How Does Upside Work, and How Does It Make Money?

Upside, formerly known as GetUpside, operates on a compelling premise: connecting consumers with merchants to drive mutually beneficial outcomes. To understand how Upside works and generates revenue, it’s essential to delve into its core mechanism and the multifaceted value proposition it offers to both shoppers and businesses.

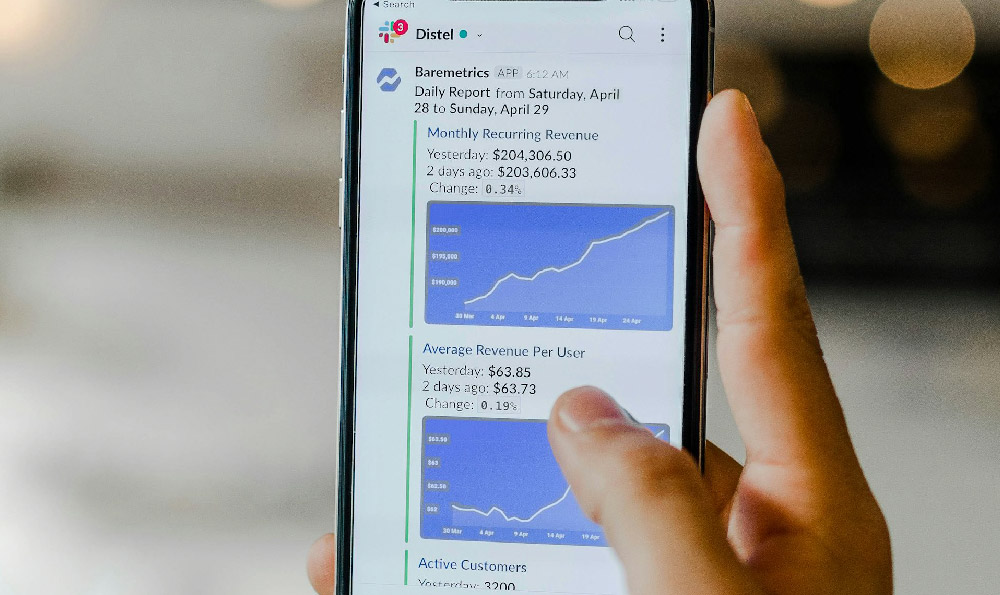

At its heart, Upside is a personalized cashback app that rewards users for making purchases at participating gas stations, restaurants, and grocery stores. Unlike traditional loyalty programs that require points accumulation or specialized memberships, Upside integrates directly with credit and debit card transactions, offering a seamless and hassle-free user experience. The platform uses location services to identify nearby participating businesses and presents users with personalized offers tailored to their spending habits and purchase history. These offers, often expressed as cents-per-gallon discounts on gasoline or percentage-based cashback on restaurant bills, are designed to incentivize consumers to choose participating merchants over their competitors.

The brilliance of Upside lies in its ability to measure incremental lift. The company utilizes sophisticated data analytics to determine the extent to which its offers actually drive new customer traffic and increased spending at participating businesses. This is achieved by comparing the purchasing behavior of Upside users with that of a control group who are not exposed to the platform's offers. By analyzing these data sets, Upside can accurately attribute the increase in sales directly to its program, providing merchants with concrete evidence of its effectiveness. This data-driven approach is crucial in building trust and establishing long-term partnerships with businesses.

Upside's revenue model is built upon a commission-based structure. The company earns a percentage of the incremental profit generated by participating merchants as a result of its platform. This is a key differentiator from traditional marketing and advertising models, where businesses often pay upfront fees without a guarantee of results. With Upside, merchants only pay when they see an actual increase in sales attributable to the platform. This performance-based approach aligns Upside's interests with those of its partners, fostering a collaborative relationship built on mutual success.

To illustrate this, consider a gas station owner who is struggling to compete with larger chains. By partnering with Upside, they can offer personalized discounts to attract new customers and incentivize existing customers to visit more frequently. Upside's algorithms might analyze the spending habits of users in the area and offer a discount of, say, 10 cents per gallon to those who haven't visited the gas station in the past month or who typically purchase gasoline at a competitor's location. If this offer successfully attracts new customers and increases overall sales volume at the gas station, Upside would receive a percentage of the resulting profit increase.

The process for users is straightforward. After downloading the Upside app and linking their credit or debit card, users can browse nearby offers and select the ones they wish to redeem. Once they make a purchase at a participating merchant, they simply pay with their linked card as usual. Upside automatically detects the transaction and credits the cashback to the user's account. Users can then withdraw their earnings via PayPal, bank transfer, or gift card.

One of the critical components of Upside's success is its ability to personalize offers effectively. The platform leverages machine learning and data analytics to understand individual consumer behavior and tailor offers that are most likely to resonate with them. This ensures that users receive relevant and enticing discounts, increasing the likelihood of them choosing participating merchants. This personalization is not just about offering lower prices; it can also involve highlighting specific products or services that a user is known to be interested in. For instance, a restaurant might offer a discount on a particular dish that a user has ordered in the past or a gas station might offer a bonus reward for purchasing premium gasoline.

Furthermore, Upside emphasizes data privacy and security. The company employs robust security measures to protect user data and ensure that all transactions are encrypted. Upside also provides users with transparency and control over their data, allowing them to opt out of data sharing or delete their accounts at any time. This commitment to privacy is essential in building trust with users and maintaining a positive brand reputation.

The competitive landscape for Upside includes other cashback apps, loyalty programs, and digital marketing platforms. However, Upside distinguishes itself through its focus on measuring incremental lift, its commission-based revenue model, and its emphasis on personalized offers. By providing merchants with concrete evidence of its effectiveness and aligning its interests with theirs, Upside has been able to establish strong partnerships and drive significant growth.

Looking ahead, Upside has the potential to expand its reach into new industries and offer even more sophisticated personalized experiences. For example, the platform could integrate with mobile payment systems or expand its offerings to include deals on other types of goods and services. As data analytics and machine learning technologies continue to evolve, Upside will likely be able to further refine its algorithms and provide even more precise and effective offers to consumers and merchants alike. This continual refinement and adaptation will be key to sustaining its competitive advantage and maximizing its impact on the retail landscape. The continued focus on providing value to both merchants and consumers through measurable results and personalized experiences positions Upside as a significant player in the future of retail marketing and customer engagement.