. Building an emergency fund, ideally covering 3-6 months' worth of living expenses, is paramount. This financial cushion provides a safety net against unexpected events like job loss or medical emergencies, preventing you from having to liquidate investments prematurely.

Next, clearly define your financial goals. Are you saving for retirement, a down payment on a house, your children's education, or simply aiming to grow your wealth over time? Each goal requires a different investment strategy and timeline. For instance, retirement savings necessitate a long-term perspective, allowing you to invest in assets with higher growth potential, such as stocks. Shorter-term goals, like saving for a down payment within a few years, necessitate a more conservative approach, focusing on safer investments like bonds or high-yield savings accounts.

Assessing your risk tolerance is critical. Risk tolerance refers to your comfort level with the potential for investment losses. Individuals with a high-risk tolerance are willing to accept greater volatility in exchange for the possibility of higher returns. Conversely, those with a low-risk tolerance prefer investments that offer stability and preservation of capital, even if it means lower returns. Several factors influence risk tolerance, including age, investment experience, financial situation, and personality. A younger investor with a long time horizon can typically afford to take on more risk than an older investor nearing retirement. Accurately gauging your risk tolerance will guide you in selecting investments that align with your comfort level and avoid making rash decisions during market fluctuations.

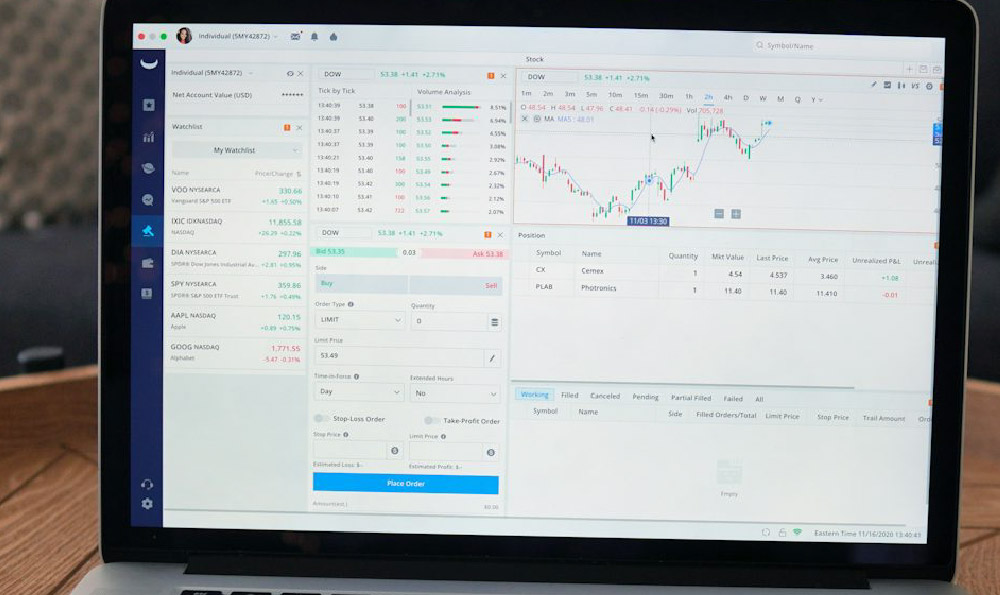

Once you have established a solid financial foundation and defined your goals and risk tolerance, you can explore various investment options. Stocks represent ownership in publicly traded companies. They offer the potential for high returns but also come with significant volatility. Diversifying your stock portfolio across different sectors and industries can help mitigate risk. Bonds are debt securities issued by governments or corporations. They are generally considered less risky than stocks, providing a more stable income stream. However, their returns are typically lower. Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They offer professional management and diversification, making them a convenient option for beginners. Exchange-Traded Funds (ETFs) are similar to mutual funds but trade like stocks on exchanges. They often have lower expense ratios than mutual funds and offer greater flexibility. Real estate involves investing in properties, such as residential homes or commercial buildings. It can provide rental income and appreciation potential but also requires significant capital and management.

Regarding the pursuit of rapid wealth accumulation, it's essential to understand the inherent risks involved. High-risk investments, such as penny stocks, options trading, or cryptocurrencies, may offer the potential for quick profits but also carry a high probability of substantial losses. These investments are often highly volatile and speculative, making them unsuitable for novice investors or those with a low-risk tolerance. While it's possible to achieve significant gains in a short period, it's equally likely to lose a substantial portion, or even all, of your investment. Remember the adage: "If it sounds too good to be true, it probably is." Be wary of promises of guaranteed high returns, as these are often scams.

Instead of chasing fleeting opportunities for quick riches, focus on building a diversified portfolio that aligns with your risk tolerance and long-term goals. Regular investing, even small amounts, can compound significantly over time. Consider automating your investments to ensure consistent contributions, regardless of market conditions. Regularly review your portfolio and rebalance it as needed to maintain your desired asset allocation. Staying informed about market trends and economic conditions is crucial for making informed investment decisions. Consult with a qualified financial advisor to get personalized guidance and support. A financial advisor can help you develop a comprehensive financial plan, select appropriate investments, and stay on track towards achieving your financial goals.

Investing is a marathon, not a sprint. While the idea of getting rich quickly is alluring, a more prudent and sustainable approach involves building a solid financial foundation, defining your goals, assessing your risk tolerance, and investing in a diversified portfolio for the long term. Focus on consistent contributions, regular reviews, and staying informed. While rapid wealth accumulation may be possible, it's often accompanied by significant risks. A patient, disciplined, and informed approach to investing is the most reliable path to long-term financial success. Remember that time is your greatest asset, and the sooner you start investing, the greater the potential for compounding to work its magic.