How Did Quan Get Rich, and Why Does It Matter?

Quan's journey to wealth, and the lessons it holds, are more than just a captivating success story; they are a roadmap for financial empowerment and a testament to the power of strategic financial planning. Understanding the specifics of Quan's path, and the broader principles it exemplifies, is crucial because it provides a tangible example that demystifies the often-intimidating world of finance and demonstrates that wealth accumulation is achievable with the right knowledge and approach.

While a detailed biographical account of Quan's financial journey would depend on the specifics of the hypothetical individual, we can construct a compelling narrative based on common paths to wealth, emphasizing key principles applicable to a wide range of individuals. Let's say Quan started with modest means, perhaps a middle-class upbringing with limited financial support. Unlike those born into wealth, Quan recognized early on that financial independence was a goal that required proactive planning and diligent execution.

One of the crucial aspects of Quan's success was the understanding and management of personal finances. Instead of falling prey to impulsive spending and consumerism, Quan prioritized saving and budgeting. This involved meticulously tracking income and expenses, identifying areas for optimization, and setting clear financial goals. This disciplined approach wasn't about deprivation; it was about consciously allocating resources towards investments and future financial security. This foundational habit allowed Quan to build a financial safety net and create the capital needed for future investment opportunities.

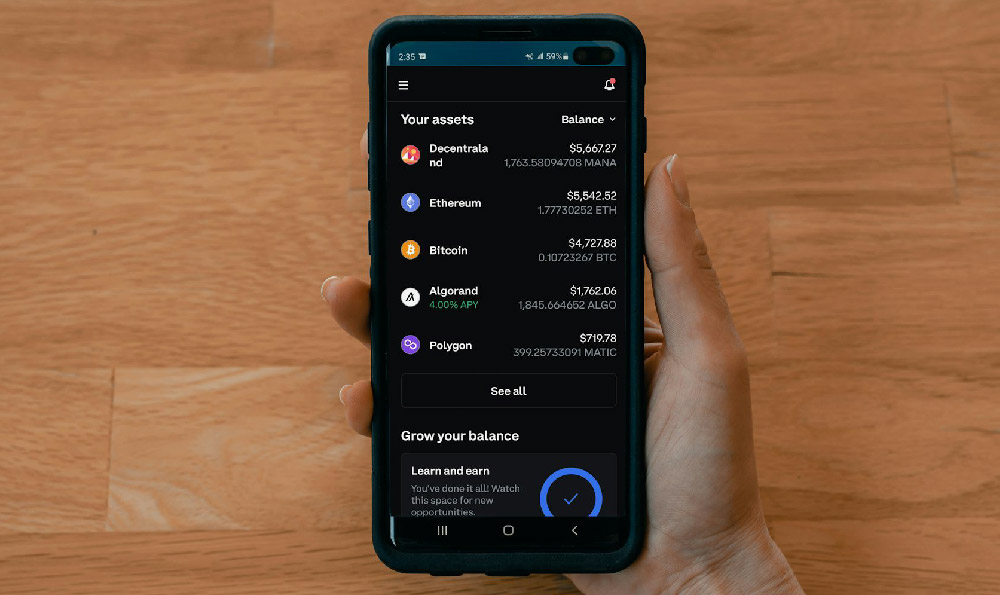

Beyond personal finance, Quan demonstrated a keen understanding of the importance of early investment. Instead of waiting until later in life to start saving for retirement or other long-term goals, Quan began investing early, leveraging the power of compounding. Whether it was through a 401(k) at work, a Roth IRA, or other investment vehicles, the early start allowed Quan's investments to grow exponentially over time. This involved diversifying across a portfolio of stocks, bonds, and other assets to mitigate risk and maximize potential returns. Understanding asset allocation and risk tolerance was paramount. Quan didn't blindly follow market trends but instead developed a well-informed investment strategy based on personal goals and a deep understanding of the underlying assets.

But Quan's success wasn't solely reliant on traditional investment strategies. A key element in this hypothetical story involves entrepreneurial spirit or the ability to identify and capitalize on opportunities. Perhaps Quan started a side hustle, offering services or products online. Or maybe Quan invested in a real estate venture, renovating and renting out properties. This willingness to take calculated risks and pursue entrepreneurial endeavors generated additional income streams and accelerated wealth accumulation. The critical distinction here is the "calculated" nature of the risk. Quan didn't gamble blindly; the individual researched thoroughly, analyzed potential outcomes, and developed a comprehensive plan before committing resources.

Furthermore, Quan's commitment to continuous learning played a significant role. The financial landscape is constantly evolving, and staying informed about market trends, investment strategies, and regulatory changes is crucial for long-term success. Quan proactively sought knowledge through books, online courses, industry publications, and networking with financial professionals. This dedication to lifelong learning allowed Quan to adapt investment strategies as needed and identify emerging opportunities before they became mainstream. It fostered an adaptability that is critical in a dynamic financial world.

Beyond the tangible financial actions, Quan also cultivated a mindset conducive to wealth creation. This included developing a strong work ethic, a positive attitude towards money, and a willingness to persevere through challenges. Financial success is not always a smooth and linear path; there will be setbacks and periods of uncertainty. Quan's resilience and ability to learn from mistakes were essential for staying focused on long-term goals. This mental fortitude also involved maintaining a realistic perspective on wealth and avoiding the pitfalls of greed and envy. Quan understood that true wealth is not just about financial abundance but also about living a fulfilling and meaningful life.

Why does Quan's journey matter? Because it provides a concrete example of how financial independence can be achieved through a combination of disciplined saving, strategic investment, entrepreneurial spirit, and continuous learning. It challenges the perception that wealth is only attainable for a select few and demonstrates that anyone, regardless of their starting point, can build a secure financial future with the right mindset and actions. It dismantles the myth that financial literacy is the domain of experts, showing that everyday individuals can take control of their finances and make informed decisions.

Moreover, Quan's story is crucial because it empowers others to take action. By showcasing the tangible steps involved in wealth accumulation, it motivates individuals to start their own financial journeys and take control of their financial destinies. It encourages people to prioritize saving, investing, and lifelong learning, fostering a culture of financial responsibility and empowerment. The broader societal impact of individuals achieving financial security extends beyond personal benefits. It reduces reliance on social safety nets, fuels economic growth, and creates a more equitable society where everyone has the opportunity to thrive.

In conclusion, Quan's path to wealth is a multifaceted one, built upon a foundation of financial literacy, disciplined saving, strategic investment, entrepreneurial spirit, continuous learning, and a resilient mindset. Its significance lies not only in the financial success achieved but also in the valuable lessons it imparts about the power of financial planning and the potential for anyone to achieve financial independence. By understanding and applying these principles, individuals can embark on their own journeys towards financial freedom and create a brighter future for themselves and their communities.