How to Form an LLC and Make Money? A Guide

Forming an LLC, or Limited Liability Company, can be a strategic move for entrepreneurs and investors alike. It offers a blend of liability protection and operational flexibility, making it an attractive structure for various business ventures. While an LLC itself doesn't directly generate income, it serves as a vehicle through which income-generating activities can be conducted and managed. This guide explores the process of forming an LLC and how it can be leveraged to make money through different avenues.

The initial step involves choosing a suitable business name that complies with state regulations and isn't already in use. Most states have online databases to check for name availability. The name should ideally reflect the nature of the business and be memorable for potential customers. Once a name is chosen, you need to designate a registered agent. This individual or entity is responsible for receiving legal and official documents on behalf of the LLC. The registered agent must have a physical address in the state where the LLC is formed.

Next, articles of organization, also known as a certificate of formation, must be filed with the relevant state agency, typically the Secretary of State. This document includes essential information about the LLC, such as its name, address, purpose, and the names and addresses of its members (owners). The filing fee varies by state.

While not legally required in all states, creating an operating agreement is highly recommended. This document outlines the ownership structure, member responsibilities, profit and loss distribution, and procedures for managing the LLC. A well-drafted operating agreement can prevent disputes among members and provide clarity on how the business will be run.

Depending on the nature of the business and its location, you may need to obtain various licenses and permits. These could include business licenses, sales tax permits, or industry-specific permits. Researching and obtaining the necessary licenses and permits is crucial for legal compliance. You'll also need to obtain an Employer Identification Number (EIN) from the IRS if the LLC has more than one member or plans to hire employees. Even single-member LLCs may need an EIN in certain circumstances.

Now that the LLC is formed, you can leverage it to generate income through various business models. One common approach is to operate a service-based business. This could involve offering consulting services, freelance writing, web design, or any other skill-based service. The LLC provides liability protection in case of lawsuits or other legal issues arising from your work. For instance, if a client sues your consulting business for negligence, your personal assets would generally be protected from being seized to satisfy the judgment, unlike in a sole proprietorship.

Another lucrative avenue is e-commerce. An LLC can be used to operate an online store selling physical products. This could involve sourcing products from manufacturers, creating your own products, or dropshipping. The LLC protects you from personal liability if a product malfunctions and causes harm to a customer, potentially limiting your financial exposure to the assets held within the LLC.

Real estate investing can also be conducted through an LLC. Purchasing rental properties under an LLC can shield your personal assets from lawsuits or debts related to the properties. For example, if a tenant slips and falls on your property and sues, the LLC’s assets are at risk, but your personal assets like your primary residence are typically protected. Furthermore, an LLC can facilitate the process of obtaining mortgages and managing multiple properties. The LLC structure can also simplify the transfer of ownership in the future.

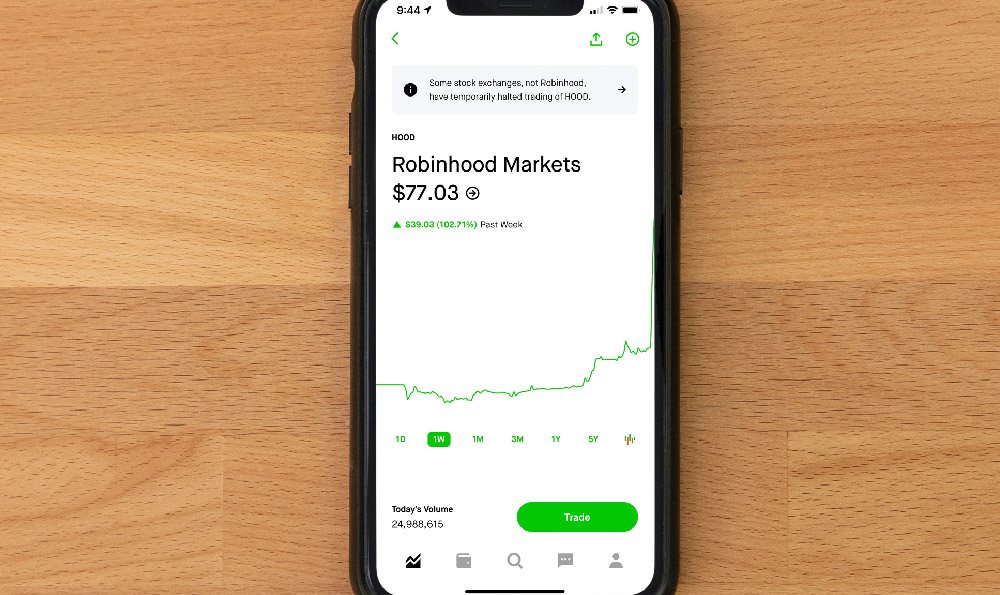

Investing in stocks, bonds, and other securities through an LLC, while less common, is possible. While the tax implications can be complex, it can be beneficial in certain estate planning scenarios or for managing large investment portfolios. It's essential to consult with a tax advisor to understand the specific tax consequences of this approach.

Creating and selling online courses and digital products is another increasingly popular way to generate income through an LLC. This can involve sharing your expertise in a particular field through video courses, e-books, templates, or software. The LLC can protect you from liability related to the content you create, such as copyright infringement claims.

Affiliate marketing, where you promote other companies' products and earn a commission on sales, can also be structured through an LLC. This can involve building a website or social media presence and promoting products through affiliate links. The LLC provides liability protection in case of disputes with affiliate partners or claims related to the products you promote.

Regardless of the business model chosen, it's crucial to maintain accurate financial records. This includes tracking income and expenses, creating financial statements, and filing taxes on time. Depending on the complexity of the business, you may need to hire an accountant or bookkeeper to assist with these tasks. Remember that LLCs have specific tax obligations that vary based on the number of members and the elections made regarding tax treatment. An LLC can be taxed as a sole proprietorship, partnership, or corporation. Each option has different tax implications, and the best choice depends on the specific circumstances of the business.

Finally, consider the ongoing costs of maintaining an LLC. These can include annual report fees, registered agent fees, and accounting and legal fees. Factor these costs into your business plan to ensure that the LLC is financially sustainable. Building a successful business through an LLC requires careful planning, diligent execution, and a commitment to providing value to customers. By leveraging the legal and operational advantages of the LLC structure, entrepreneurs and investors can create sustainable income streams and build long-term wealth while mitigating personal liability. Thorough research, professional guidance, and a solid business strategy are key to maximizing the potential of an LLC.