GTA Online Make Money Fast 2023: Guide to Side Jobs and Gambling

Unlocking High-Yield Opportunities in the Cryptocurrency Market: A Strategic Approach for Profit and Caution

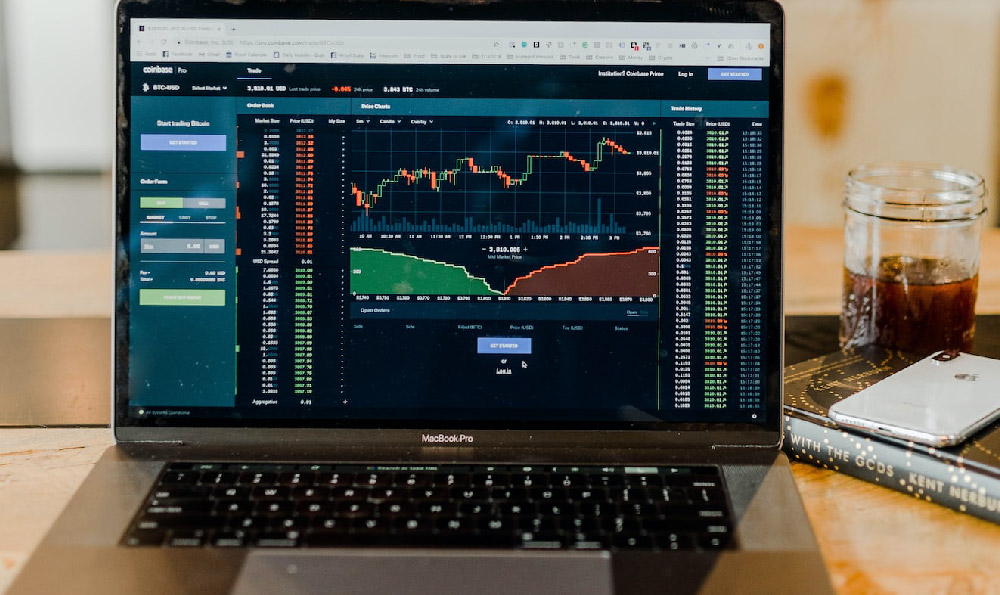

The cryptocurrency market remains one of the most dynamic and unpredictable sectors in the global financial landscape, offering both immense potential and significant risks. As investors navigate this volatile arena, the quest to "make money fast" often drives decisions, yet it is crucial to approach it with a blend of analytical rigor and prudence. While rapid gains can allure, sustainable growth hinges on understanding market fundamentals, leveraging technical tools, and recognizing the pitfalls that lurk in the shadows. This guide delves into actionable strategies, emphasizing long-term value while addressing the allure of short-term speculation.

The cryptocurrency market is a complex ecosystem influenced by technological advancements, regulatory shifts, and macroeconomic factors. Bitcoin, Ethereum, and a host of altcoins create a mosaic of opportunities, but their prices are subject to sharp fluctuations. For instance, market sentiment can quickly pivot from optimism to fear, triggering sell-offs that may mislead inexperienced traders. Such volatility means that investing in cryptocurrencies is not merely about buying low and selling high—it demands a deeper comprehension of underlying trends and indicators. Analysts often note that the market's behavior resembles a double-edged sword, capable of delivering exponential returns but also posing existential threats if not managed correctly.

Technical indicators are indispensable for discerning market movements. Tools like Moving Averages, RSI, and MACD can reveal critical signals about momentum and potential reversals. For example, the 50-day moving average is a common benchmark, signaling strength when prices remain above it and weakness when they fall below. However, these indicators should be viewed as supplemental guides rather than definitive blueprints. The caveat here is that no single tool guarantees accuracy, and overreliance on them can lead to blind trading. In 2023, a handful of investors failed to anticipate the collapse in stablecoins by ignoring these indicators, leading to substantial losses. This underscores the importance of integrating multiple data points into decision-making processes.

Strategies for harnessing cryptocurrency's growth potential typically involve a mix of active and passive approaches. Short-term traders often exploit market gaps and trends, utilizing leverage to amplify gains. However, leveraged trading is inherently risky, as it can magnify losses just as drastically. For example, a 10x leverage position on a cryptocurrency that drops 20% results in a 200% loss, a scenario that has derailed many newcomers to the market. Conversely, long-term investors focus on fundamentals such as adoption rates, technological innovation, and macroeconomic conditions. A 2023 study revealed that holders of cryptocurrencies with robust development teams and real-world applications saw more consistent growth compared to those chasing speculative trends. This illustrates the value of aligning investments with projects that have sustainable value.

Risk management is the cornerstone of any successful investment strategy. While the market's allure lies in its potential for quick returns, the reality is that most traders underperform due to inadequate risk controls. Techniques such as stop-loss orders, position sizing, and diversification can mitigate potential losses. For example, a diversified portfolio that spreads investments across multiple cryptocurrencies and market conditions can buffer against the volatility of any single asset. In 2023, the rise of AI-driven portfolio management tools has further enhanced the ability to automate risk mitigation, but they should not replace fundamental analysis.

The psychological aspect of investing equally demands attention. Emotional decision-making, such as panic selling during market dips or greed-driven buying at peaks, often leads to suboptimal outcomes. In 2023, a notable trend emerged where investors began to adopt behavioral strategies, like "trading with a plan" and "staying detached from market noise." These approaches help in maintaining discipline and reducing the impact of market manipulation, which has been a persistent issue in the crypto space. For instance, pump-and-dump schemes have targeted less liquid markets, exploiting the naivety of retail investors who fail to recognize the tactics behind such scams.

In conclusion, the cryptocurrency market offers a unique blend of opportunities and challenges. While the promise of "quick money" is tempting, it is essential to balance ambition with caution. By understanding market dynamics, utilizing technical indicators, and implementing robust risk management practices, investors can navigate the complexities of this space more effectively. The key lies in prioritizing long-term value over fleeting gains, and in doing so, creating a resilient portfolio that withstands the market's turbulence. As the industry continues to evolve, staying informed and adaptable will be paramount for achieving financial success.