How much Bitcoin can you mine, and how much money can you earn?

Okay, let's delve into the fascinating, and often misunderstood, world of Bitcoin mining, breaking down the potential returns and the significant investments required. It's important to approach this topic with a clear understanding that Bitcoin mining is no longer a pursuit for the casual home computer user. It's a highly competitive, resource-intensive industry dominated by large-scale operations.

To accurately assess how much Bitcoin you could mine and how much money you could potentially earn, we need to consider several crucial factors. These encompass the hardware involved, the electricity costs, the mining difficulty, and the prevailing Bitcoin price.

First, let's discuss the hardware. The heart of any Bitcoin mining operation is the Application-Specific Integrated Circuit (ASIC) miner. These specialized computers are designed solely to perform the SHA-256 hashing algorithm necessary for Bitcoin mining. Forget using your CPU or GPU; these are now functionally obsolete for profitable Bitcoin mining. The efficiency of an ASIC miner is measured in Terahashes per second (TH/s), indicating the speed at which it can perform these calculations. Furthermore, its power consumption, measured in Watts, is equally critical because it directly impacts your operating expenses. The initial capital expenditure on an ASIC miner can range from a few hundred to several thousand dollars, depending on its hash rate and energy efficiency. Newer, more powerful models will typically command a higher price tag, but also offer a potentially higher return on investment. Older models may be cheaper upfront but might consume significantly more power, rendering them less profitable or even unprofitable.

Next, we confront the elephant in the room: electricity costs. Bitcoin mining is an energy-intensive process. The amount of electricity your ASIC miner consumes directly impacts your profitability. Regions with low electricity costs, such as those with access to renewable energy sources like hydropower or geothermal energy, are generally more attractive for Bitcoin mining operations. Conversely, areas with high electricity rates can quickly erode your potential profits. To determine your actual costs, you need to calculate the power consumption of your miner in Watts, multiply it by the number of hours it operates per day, and then multiply that result by your electricity rate per kilowatt-hour (kWh). This will give you a daily electricity cost, which needs to be factored into your overall profitability calculation.

Then comes the concept of Bitcoin mining difficulty. This is a dynamic adjustment that is algorithmically adjusted approximately every two weeks to maintain a consistent block generation time of roughly 10 minutes. As more miners join the network and the overall hash rate increases, the difficulty increases accordingly. This means that even with the same hardware, you will mine fewer Bitcoins over time as the difficulty rises. This is a crucial factor to consider when projecting your potential earnings. Websites and services exist that track the current mining difficulty and provide historical data, allowing you to analyze trends and anticipate future adjustments.

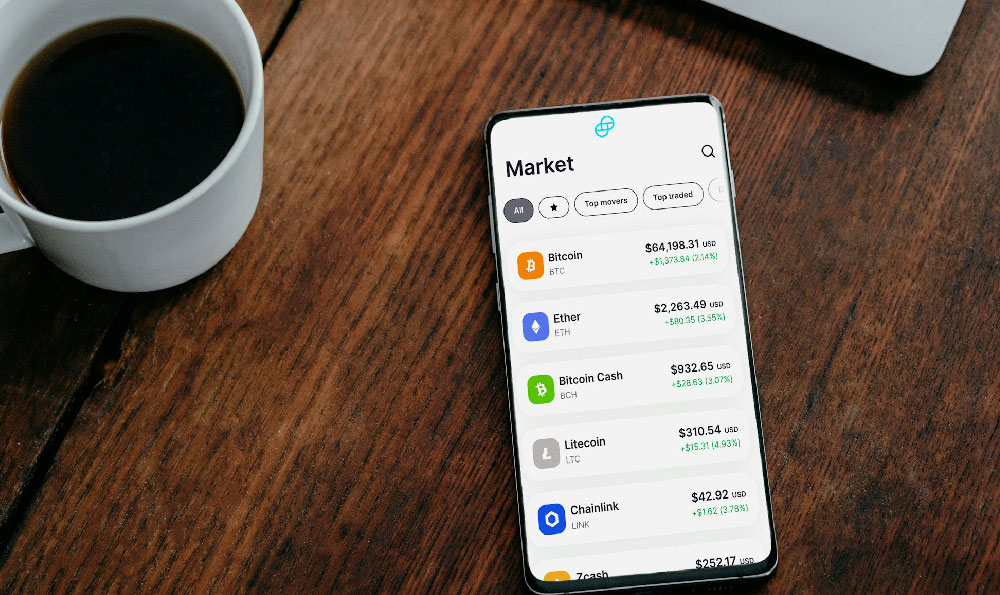

Finally, the Bitcoin price itself is, of course, the ultimate determinant of your profitability. If the Bitcoin price is high, your mined Bitcoin will be worth more, increasing your potential earnings. Conversely, if the Bitcoin price drops significantly, your mining operation may become unprofitable. Therefore, it is essential to continuously monitor the Bitcoin market and be prepared to adjust your strategy accordingly. Hedging strategies, such as selling mined Bitcoin immediately or using futures contracts, can help mitigate the risk of price fluctuations.

So, let's talk numbers. Predicting the precise amount of Bitcoin you can mine is complex, but there are online mining calculators that can help you estimate your potential earnings based on your hardware, electricity costs, and the current mining difficulty. These calculators typically require you to input the hash rate of your miner, its power consumption, your electricity rate, and the current Bitcoin block reward (currently 6.25 Bitcoin per block). They then use this information to estimate how much Bitcoin you can mine per day, week, or month. These calculators are valuable tools, but they are only estimates and should not be taken as guarantees. Remember, the mining difficulty can change, and the Bitcoin price can fluctuate, impacting your actual earnings.

Beyond these core elements, one must also consider other factors that can significantly impact profitability. Mining pools are a common way for individual miners to increase their chances of earning rewards. By joining a pool, you combine your hashing power with other miners and share the rewards proportionally. This can provide a more stable and predictable income stream compared to solo mining. However, mining pools typically charge fees, which need to be factored into your profitability calculations.

Furthermore, the maintenance and upkeep of your mining hardware are also essential. ASIC miners can be prone to failure, and downtime can significantly impact your earnings. Regular maintenance, such as cleaning dust and ensuring proper cooling, is crucial to maximize the lifespan and efficiency of your miners.

Before diving into Bitcoin mining, thoroughly research all aspects involved and understand the risks. Running a profitable mining operation requires significant capital investment, technical expertise, and a keen understanding of the Bitcoin market. It's not a get-rich-quick scheme but rather a complex business venture with inherent risks. Conduct thorough due diligence, use mining calculators to estimate your potential earnings, and continuously monitor the market to adjust your strategy as needed. Never invest more than you can afford to lose, and always prioritize security to protect your mining operation from hacking and other threats. Proceed with caution and a well-informed approach, and you may have a chance to see some profitability in the fascinating, and challenging, world of Bitcoin mining.