Investing $100: Where to Start and What to Consider?

Okay, I understand. Here's an article based on the title "Investing $100: Where to Start and What to Consider?", focusing on providing rich content and detailed answers, while avoiding excessive bullet points and ordinal indicators.

Investing, even with a modest sum like $100, is a pivotal step towards building financial security. While it may seem like a small amount, the principles and habits formed by investing early, even with limited funds, are far more valuable than the initial return. Thinking strategically about how to deploy that $100 is key to setting yourself up for future success. It's not about getting rich quick; it’s about laying the foundation for long-term wealth accumulation and financial literacy.

The initial inclination might be to seek high-yield investments or strategies promising rapid growth. However, with a small initial investment, focusing on learning and building a solid understanding of financial markets should take precedence. This education-first approach will provide invaluable insights and reduce the risk of making costly mistakes down the line.

One of the most accessible and educational avenues for a beginner is fractional shares. Many brokerage platforms now allow investors to purchase a fraction of a share in publicly traded companies. This means you can invest in companies like Apple, Amazon, or Google, even if you can't afford a full share, which could cost hundreds or even thousands of dollars. Fractional shares offer a diversified portfolio, even with a limited budget, and allow you to learn about different sectors and industries. For example, you could allocate $25 to a technology company, $25 to a healthcare company, $25 to a consumer goods company, and $25 to an exchange-traded fund (ETF) that tracks a broad market index like the S&P 500. This provides exposure to different market segments and helps you understand how they perform over time.

Choosing the right brokerage platform is crucial. Look for platforms that offer commission-free trading, fractional shares, and a user-friendly interface, especially designed for beginners. Research different platforms, compare their features, and read reviews from other users before making a decision. Some popular options for beginners include Robinhood, Webull, and Acorns. Consider features like educational resources, automated investing options (like robo-advisors), and minimum account balances.

Exchange-Traded Funds (ETFs) are baskets of stocks or bonds that track a specific index, sector, or investment strategy. They provide instant diversification at a low cost. With $100, you can invest in a small number of shares of an ETF that tracks the S&P 500, the Dow Jones Industrial Average, or a specific sector like technology or healthcare. ETFs are a relatively safe and easy way to gain exposure to a broad market or sector without having to pick individual stocks. They also typically have lower expense ratios than mutual funds.

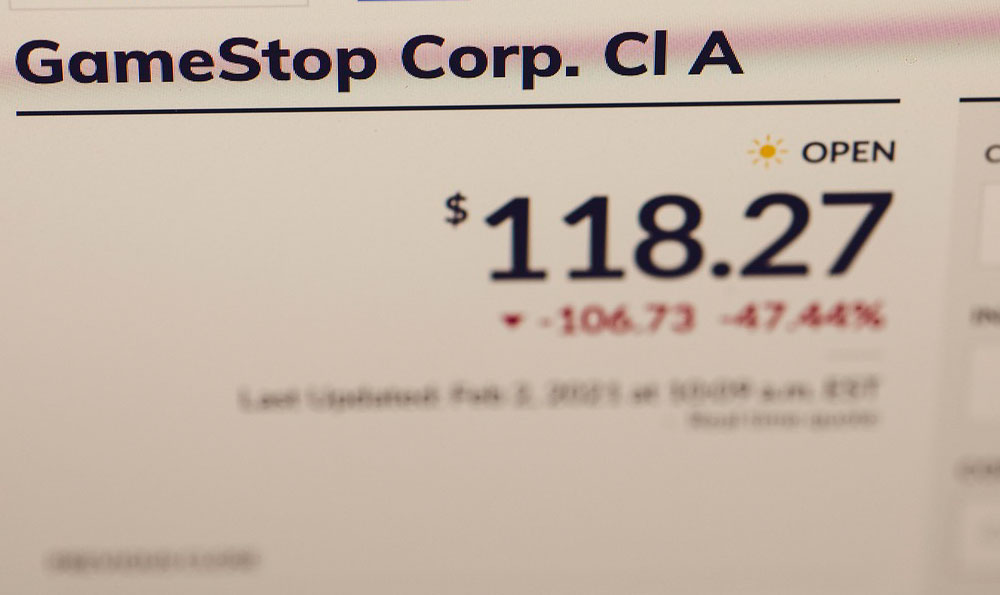

Another important consideration is understanding your risk tolerance. Risk tolerance refers to your ability and willingness to withstand fluctuations in the value of your investments. Generally, younger investors with a longer time horizon can afford to take on more risk, while older investors closer to retirement may prefer more conservative investments. However, risk tolerance is also a personal preference. Before investing, it’s worth considering how you would feel if your $100 investment decreased in value by 10%, 20%, or even more. This mental exercise can help you determine your risk tolerance and choose investments that are appropriate for your comfort level.

Remember, investing is a long-term game. Don't expect to get rich overnight. Be prepared to hold your investments for several years, or even decades, to see significant returns. Avoid the temptation to constantly check your portfolio or make impulsive decisions based on short-term market fluctuations. Instead, focus on staying the course and building a diversified portfolio that aligns with your long-term financial goals.

Beyond the specific investment vehicles, learning about personal finance is just as crucial. Use the initial investment as a catalyst to learn more about budgeting, saving, debt management, and other essential financial concepts. Read books, listen to podcasts, or take online courses on personal finance. The more you know about money management, the better equipped you'll be to make informed investment decisions and achieve your financial goals. Libraries are great resources for learning about investing without adding to your expenses. Many also offer free workshops and seminars on various financial topics.

Finally, consider automating your investments. Set up a recurring investment of $10, $20, or even $5 per week or month into your chosen investment vehicle. This will help you build the habit of investing regularly and take advantage of dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of the market price. Dollar-cost averaging can help to reduce your average cost per share over time, as you'll buy more shares when prices are low and fewer shares when prices are high.

In conclusion, investing $100 might not seem like much, but it's a powerful first step towards building a solid financial future. By focusing on education, diversifying your investments, understanding your risk tolerance, and automating your savings, you can turn a small initial investment into a significant long-term asset. The key is to start now, stay disciplined, and never stop learning. Remember that the experience gained and the financial habits established are often more valuable than the immediate returns on the investment itself. It's a journey, not a sprint, and every step, no matter how small, contributes to the overall goal of financial well-being.